Ripple SEC Lawsuit:

The trial against Ripple, the company behind the XRP cryptocurrency, began in December 2020. The US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, alleging that the company had conducted an unregistered securities offering by selling XRP to investors.

The SEC's argument is based on the fact that Ripple sold XRP to investors in an initial coin offering (ICO) in 2013, raising over $1 billion. The SEC alleges that Ripple marketed XRP as an investment opportunity, promising investors they could expect to profit from its future appreciation in value.

Ripple has disputed the SEC's position, arguing that XRP is not a security but a currency. Ripple maintains that XRP is used primarily as a means of facilitating cross-border payments and is not intended to be an investment vehicle. The Ripple payment platform was designed mainly to be employed by banks and individual investors are free to speculate on the selling price of XRP.

According to the SEC, Ripple never submitted the necessary registration documents required by businesses attempting to raise funds from the public. In the case, the government agency said that Ripple had “created an information vacuum” by selectively sharing information it deemed necessary.

Ripple's attorneys argued that the SEC neither cautioned nor informed the company. Ripple was also not advised that XRP may be categorized as a security.

In addition, the SEC argues that Ripple has significant control over the supply and distribution of XRP, which is not decentralized like other cryptocurrencies such as Bitcoin. This control, combined with Ripple's efforts to promote XRP as an investment, suggests that XRP meets the definition of a security under U.S. securities law.

Crypto Regulatory Landscape

In the United States, the Securities and Exchange Commission (SEC) has taken a strict stance on initial coin offerings (ICOs), considering them as a security and subject to the same regulations as traditional securities. The Commodity Futures Trading Commission (CFTC) also regulates certain cryptocurrencies as commodities.

The SEC has issued several warnings and enforcement actions against companies that have conducted ICOs without complying with securities laws.

The first SEC lawsuit against crypto was in 2013 against a company called “BTC Trading Corp” and its founder, who were accused of running a Ponzi scheme involving Bitcoin. The SEC alleged that the company promised investors high returns from Bitcoin trading, but instead used new investors' funds to pay off earlier investors. The case resulted in a court order for the defendants to pay over $4.5 million in penalties and restitution.

Under the Howey Test, an asset is considered a security if it meets all four of the following criteria:

It involves an investment of money.

There is an expectation of profits from the investment.

The investment is in a common enterprise.

Any profits come from the efforts of a promoter or third party.

The Howey Test has been used to determine whether certain cryptocurrencies, such as initial coin offerings (ICOs), are considered securities. If a cryptocurrency meets the criteria of the Howey Test, it may be subject to securities regulations and require registration with the SEC.

Ripple SEC Investigation Background:

Ripple overview

Ripple is a cryptocurrency project that has gained significant attention in recent years due to its unique approach to the industry. Unlike other cryptocurrencies such as Bitcoin or Ethereum, Ripple is not designed to be a decentralized currency for individuals to use for transactions. Instead, it is a payment protocol for banks and financial institutions. The primary mechanism of Ripple is a payment settlement asset exchange and remittance system comparable to the SWIFT network that handles global money and security transfers.

One of the key features of Ripple is its use of a distributed ledger technology called XRP Ledger. This ledger allows for real-time settlement of transactions, eliminating the need for intermediaries and reducing the risk of fraud or errors. It also enables banks to access liquidity on-demand, reducing the need for pre-funded accounts and freeing up capital. Ripple transactions require less energy than Bitcoin transactions, can be confirmed in a moment, and are cheap, whereas BTS consume more energy, are slower to confirm, and have greater fees to pay.

Ripple employs a medium called the gateway, which serves as the link in the trust chain between two parties interested in executing a transaction. The gateway serves as a credit middleman, accepting and sending currency to public addresses via the Ripple network. Any individual or corporation may sign up and operate a gateway, allowing the person who registered to function as an intermediary for swapping currency pairs, sustaining liquidity, and moving transactions across the network.

Another interesting aspect of Ripple is its focus on partnerships with established financial institutions. Rather than trying to disrupt the existing financial system, Ripple aims to work alongside banks and other institutions to improve their processes and provide added value to their customers. This approach has led to partnerships with major players in the financial industry, including American Express, Santander, and Standard Chartered.

XRP token price

XRP is used as a digital asset to facilitate cross-border payments and transactions on the Ripple network. Unlike other cryptocurrencies, XRP is not mined but instead issued by Ripple Labs. The XRP received 80 billion XRP from Ledger developers for the organization to establish use cases surrounding this digital currency, including its worldwide payments system, RippleNet.

Every transaction is public and transparent. On the ledger, there are now over 150 validators run by institutions, exchanges, organizations, and individuals from across the globe.

