Intro

Perpetual futures contracts have become increasingly popular in the world of decentralized finance (DeFi). These contracts are a type of derivative that allows traders to speculate on the future price of an asset without actually owning it. In this article, we will explore what perpetual futures contracts are, their role in DeFi and how to execute perpetual contracts at DEX.

What are Perpetual Futures Contracts?

Perpetual futures are like traditional futures contracts in that they allow traders to buy or sell an asset at a predetermined price at a future date. However, unlike traditional futures contracts, perpetual futures contracts do not have an expiration date.

You can hold a position for a while as there is an adequate margin to keep it open. For example, if you purchase ETH/USD for $5,000, you will be free of any contract expiration period. When you choose, you can close the purchase and lock in your gain (or suffer a loss).

Perpetual futures contracts use a funding mechanism to ensure that the contract price stays close to the spot price of the underlying asset. This funding mechanism is based on the difference between the contract price and the spot price.

Advantages and Disadvantages of Perpetual Futures Contracts

Perpetual futures can be useful for traders who want to hedge their positions or for those who want to take advantage of market volatility.

One of the advantages of perpetual futures contracts is that they do not have an expiration date. This means that traders can hold their positions for as long as they want without worrying about their contracts expiring.

The advantage of perpetual trading is that it allows you to keep your position open for an indefinite period. Let's say, you believe the price of BTC will rise. When it grows, you close the deal and get your profit. However, price volatility is common in crypto finance. If the price of a coin falls, you can wait by keeping the transaction active until the price stabilizes or rises.

But! Perpetual trading is a type of leverage trading.

As you remember, to open a leveraged trade, you need collateral confirming your solvency in case your trade fails. Taking your amount as collateral by the exchange allows the platform to maintain liquidity and protect itself from fluctuations.

You can learn more about leveraged trading in bitoftrade articles:

Crypto Leverage vs Margin Trading: Which One to Use?

How to Expand Your Profit Potential when Leverage Trading with Crypto

The Art of Leveraged Trading: A Professional Approach

So, the requirements for margins are a vital component of perpetual trading since they act as collateral to protect from losses in the future.

In order to open a perpetual leverage trade, an initial margin is required. The initial margin is the bare minimum required to open a position. It functions as collateral for your trading position to cover potential losses. The minimal amount required in your margin account to keep your trade position active is known as the maintenance margin.

The Difference between Perpetual and Regular Futures

Futures contracts are widely used in traditional finance. Futures contracts have also grown in popularity in crypto finance.

In their fundamental role, perpetual futures are similar to regular futures in that the asset is not exchanged right now, as in the spot market, but is bought/sold in the future.

Futures contracts in crypto finance are agreements between two parties to buy or sell a specific cryptocurrency asset at a predetermined price and date in the future. These contracts are traded on specialized exchanges and allow traders to speculate on the future price movements of cryptocurrencies.

Futures contracts have a set expiration date, while perpetual futures contracts do not.

A further important difference is that perpetual futures contracts have a funding mechanism to keep the contract's price in sync with the asset being traded. Since perpetual futures only expire in extreme cases or at the behest of the trader placing the order, the spot price and the perpetual contract price can fluctuate. Funding rates assist in keeping these prices in line. Traditional futures contracts do not have this feature.

The Risk of Trading Perpetual Futures

One of the disadvantages of perpetual trading is that perpetual futures contracts can be more volatile than traditional futures contracts. This is because they do not have an expiration date, which means that traders can hold their positions for longer periods of time, which can lead to increased volatility.

Another critical feature of the dangers of trading perpetual futures is that it is a relatively new area of crypto finance with fewer players than in the spot market or regular futures market.

As a result, because the service provider may not have sufficient market makers and liquidity, a perpetual futures trader may have trouble opening large-volume positions.

For the same reasons noted above, the spread in the perpetual futures market can be greater. The spread is the difference between an asset's selling and buying prices, often known as the bid-ask spread.

Before employing this risky trading instrument, weigh the benefits and drawbacks. But, while you're pondering, we'll show you how to use the bitoftrade decentralized platform to place perpetual futures positions!

How to Execute Crypto Perpetual Futures at bitoftrade?

