What is the Terra LUNA token?

The Terra Luna coin is the collateral behind the network of global stable coins using the Terra blockchain. With $20 billion now locked, LUNA coin is the 2nd largest DeFi protocol by total value locked (TVL), only behind Ethereum. The first stable Luna terra coin introduced was the KRT pegged to the Korean Won, and already, over 2.5 million people use it annually for more than $1B in transactions. The Luna crypto surged 12,000% in 2021 and is likely to go further due to the increasing demand for UST, a truly decentralized stable coin alternative to USDT, USDC, and BUSD which are far more centralized.

Luna coin, Terra labs, and the Terra alliance began in Korea. Terra was founded in 2018 by business entrepreneur Daniel Schin, and computer scientist Do Kwon. Then in 2019, the Terra blockchain was launched. Since Luna coin launched, the Terra ROI is 4,463%. The price of Luna hit an all-time high of $99.72 in December 2021. In 2019 the KRW token was integrated into the popular Korean mobile payments app Chai and has 2.5 million users. In addition to Chai, the KRW is now integrated with 14 banks, Korea’s number 1 gaming publisher, and number 1 bookstore, all utilizing the Terra blockchain.

Terra DeFi Stand Out Protocols & Partners

Terra Swap

There are many projects partnered with Terra but some stand out and have a good chance of becoming “blue chip” projects. Terra Swap is the first Decentralized exchange (DEX) on Terra. Like PancakeSwap, it's an automated market maker (AMM) built to swap any CW20 tokens on Terra and the native Terra token. The non-custodial wallet by Terraform Labs, Terra Station will grant anyone access to TerraSwap with luna crypto to cover the Terra network fees.

Anchor Protocol

The Anchor protocol is a decentralized savings protocol offering stable yields by staking returns from multiple POS blockchains in one place. There is no minimum deposit, and users can earn a steady 20% APY. These UST deposits are known as liquid staking assets or bonded assets (bAssetts). Anchor is one of Terra’s most popular DeFi protocols, with over $3.36 billion or 15% of the entire ecosystem.

Mirror Finance

Mirror is a portal in DeFi for creating synthetic assets, aka Mirrored Assets (mAssets). These mAssets act like their real-world counterparts, assets like stocks and bonds, but these live in the metaverse and can be traded in a permissionless manner with fractional ownership making these assets more accessible to more people.

Pylon Protocol

The launchpad redirects Anchor's yield into new projects built on the Terra blockchain. Pylon users make deposits that are retrievable instead of investing in a risky IDO with their capital. It is achieved by simply redirecting their yield to projects that launch on Pylon. For investors, it reduces risk, as such a process is interest only, allowing them to make simple, riskless and retrievable deposits by putting Terra stablecoins as a collateral. When a deposit’s lockup period comes to an end, investors receive their investment back together with pleasant rewards. On top of that the launching projects have been vetted by Pylon. The system is governed by its holders using their native governance token MINE.

Risk Harbor Ozone

The highly anticipated Ozone project went live on New Years' Eve 2021 on the algorithmic risk management marketplace. It’s live on Anchor right now and was spearheaded by the co-founder of Terra Luna Do Kwon.

Terra Ecosystem - What is Terra LUNA Coin?

Luna token acts as the collateral backing up the stable coins on the terra blockchain. There are more than a dozen stable coins pegged to various fiat currencies, but the most popular by far is the UST pegged to the US dollar. An equivalent amount of LUNA must be burned to mint UST or any of the terra stablecoins. For example, when 1 LUNA is worth $100, burning 1 LUNA would mint 100 UST. When UST has burned to mint LUNA, the economic incentive comes into play to enable the stable coin to maintain its peg.

For example, if UST is trading for, say $1.25 then LUNA holders can burn their LUNA tokens for a 25% profit. This brings the peg back down to $1 due to the excess supply of new stable tokens minted as a result of the burning Terra LUNA crypto. On the flip side, UST holders can burn their tokens to mint LUNA and reap a 2X profit if UST is trading at 50 cents. This reduces UST supply in circulation, which automatically restores the peg.

Every time LUNA is burned minting UST, a small fee is taken. This transaction fee is set aside in a fund specifically for new Terra projects and protocols. This proof of stake blockchain was built on the Cosmos blockchain using the Cosmos SDK; 130 validators act as oracles checking the values of the various stable coins. The luna network can process a few hundred transactions per second.

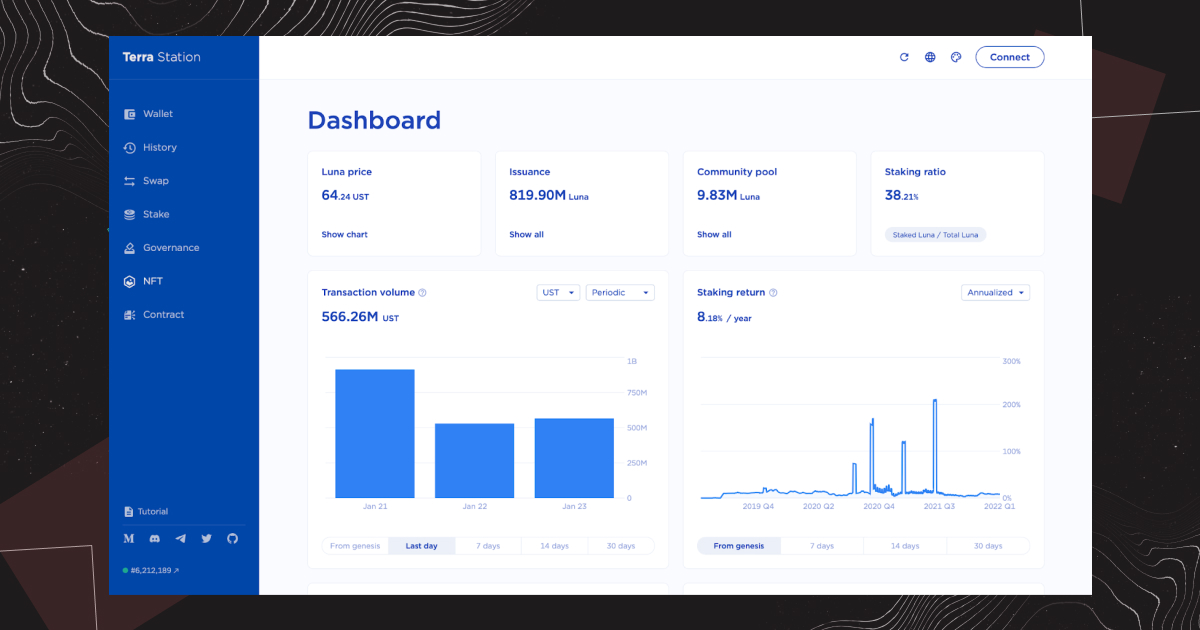

Terra LUNA Staking Rewards

The Luna staking rewards can be received in Terra Station, a non-custodial wallet, keeping with the core tenant of decentralization. Luna coin staking rewards get automatically distributed to each block and have a 21-day unbonding period. To compound rewards, a new delegation is required. 0.05% Slashing for double signing and 0.05% Slashing for downtime. Don’t forget to reserve a bit of Terra in your wallet for the network fees required to bond or unbond.

The first step to stake Luna is to visit terra.money and download the Terra Station, a non-custodial crypto wallet. Once downloaded, open the dashboard to connect your wallet. You can connect to Terra Station using a Ledger, to make a new wallet, recover an existing one, or import a private key. If you select to create a new wallet, be sure to save your seed phrase and do NOT share it ever, as it will allow anyone to access your assets. The next step is to fund your wallet, locate your deposit address, and copy it. Then go where your Terra is and send it to this address. Now you can see your LUNA funds in your Terra Station wallet. The Terra Station wallet supports any CW20 token. That’s how easy staking Luna is.

Terra Luna Coin Price Prediction

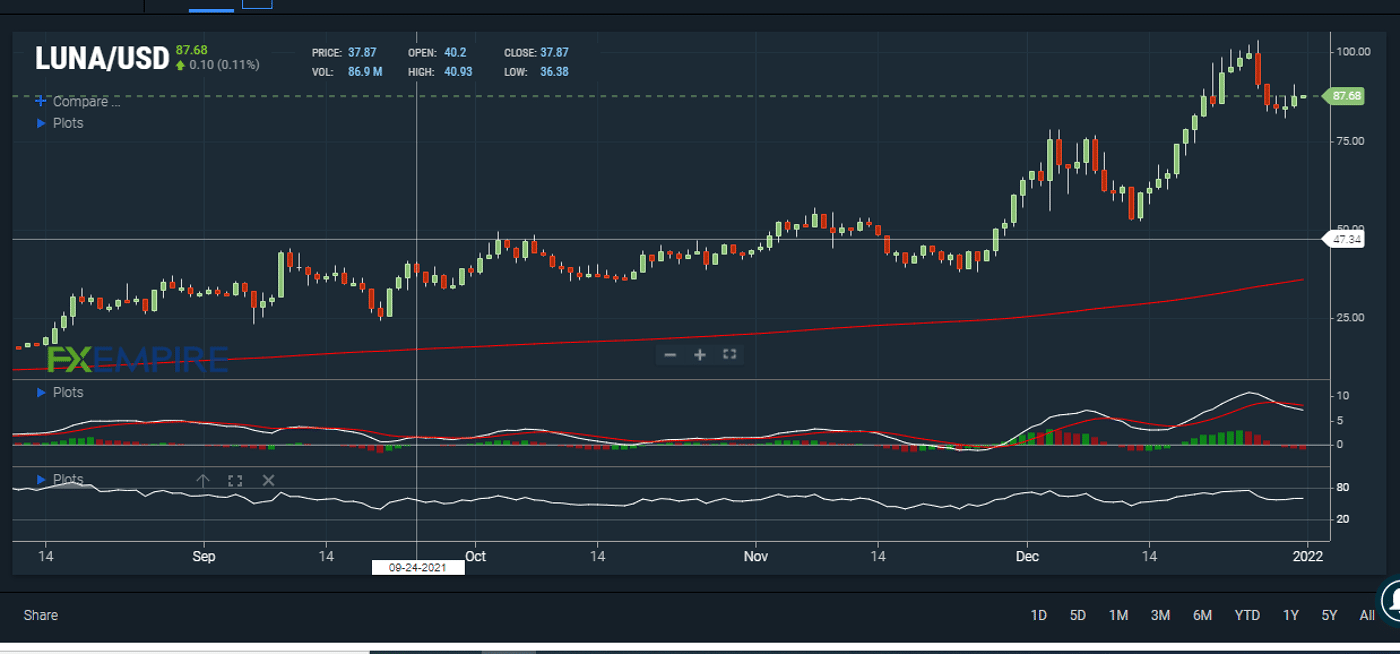

A Terra Luna Coin price prediction is primarily bullish for the short term.

The Luna coin price chart is one of the most bullish in the cryptocurrency market. The luna coin price has increased thousands of percentage points to its current value over the past year and could look to build on that in 2022.

Picture disclaimer: LUNA is trading above its 200-day EMA. Source: FXEMPIRE

Picture disclaimer: LUNA is trading above its 200-day EMA. Source: FXEMPIRE

The Luna coin price today (01/02/2022) is currently up by more than 100% from its 200-day moving average price of $35, indicating that the coin has been performing well over the past few months. The MACD line has stayed above the neutral zone since August. Even when the broader cryptocurrency market was underperforming, LUNA was performing excellently. The RSI of 63 shows that LUNA could be heading to the overbought region soon. The asset being in the overbought region means that its market price exceeds its fair or true worth. An asset that is overbought is expected to experience a decline in its value and is typically considered good for sell.

LUNA is expected to perform excellently in the coming year as well. According to WalletInvestor’s 2022 forecast, LUNA’s price will surge by nearly 150% to reach $200 by the end of next year. By reaching $200, LUNA’s market cap could top $180 billion and cement its position as one of the leading cryptocurrencies in the world.

Regardless, it would be exciting to see how LUNA and the broader DeFi space perform over the coming year.

The long term price prediction for Terra is a difficult one because it strongly depends on 3 key factors:

- Will the network development continue according to their roadmap?

- Will the growth of the platform continue at the pace it does now?

- Will the network be decentralized enough for Terra not to be regulated to the point where it could harm its’ use?

(For a better elaboration on these factors here is a short video of Guy from CoinBureau about it)

A Luna coin price prediction 2025 of $350 would be very realistic if terra coin can maintain this bullish performance and steer clear of negative regulation.

Wrapped LUNA Token (WLUNA) - LUNA Token on Ethereum

Wrapped Luna or WLUNA is an ERC-20 token on the Ethereum network meant to represent Terra LUNA on the Ethereum blockchain. WLUNA coin is not LUNA, but it does track the value of LUNA coin so that traders can hold, trade, and participate in DeFi dApps on the Ethereum blockchain. Where can you buy WLUNA? You can buy WLUNA on bitoftrade, which will allow you to tap into the profits leveraging Swap Trading. The second easiest way to acquire WLUNA is to trade 1 LUNA for 1 WLUNA - an upcoming feature on our platform that will be available for the users in the near future. With the LUNA price defying the market, and the fundamental strength of the project tapping into leverage trading, trading WLUNA tokens could be very lucrative.

Right now, the Ethereum blockchain is the only network bigger than Terra for total value locked. You would like to take advantage of Luna’s price action on their mission to overtake Ethereum and become the number one DeFi protocol globally, there are lots of profits waiting for savvy traders such as yourself here on bitoftrade.