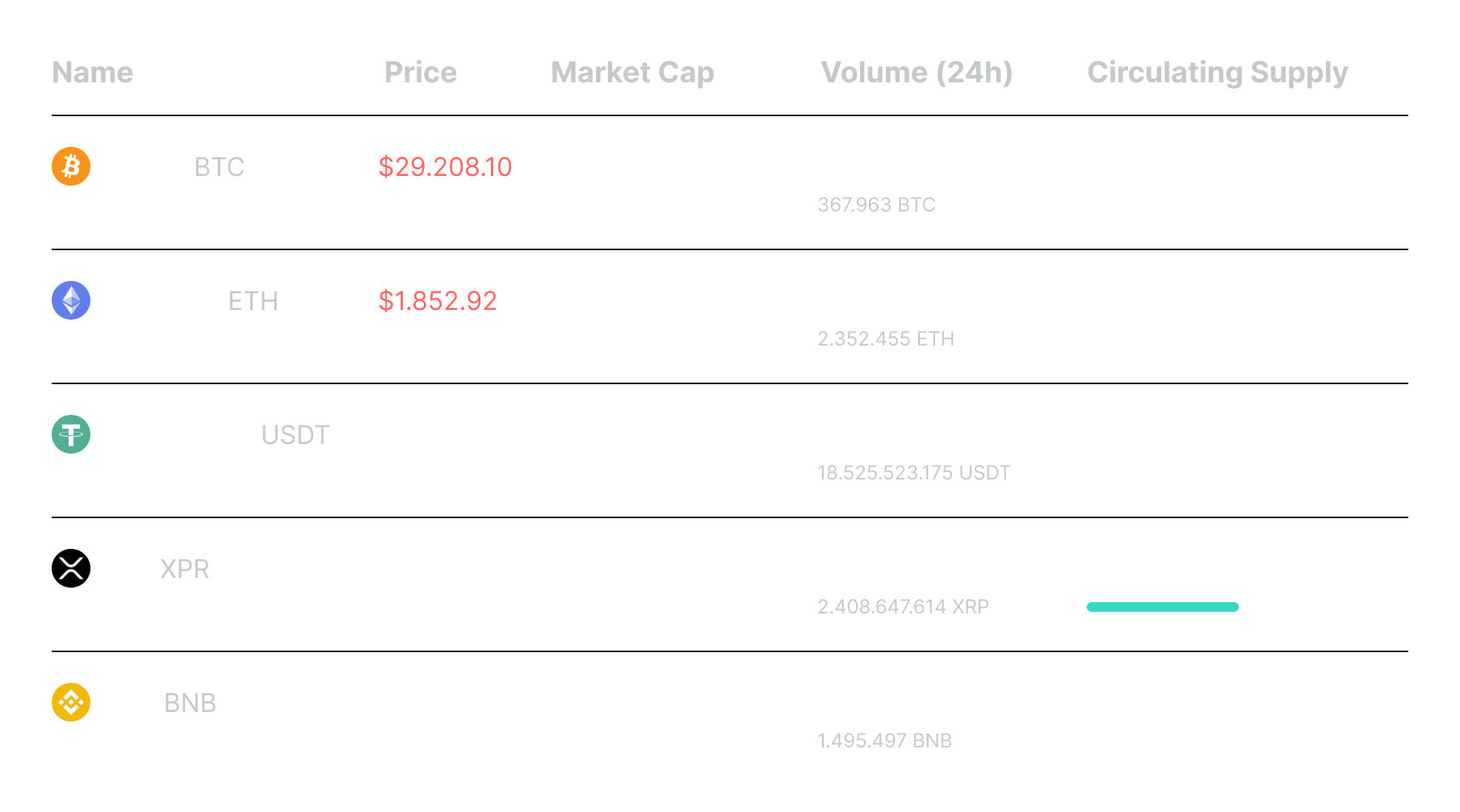

XRP is now the fifth most valued crypto asset. The circulation supply of XRP is 52,664,942,014 XRP with a market cap of $36,880,924,796.

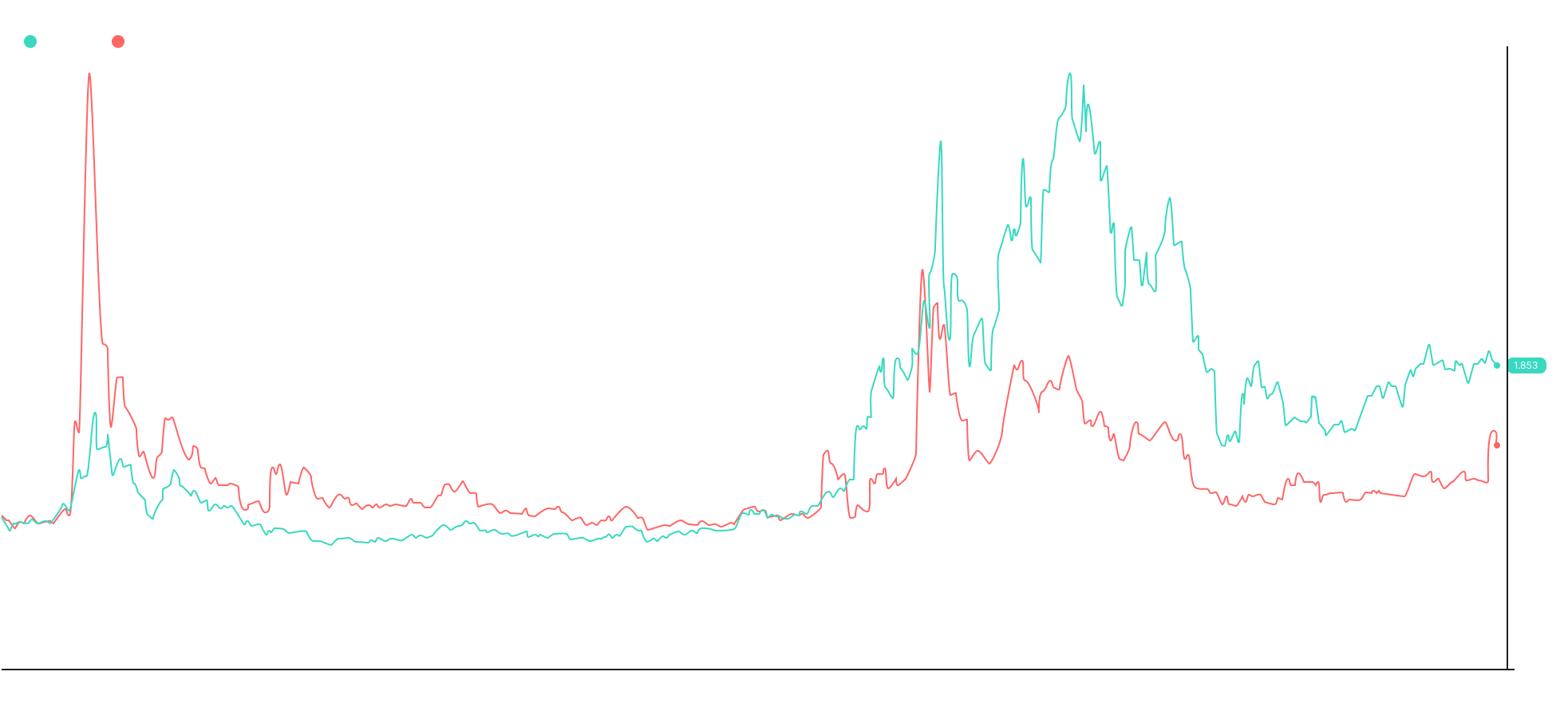

In 2020, at the time when the lawsuit rolled out, XRP's price started around $0.19 and reached a high of $0.76 in November before dropping back down to around $0.21 in December.

If we compare the price action of XRP with the dynamics of ETH, we will see similar growth trends until 2022. In comparison, 2022 turned out to be a more favorable year for demanded ETH. But if we look at XRP separately, we can see growth over the past years.

In general, the token price movement for 2019-2021 rarely exceeded $0.4, but this year we have witnessed substantial fluctuations. The price of the XRP increased when a federal judge ruled in favor of Ripple in a lawsuit.

By late afternoon 13th July, XRP traded near 82 cents, roughly 75% higher than where it started the day at 47 cents. The Court's judgment spurred a slight surge in the crypto markets, with key tokens such as BTC and ETH surging by 3% to 6%. Polygon’s MATIC token gained 17%, Litecoin and Solana rose by 18%, and Cardano by 20% that day.

According to CryptoWatch statistics, XRP reached a high of 93.8 cents, its highest level since March 2022, before stabilizing at $0.6 - $0.7 these days.

As you may have noticed, XRP has not been traded on most trading platforms. Binance never delisted XRP from its platform situated outside the United States, however, XRP was delisted from Binance US. Ripple has been taken off Coinbase and Gemini's listings in the United States.

The good news for the crypto company is that Ripple, which had been delisted from Coinbase, will now be traded on the site again. Gemini stated that the token may be listed on the exchange as well.

Ripple SEC Settlement: How did it end?

The court has declared XRP as a digital asset, allowing the token to be traded more freely on US crypto platforms. However, it is important to note that by the Howey test Ripple Labs was found guilty of securities fraud in the selling of XRP to institutional investors.

The SEC's charges against Ripple Labs, Inc. were aimed at recognizing XRP as an investment contract that must comply with the rules of the regulatory agency. But the court stated and considered the case based on the recognition that any asset can be the subject of an investment contract but selling any asset (including a digital asset) via an investment contract does not automatically make that subject asset into a security.

That's why it was important in the process to consider all use cases for the XRP token distribution:

- Direct sales to institutional investors (institutional sales)

- Anonymous sales through trading algorithms (programmatic sales)

- Distributing as a form of payments (other distributions)

To better understand the court's decision, let's explain the difference between institutional sales and programmatic sales.

The sale of assets does not automatically turn the underlying asset into a security. Thus, according to the Court's verdict, when Ripple sells XRP “programmatically” or anonymously through crypto exchanges (“Programmatic Sales”), it is not an investment contract.

So-called programmatic sales take place when XRP is traded directly on a crypto exchange.

The Court determined that these sales did not meet the third criteria of the Howey test because public buyers could not have been aware of the promises and marketing efforts tying the XRP's performance to the company's performance. The judge claims that Ripple didn't promise anything to secondary-market purchasers, which is typical for most exchange-traded assets.

After determining that the third Howey criteria were inapplicable, the Court found that XRP programmatic sales were not an unregistered offering and purchase of investment contracts in violation of Section 5 of the Securities Act.

Why, in the opinion of the court, did the institutional sale of the tokens violate federal securities laws?

In contrast to institutional XRP sales, programmatic sales were blind bid/ask transactions in which investors did not know who was offering the token.

According to the Court, such sales did not constitute an investment in the project because investors weren't expecting Ripple to receive the purchase money and utilize the earnings to boost XRP.

When analyzing the third Howey criteria, the Court observed that buyers in both kinds of sales expected to profit from holding XRP. So, the key issue is whether that expectation was formed from Ripple's efforts.

The court determined that Institutional Buyers expected benefits from Ripple's efforts, whereas Programmatic Buyers did not.

Because Ripple claimed that XRP is nothing but a currency or utility token, XRP tokens are limited to use as a speculative investment. The court referenced investment contracts in which the buyer primarily specified that the buyer was purchasing XRP “exclusively for resale or other distribution.”

When Ripple sells XRP to institutional investors directly through written agreements (“Institutional Sales”), the token becomes an investment contract and falls under the Howey test. According to US District Judge Analisa Torres, when Ripple Labs pushed XRP, institutional investors were more likely to be aware of its security-like attributes.

The SEC has mentioned a number of crypto projects that rely on early token sales to institutional investors before their public launch to get started, typically pre-registering such attempts with authorities to prevent any possible consequences. According to the SEC, Ripple did not inform the agency about the financial activity mentioned above.

The SEC's job is to establish a connection between the initial distribution of a token and the subsequent involvement of its founders and issuing organizations with the later sale of these tokens on crypto trading exchanges as an ongoing investment plan.

According to the judgment in the Ripple case, the US judiciary doesn't think that way.

As the Court stated, the institutional sale of XRP constituted an unregistered offer and sale of investment contracts in violation of Section 5 of the Securities Act. So, based on the case against Ripple, the courts in the United States concluded that cryptocurrencies are securities if they are purchased by institutional buyers rather than ordinary investors through exchanges.

Conclusion:

The circumstances of this case are complex, and it is too early to make good forecasts and declare crypto's victory, as is frequently stated in the mainstream press. The three-year lawsuit against Ripple demonstrated, foremost, that crypto businesses now provide a vast array of financial services and products that are difficult to categorize properly under current legislation.

The Securities and Exchange Commission's investigation against Ripple will now focus on whether Ripple's executives — Brad Garlinghouse and Chris Larsen — abetted the illicit sale of XRP to institutional investors.

If the SEC's appeal is successful, it will reinforce the commission's stance and confirm that XRP is a security. This result would almost certainly result in harsher regulations and possibly serious ramifications for other digital currencies like XRP.

However, if the SEC's appeal is denied, it will be an important setback to their power and jurisdiction over the digital asset market. The failure may force the commission to reassess its categorization of various tokens or push it to change its rules.

When engaging in crypto financial activities, institutional investors and organizations must be cautious. Ordinary crypto traders, as appears, may exhale free - their activities are not illegal, according to court rulings.

Furthermore, other cryptocurrencies that were sold in ICOs may also come under scrutiny from the SEC, potentially leading to further regulatory action in the industry.

We are keeping an eye on the events including the SEC complaint against Binance and Coinbase. We discussed the topic in one of our articles: SEC vs Crypto

Follow our social media to stay up to date with the latest all-in-one bitoftrade platform news: