The cryptocurrency market is well into its second decade now, and the last couple of years have seen the rise of Decentralized Finance, AKA DeFi. In marketing, they teach that timing your product to the market can be one of the essential aspects in determining success. Is the market ready for your solution? Well, in the case of the 1inch crypto exchange launch, their timing could not have been better. Just as the DeFi boom was revving up to rise, they launched 1inch DEX aggregator protocol and quickly proclaimed the 1inch exchange was the most efficient Decentralized Exchange DEX in the space, and then went about proving it.

This week the 1inch token traded as low as $1.24, well above the all-time low according to CMC. Can you say sick entry point? I digress. What is the 1inch price prediction for 2022 and beyond? What about the 1inch price prediction for 2025, or even as far forward as 2030? Will the 1inch token gain or lose value this year and in the long run? The 1inch platform launched with only 33 liquidity pools and 3 blockchains, and in two years, the 1inch protocol now has 273 liquidity pools the 1inch dex aggregator can access across 8 blockchains.

This is a nightmare for arbitrage traders and a boon for everyone else. The 1inch exchange has shown itself to be the go-to solution for traders looking to optimize their DeFi experience. The 1inch platform has over 1.6 million users, and it’s an exchange that’s not even an exchange. It’s a DEX aggregator that finds the most efficient transaction from all the liquidity pools it can access and allows traders to access these pools and take advantage of this streamlined process. 1inch has spot trading, leverage trading, and even limit orders available. Add to that the 1inch instant governance that the 1INCH token grants to investors, and it is the go to place for traders looking to advance their DeFi skills. To get instant governance rights, all you have to do is buy some 1inch tokens.

What Is 1inch and Why does It Lure So Many Traders?

What is 1inch? What makes it so unique to be luring 1.6 million traders in 2 short years? The 1inch protocol has two main parts that work together to battle arbitrage traders, and assist liquidity providers. The two main ingredients that make up the 1inch protocol are the 1inch DEX aggregator and the 1inch Automated Market Maker.

1inch DEX Aggregator

The 1inch DEX aggregator utilizes the Pathfinder algorithm to find the trading path of least resistance. The Pathfinder API searches through 125+ liquidity pools, searching for the most efficient order route or path, hence the name Pathfinder, to execute your order.

1inch Automated Market Maker (AMM)

The 1inch AMM works similarly to other AMMs. However, the 1inch exchange launched as Mooniswap improved the efficiency compared to other AMMs like Sushiswap, Uniswap, Bancor and the list goes on. Instead of being limited to native liquidity pools, the Pathfinder API enables any trader to connect to the 1incch exchange and instantly access 8 blockchains and 273 liquidity pools. This means that to execute the best orders, the 1inch protocol can slice and dice your orders into as many pieces across as many liquidity pools that they have access to ensuring you always get the best trade possible. The 1inch platform gives traders control of the parameters that they consider to be best to fit their personal strategy.

The 1inch exchange is not for beginners. It was born from an ETH dev conference in 2019 where the Eth global hackathon was held. Sergei Kuntz, the CEO of 1inch, was watching Anton Bukov on his YouTube channel from NEAR protocol do a smart contract audit live and the two were introduced and hit it off immediately.

The founders built the 1inch exchange with all the DeFi tools listed below. Let’s take a deeper dive into everything you get when you utilize the 1inch protocol.

1inch Limit Order Protocol

Placing a 1inch limit order on the 1inch protocol is as easy as visiting the Dapp site. The app landing page will default to the native token of the chain you select. To place a limit order on 1inch protocol, traders can connect to one of eight blockchains, Ethereum, BNB, Polygon, Optimism, Arbitrum, Gnosis, Avalanche, and Fantom. Don’t see the token you want? No problem, they give you the ability to add tokens, and then 1inch limit orders will be available for your favorite tokens.

1inch Liquidity Protocol

The 1inch liquidity protocol is doing what we are all trying to do faster and more efficiently. It finds the most efficient, cost-effective route for your token swaps or limit orders. However, unlike other AMMs Mooniswap is just an interface, and behind it is Pathfinder, which is where the magic happens. Pathfinder literally examines all the order books that fit the parameters for your order and delivers the orders with the lowest slippage, lowest gas, or fastest transaction speeds. This of course is not enough for the exorbitant gas fees of the ETH network so they just keep innovating. For example, in March, the new Chi gas token was introduced, which can save up to 42% against ETH during optimal conditions.

One more unique feature of the 1inch liquidity protocol is the infinity unlock available for those with advanced trading knowledge and a healthy risk appetite. Well, it’s available for everyone, but we suggest that you read up on it before using it. Traders can use a simple unlock each time, but for those truly out to optimize returns, the infinity unlock feature will save on gas. However, it does come with some risk, as it does have a vulnerability that opens it up for exploitation, although nothing has happened so far.

1inch Aggregation Protocol

The 1inch aggregation protocol is an algorithm that searches for the best deal in town, and in this case, the town is made up of 273 different liquidity pools across 8 blockchains. What started as a simple tool for Eth aggregation has grown into a one-stop shop that is expanding so fast that in a source yesterday, only 7 blockchains were listed, and now today, there are 8 when I checked the 1inch app itself. That's why you hear about them all the time. They are pretty busy stitching the DeFi space together. The 1inch aggregation protocol can connect to endless liquidity pools, and as it does, it helps to unravel a fundamental problem that plagues all new markets. Arbitrage. Their automated balancing algorithm is a game-changer, and it's evident in the aggressive growth and cross-chain latticework they are building. It's much more than just a bridge, and it's a full-blown web that can keep expanding and is precisely the technology needed to support the growing DeFi and Metaverse applications that are being seeded and fostered now.

1inch Token Review

More than just a utility token, the 1INCHtoken is the first ERC-20 token built with instant governance. The 1inch instant governance feature allows token owners to access governance instantly to the DEX aggregator and the liquidity protocol.

1INCH token holders, no matter how small their holdings, gain instant access to voting power to decide on various parameters within the 1inch protocol. Voters are rewarded by getting to decide on swap fees for the liquidity protocol, the price impact fee, and even the decay time for the exchange. If there are any open proposals users can vote for or against them without delay.

The 1INCH tokens total supply is set at 1.5 billion, where 30% of the supply is reserved for the community members. The four-year distribution of the community 1INCH tokens is nearing two years, and these tokens are delivered to investors via airdrop.

The remaining 1INCH tokens will be divided into three more groups. 1inch development gets 14.5%, 8% of which was received during the last funding round. The final 55.5% will be slowly distributed to both the team and early investors over the next few years.

The 1inch Foundation issues the tokens. They are a non-profit organization established to keep the community organized and manage the administration. The foundation actively engages early adopters and users to stake 1INCH in governance proposals, and they issue grants to developers with project ideas that will benefit the 1inch protocol. This includes initiatives for yield farming.

1inch Tokenomics

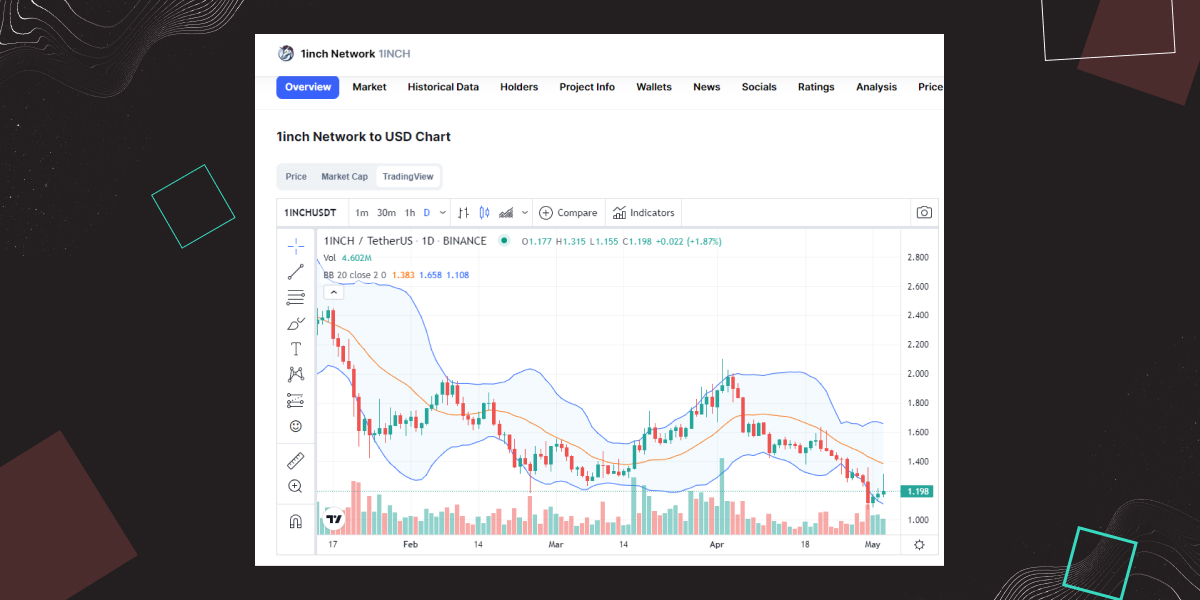

Nearly ⅓ of the total supply of 1INCH tokens are currently circulating, 413,777,581 at the time of writing. This translates to a market cap of $547,274,021, with a fully diluted market cap of $1,978,043,646. At the time of writing, the price of the 1INCH token is $1.32. It has seen downward movement since its high of $8.57 last October, but again so has the whole market, and the 1inch protocol just continues to build.

1inch Exchange Review

Did you know? That the 1inch Exchange was named for the legendary Bruce Lee’s 1-inch punch, which he could execute and knock his opponents to the ground. The founders of the 1inch protocol wanted to embody this efficiency and have spent the past couple of years showing the crypto-world how efficient a DEX can be with their innovative approach to solving the arbitrage issues so prevalent in a new market and one that is 24/7 at that.

The 1inch exchange is a router at its core. It's a DEX with no liquidity, just like Uber has no cars and Air BNB owns no hotels. The 1inch protocol has robots that harvest the best order routes from various CEX and DEXs globally, all in one easy-to-use interface.

1inch Staking

1inch staking is available right on the 1inch.exchange platform and is easy to access with the 1inch wallet or any web wallet like Ledger or MetaMask.

1inch stakers earn 38% of the fees generated within the 1inch protocol. The fees come from the positive slippage in the liquidity pools and the ecosystem partnerships. The average APY is currently around 21.7% for 1inch staking rewards.

The process is straightforward to start staking your 1INCH tokens and gain instant governance rights.

Step 1 Visit the DAO section of the 1inch dApp and connect your wallet in the upper right corner. Check your wallet address to ensure you have your 1INCH tokens.

Step 2 Determine the number of 1INCH tokens to stake on the 1inch protocol. A minimum of 25,000 is required to submit governance proposals, so if you are looking to impact the community, you need to start with this. Otherwise, there is no minimum amount to stake to gain your voting rights in their signature instant governance which is also seamless on the interface.

Step 3 Grant permission for staking your 1INCH tokens, then sign the transaction from the wallet you have connected.

Step 4 Once you have approved the transaction, it has permission to be mined. Now click on “stake token” and confirm your second transaction in your connected wallet.

Step 5 When you have successfully staked your 1INCH tokens, they will appear in the wallet you connected with as “st1INCH” tokens and on the block explorer. To view the staked tokens, be sure to add the token contract address to your wallet if you don’t see it there automatically.

The 1INCH Token Address: 0xa0446d8804611944f1b527ecd37d7dcbe442caba

Instant Governance Voting Rights That’s it! Now that you have staked your tokens, you are ready to vote and begin reaping the rewards of instant governance. You can directly affect the community in real-time, and become a shaper of this industry.

You now have voting power on the 1inch data aggregation protocol and the 1inch liquidity protocol. To check the current distribution ratio between Referral rewards and Treasury allocation, click the “Aggregation protocol” tab.

To vote, click on the view details button and enter your desired percentage of referral rewards against the treasury allocation. Finally, click on the migrate module button to confirm the transaction in your connected wallet.

If you want to take it to the next level then make sure to stake 25,000 1INCH tokens and you can now submit a governance proposal that will be open for voting for 7 days.

1inch Farming

To begin 1inch farming on the 1inch protocol, investors must first become liquidity providers in one of the active liquidity pools. If none of the current liquidity pools on the 1inch protocol are appealing, investors may create their own pool. Next, choose your desired token pairs, enter the LP token amount to mint, enter the amount in USD, or hit the Max button to cannonball into the liquidity pool.. Now you are ready to Unlock. Here is where it gets exciting, especially for traders who want to optimize their earnings. Once you click unlock, you will have two choices.

Simple Unlock or Infinite Unlock, but you can only choose one. The simple unlock is precisely like every other platform. You pay per transaction. There is less risk and as we all know with less risk comes higher costs. So, the alternative is the infinite unlock, which will save gas fees, and may be appropriate for those who can absorb the risk. Now that you have unlocked your tokens, you can click on the button to provide liquidity and sign the transaction in the wallet you connected earlier, and your transaction will be mined.

Now you are ready to farm with your new LP tokens.

Have you noticed a pattern here of instant gratification? It all goes back to that 1inch punch! Be efficient, take the shortest path.

To begin farming on 1inch, you need to stake your LP tokens. Visit the farming tab, find the pair you provided liquidity for, and click "deposit." Click on balance to enter the max number of LP tokens and unlock in the upper right. Choose your unlocking option, and check your connected wallet to confirm the transaction to be mined. Your liquidity-providing journey begins the moment the transaction has been mined.

You can either claim, withdraw, or exit to remove funds from the farm.

Claim: This function is for claiming rewards that you have accrued using on the 1inch farm. Your reward is credited to your wallet when you claim, minus any applicable gas fees. The LP tokens remain staked and continue yielding rewards for you.

Withdraw: When you use the withdrawal function, your rewards if any remain to be claimed at a later time, but your LP tokens are removed from the farm. Once your LP tokens are unstaked, you can complete your withdrawal from the farm.

Exit: This action does both claiming and withdrawal simultaneously. You will claim your rewards and withdraw your staked LP tokens from the liquidity pool. Once finished, you have no more tokens on the farm.

1inch Fees Policy

What do people pay to use 1inch? The short answer is that it depends on the parameters set. Once the parameters have been selected, traders can then analyze the fees to choose their trading style. The rate, inverse rate, and exchange fee are all displayed. The exchange fees vary, as they set their own, and 1inch has no control over that. 1inch optimizes fees with their infinite unlock feature and the CHI Gas Tokens. The fees and rewards are now wholly reliant on the DAO governance proposals that the community votes on.

Break down the fees people have to pay to make a transaction within 1inch exchange.

1inch Wallet

The 1inch platform is a decentralized exchange making it non-custodial. This means that there is no requirement to create an account, and no exchange wallet is provided. However, 1inch has a wallet that includes every DEX inside and all the liquidity sources. In addition, the 1inch wallet has top-level security and comes with a private key and seed phrase scanning. Simply scan a seed phrase to import a wallet directly to the app. And most importantly, it provides secure backups to the Apple iCloud, protecting your SEED phrase, whether or not your phone is up to date.

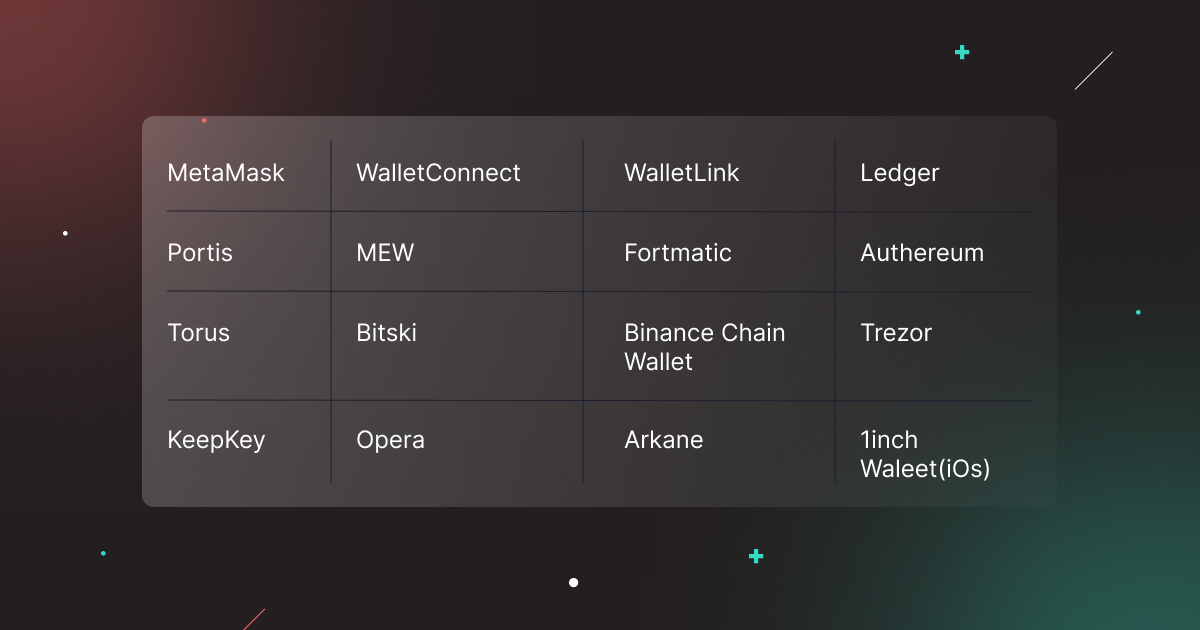

Users must choose which wallet to use. 1inch has crafted its version of a web wallet with some really great features if you are into the DeFi scene. However, there is a long list of supported hardware and software wallets that are EVM compatible. There are currently 8 networks available and many more wallets.

1inch Token Price Prediction 2022 - 2025 - 2030

What is the 1inch token price prediction for the future? No one can know, but there are a ton of speculators and experts with varying opinions. Please keep in mind when looking to predict the price of the 1inch token, there will always be factors that you don't account for. We all learned that in the last couple of years, watching the effects of the pandemic and the Russian attack on Ukraine, world events can send the market into a tailspin. Even Tweets from specific individuals can rock markets like crypto, so anything can happen. However, what will probably have the most significant effect on the 1inch price in the near and distant future is the adoption speed of blockchain tech and the overall market cap of BTC and the crypto market as a whole. We will look at this year, 2022, 2025, and 8 years into the future for the 1inch price prediction in 2030, Bitcoin's 19th year.

1inch Price Prediction 2022

Currently, the price of a 1inch token is $1.32, and experts are divided on when the coin will reverse. CryptoNewz is predicting the price of a 1inch token will rise to as high as $3.70 by the end of 2022; however, WalletInvestor has a bearish outlook putting the 1inch 2022 price prediction down to $0.228 over the next year, with little to no hope of recovery shortly. DigitalCoin is closer in sentiment to CryptoNewz with a 2022 1inch price prediction of up to $2.22. The market as a whole is trending down. If May 2022 is anything like May 2021, there may be some entry opportunities for investors looking for returns in the not too distant future, unless, of course, the doomsday scenario of WalletInvestore were to come true.

We suggest watching closely, and if you are already invested, this year may be an excellent opportunity to DCA down. Both May and July are historically rough months for crypto, watch the charts closely, and if a dip is your desire, you may just get served. The daily candle pierced through the lower bollinger on the 1st of May, as well as once in March. This could indicate a trend reversal is on the way, but as the chart continues moving sideways and down during this more bearish turn of the overall market then this price movement could play out favorably in the not too distant future.

1inch Price Prediction 2025

With a market as young as crypto and advancements and competition happening at lightning speed, we want to remind you that this price prediction for 1inch 2025 is at best-educated guessing and, at worst, a stab in the dark. No one has a crystal ball, but DigitalCoin predicts the price of 1inch tokens to hit at least $3.02 by 2025. CryptoNews is a lot more bullish, with a 2025 1inch price prediction of as high as $6.

1inch Price Prediction 2030

DigitalCoin believes that the 1inch price prediction 2030 is when investors will see 1inch reach $6.98, and CryptoNewz doesn't go past 2026. But, of course, going 8 years into the future of a market only in its second decade is guesswork, and many factors we don't know could impact prices.

Wrapping Up: Is 1inch a Good Investment?

Is 1inch a good investment? With 1.6 million users in the last 2 years, a functioning platform has proven itself to be the most efficient and cost-effective DEX in existence thus far. It may be a good fit for your portfolio. The fundamentals of 1inch are strong, the team is innovative, and they continue building and releasing new products to enhance the overall user experience. As more crypto users enter the space, demand for DeFi tools will rise. As retail investors begin to understand how DeFi can benefit them and how they now have access to tools traditionally reserved for the world's most financial elite, demand will only increase.

We believe that 1inch is here to stay, they are a leader in the space, and the current price is probably quite attractive once the fundamentals are fully understood. 1inch tokens are available on bitoftrade for leverage trading, limit orders, or swapping. So if you are ready to level up your DeFi game, then 1inch is prepared for you!