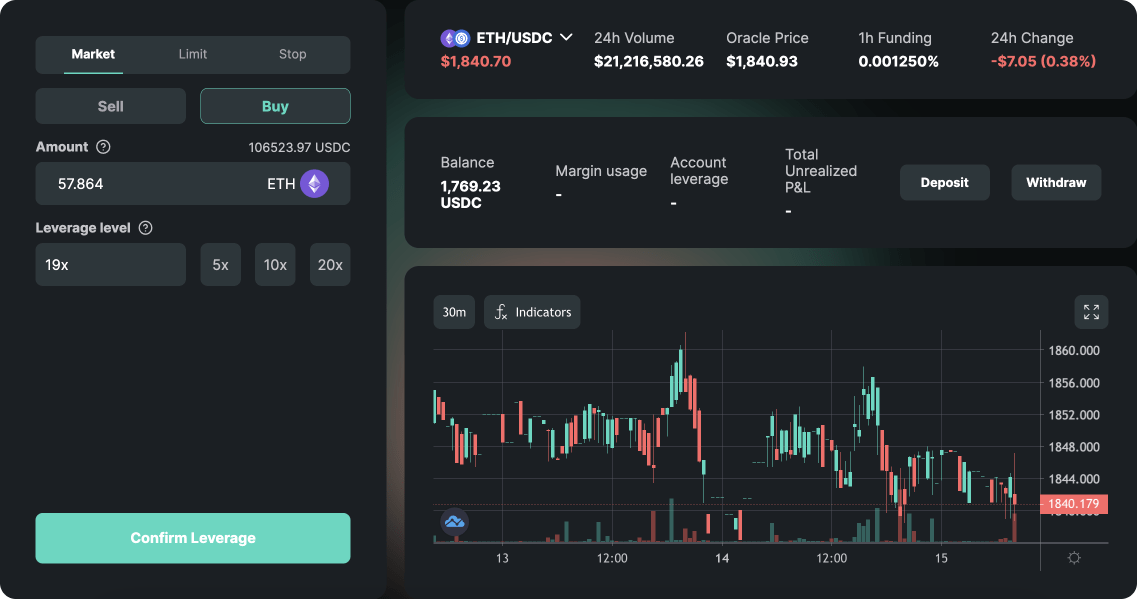

As we have said, perpetual futures is a type of leveraged trading. At bitoftrade, you can leverage up to 20x on the bitoftrade crypto perpetual contracts.

Well, let's explore step by step how to place a perpetual order on bitoftrade!

Follow these simple steps to unlock leverage feature:

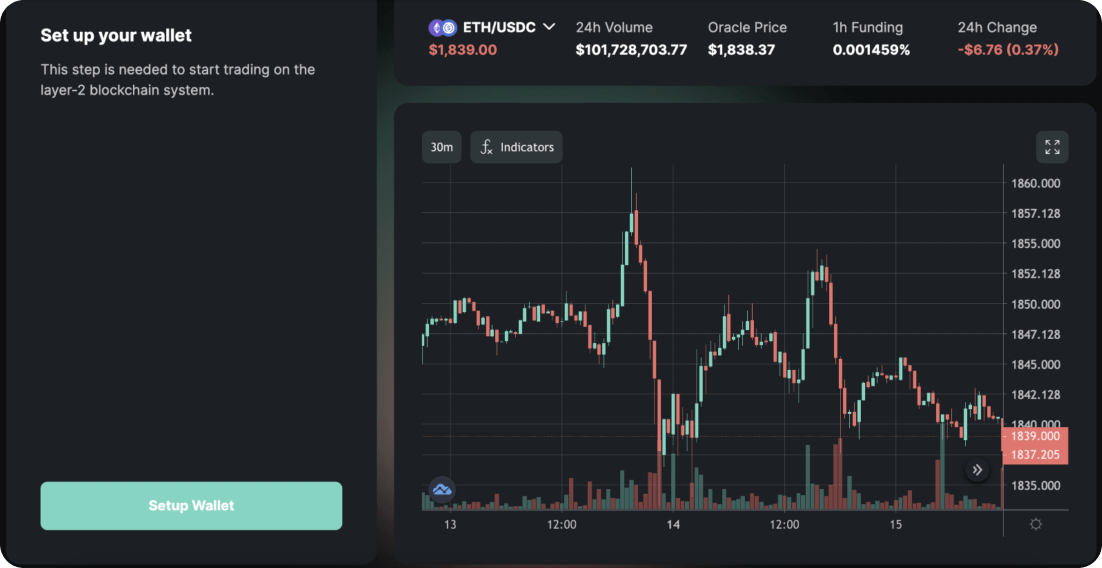

Go to our trading dashboard by clicking on “Explore app”.

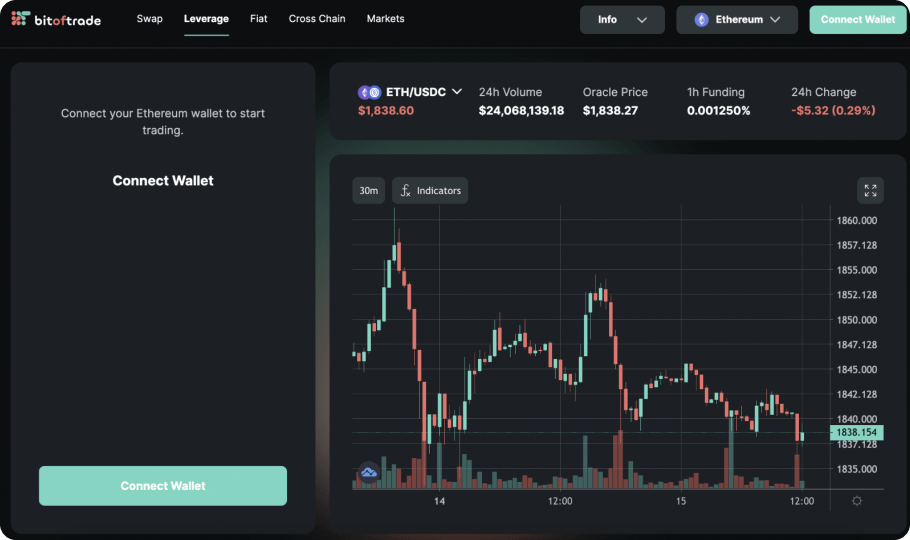

Connect your wallet and choose “Leverage” on the trading dashboard.

If it’s your first time using the leverage feature on bitoftrade, you’ll need to approve the procedure in five simple steps:

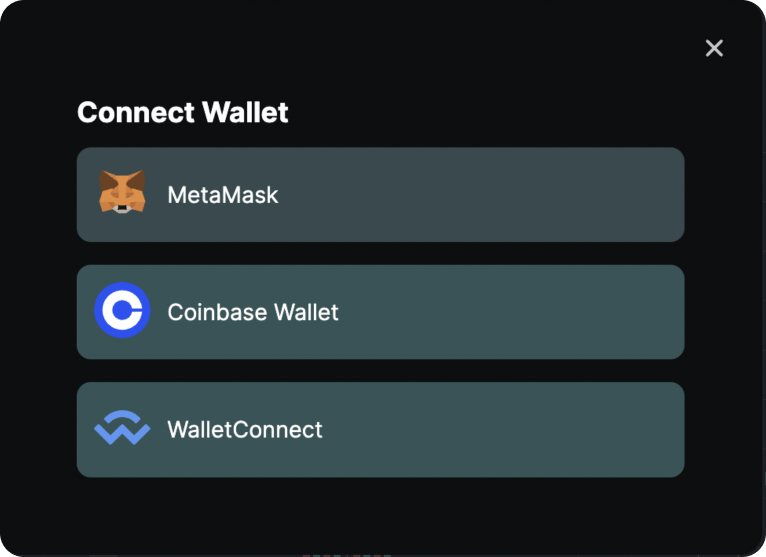

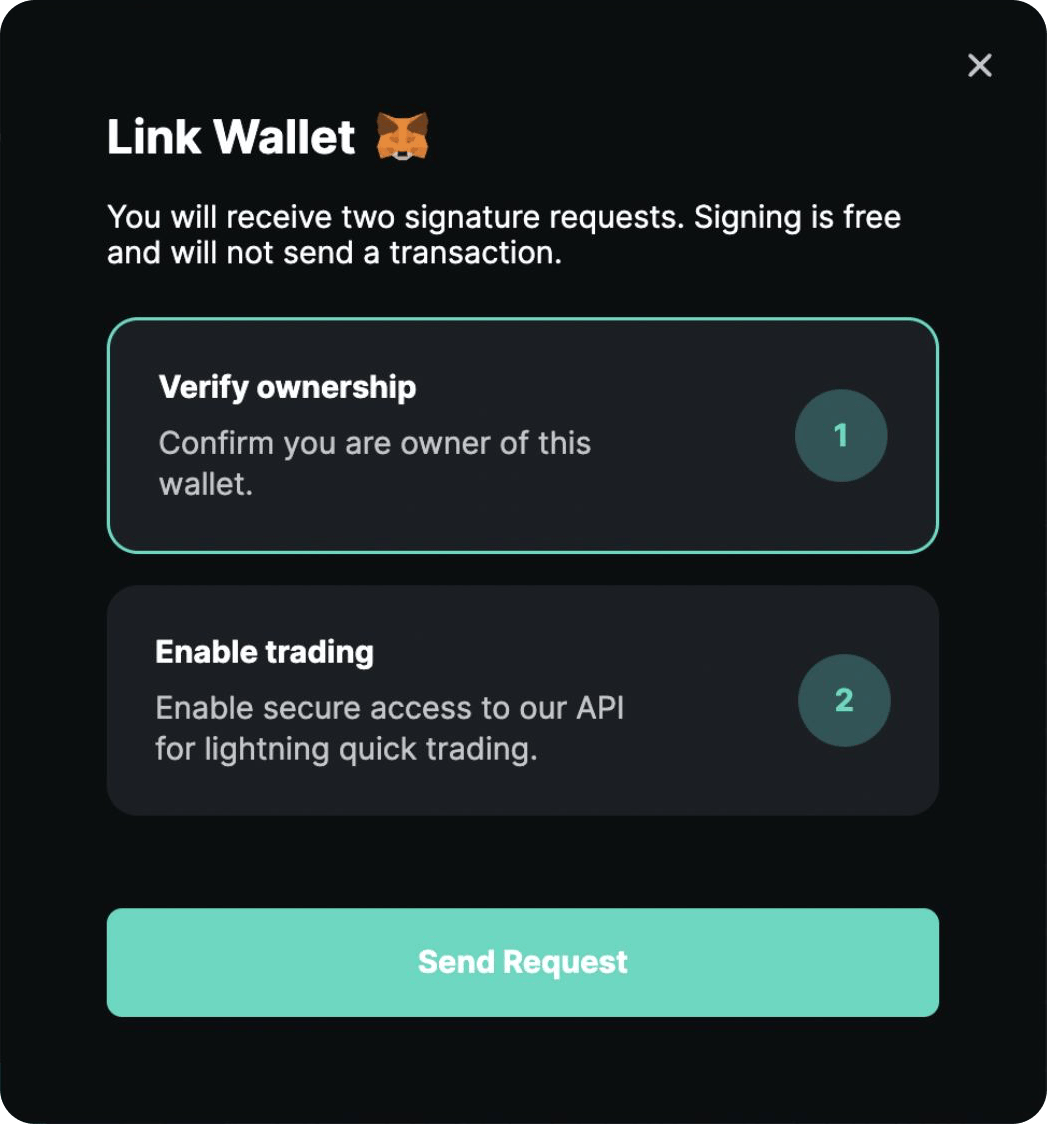

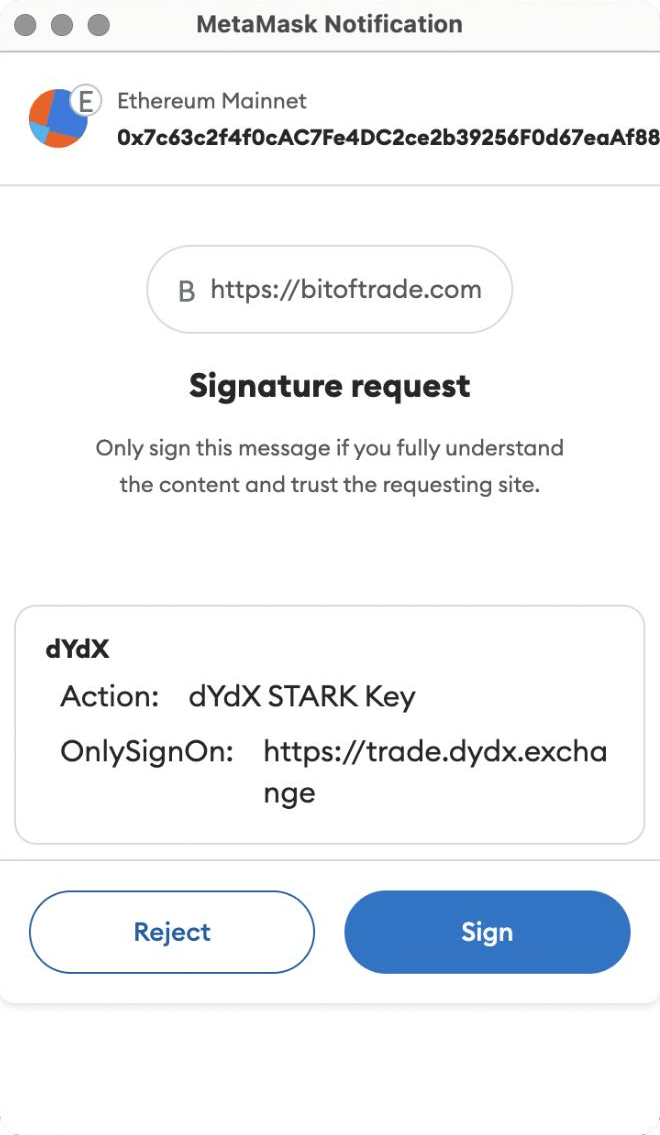

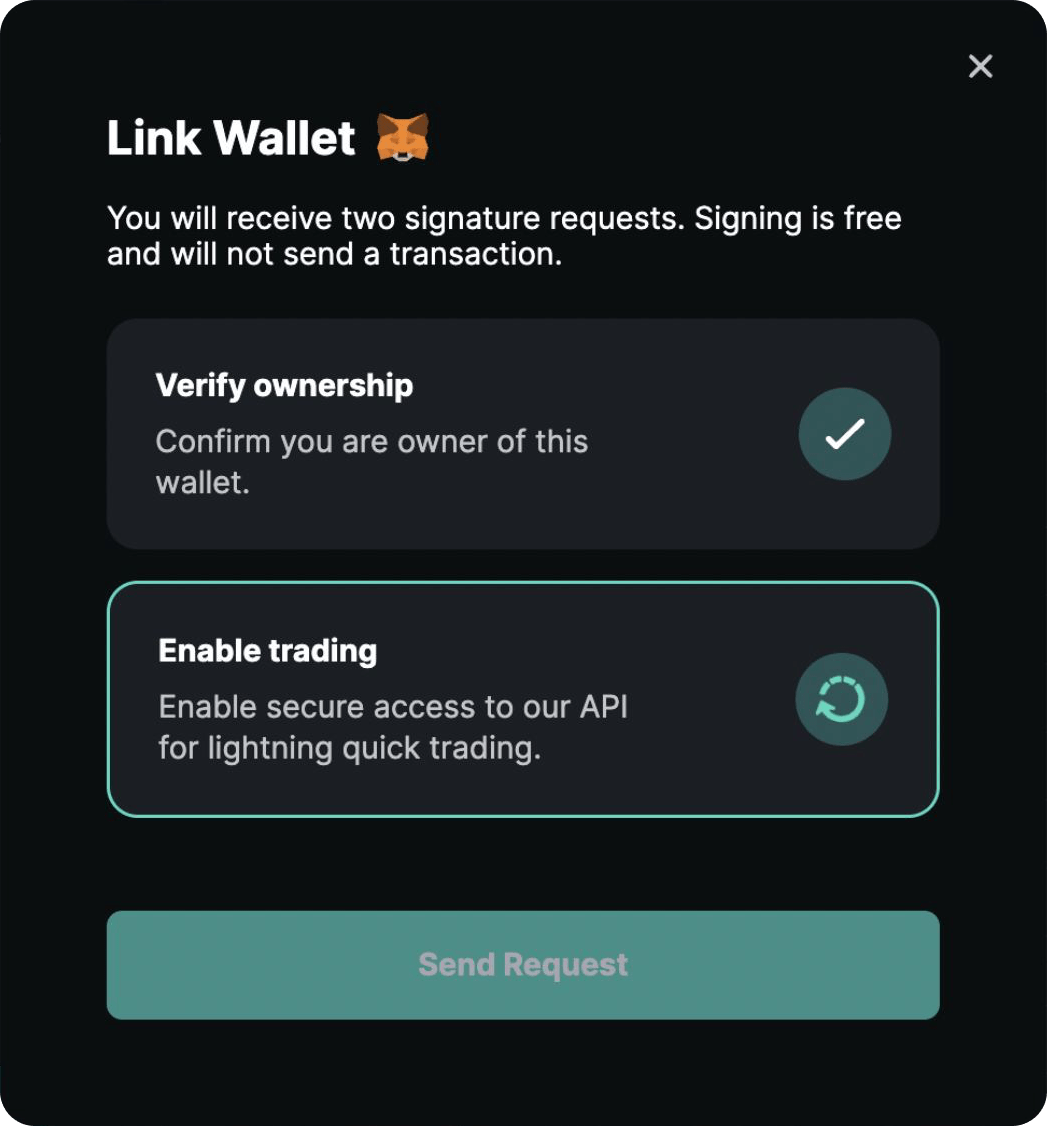

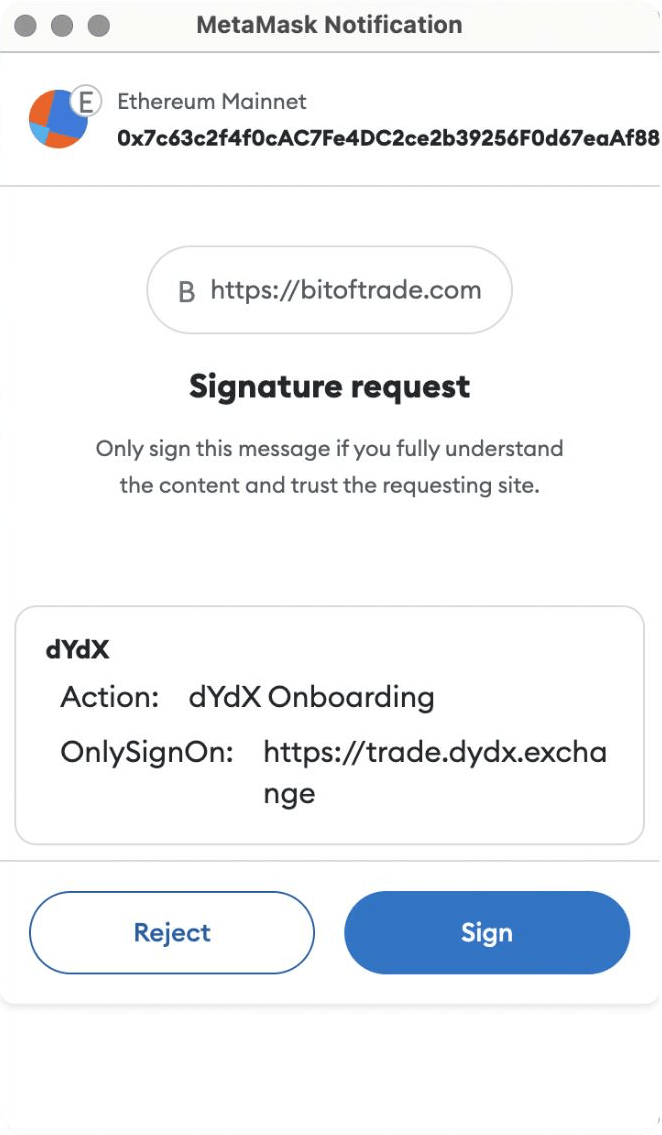

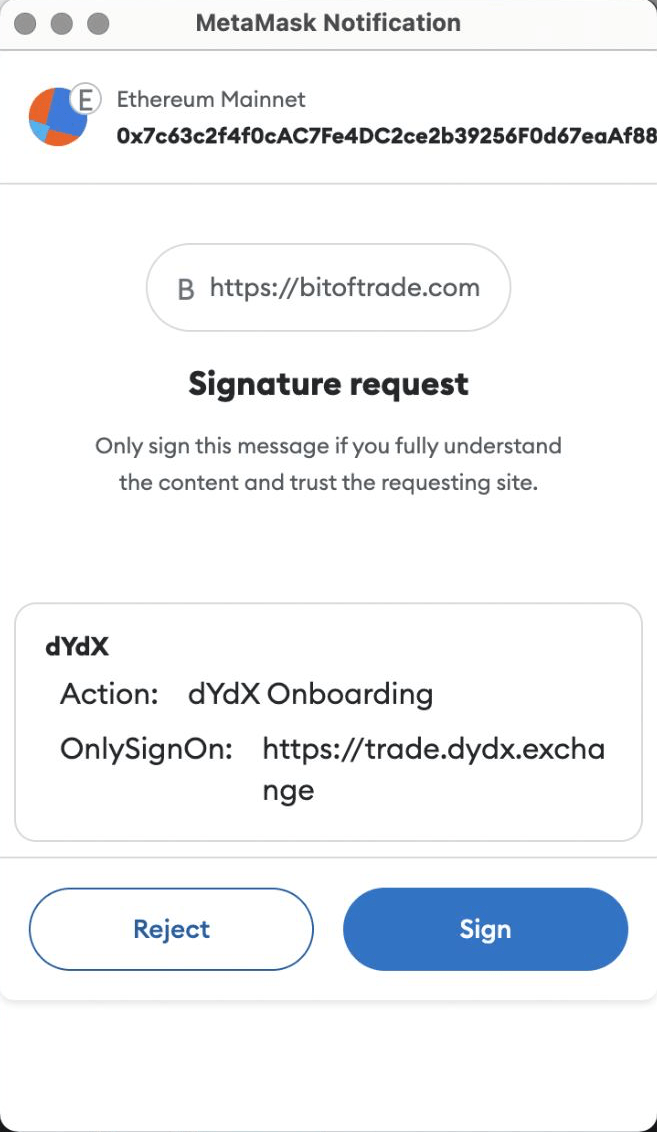

Click “Connect Wallet”, choose the one you will use and approve by signing two requests.

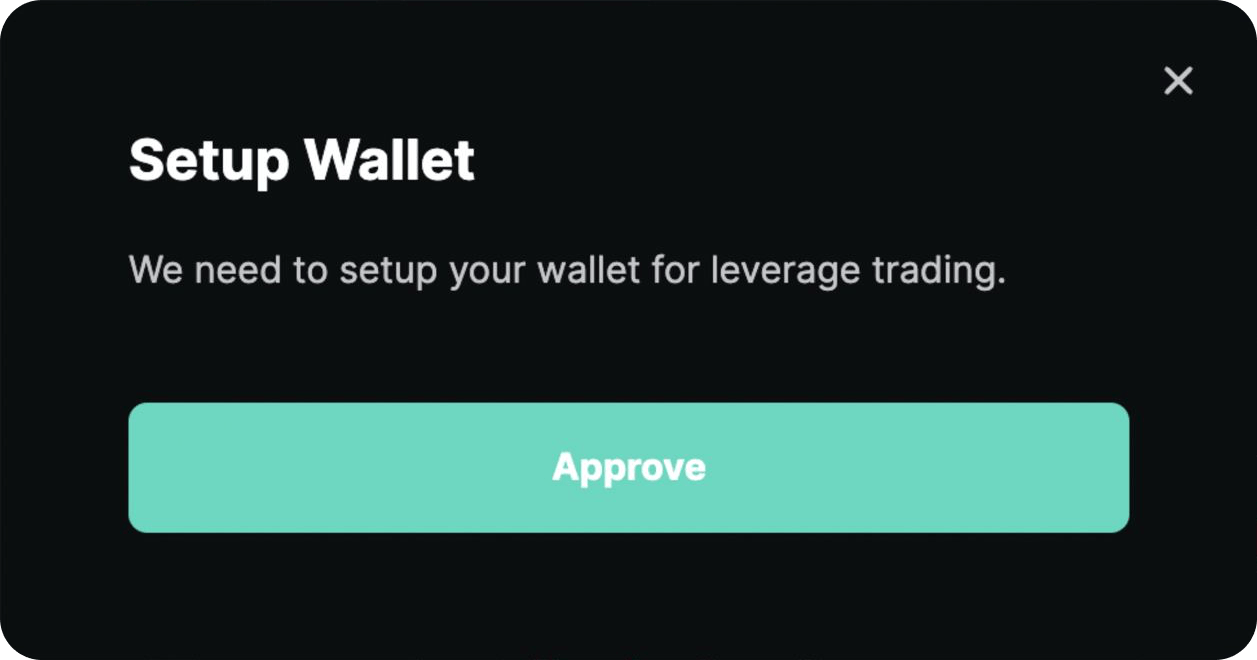

Click “Setup wallet”. This will create a leverage account linked to your wallet.

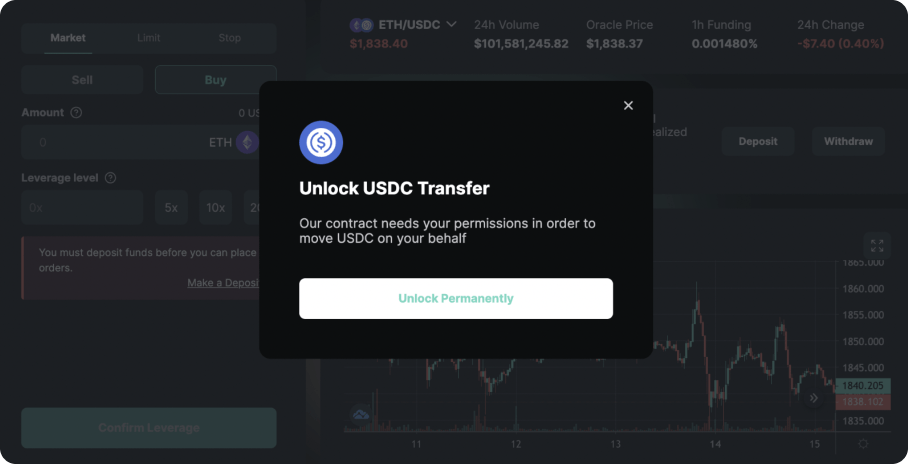

Click “Approve”. This is a one-time procedure (and includes gas fees) that approves our smart contracts to interact with your USDC balance. This step may take a few minutes.

Deposit USDC to your leverage account. Leverage trading operates in USDC, so please make sure you have USDC in your wallet and ETH to pay for gas fees. This step may take a few minutes.

After you have a positive balance in your account you can start trading perpetual futures. Choose your leveraged token and the rest of the terms of the order.

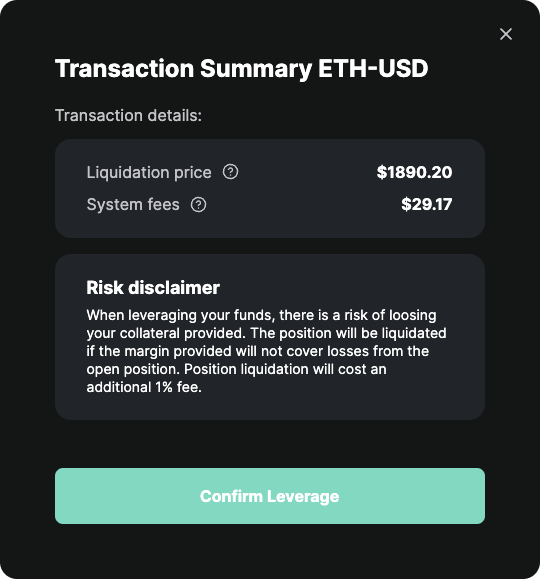

Click “Confirm Leverage” to view your transaction summary, including all estimated fees.

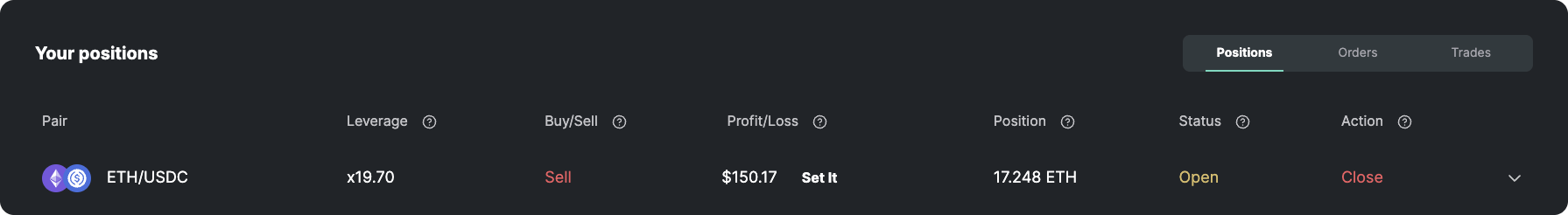

Confirm your transaction, and you’re all set. You can see your open positions at all times and close if needed.

We've got you covered now! See your orders traded 24/7 and take advantage of market movements at any time!

Yet, if you are concerned about real trading, you can first try the test version of the leverage tool.

The test network can be accessed on bitoftrade. Simply pick 'Testnet' from the list of available networks.

Conclusion

Perpetual futures contracts offer traders a convenient and cost-effective way to speculate on the future price of an asset without actually owning it. The absence of an expiration date allows traders to hold their positions for as long as they want without worrying about their contracts expiring.

Perpetual futures contracts at bitoftrade provide traders with a reliable and efficient way to trade in the dynamic world of DeFi.

Follow our social media to stay up to date with the latest all-in-one bitoftrade platform news: