Intro

The regulators had been hunting after companies for selling cryptocurrency tokens without registration for several years. Gurbir Grewal, the Director of the SEC's Division of Enforcement, notes that there has been greater oversight of the crypto industry due to the 2017 DAO report.

Before, we wrote an article about how crypto legislation works in the US. Find a story about the crypto regulators and legislative here:

US Crypto Regulations 2022. Who Regulates Crypto in the USA?

The Securities and Exchange Commission (SEC) has previously brought lawsuits against several well-known cryptocurrency businesses, like Kik Interactive and Ripple Labs, alleging that their offerings classify as “securities” and should be governed by SEC rules. On October 21, 2020, Kik Interactive proved accused by the U.S. District Court for the Southern District of New York and assessed a $5 million USD fine. As of June 2023, the lawsuit against Ripple is still pending.

Earlier this year, the SEC accused Kraken of failing to register their “staking” services with the regulator. Kraken agreed to stop providing or selling crypto assets via staking in exchange for a $30 million agreement with the SEC.

Speaking of the fight between the biggest crypto players and the SEC, Grewal claims that the SEC filed a case against Coinbase because the exchange disregarded earlier warnings.

Let's try to review what is happening in this battle at the moment.

SEC and Crypto Regulation

The SEC, or the Securities and Exchange Commission, is a government agency responsible for regulating financial markets in the United States. Its primary role is to protect investors and maintain fair and orderly markets by enforcing securities laws and regulations. The SEC oversees the registration of securities, such as stocks and bonds, and ensures that companies disclose all relevant information to investors. It also investigates and prosecutes cases of fraud and insider trading. The SEC's goal is to promote transparency and accountability in the financial industry and protect investors from fraudulent activities.

The SEC has expressed concerns about the lack of oversight and the potential for fraud in the crypto market due to its decentralized nature and lack of regulation. The SEC has taken action against companies and individuals who have engaged in fraudulent activities in the crypto market, such as selling unregistered securities or engaging in insider trading.

SEC Binance Case

On June 5, federal regulators accused Binance, the biggest digital currency exchange, stating that the company ran an illegal trade in the country and mixed-up client funds worth billions of dollars in a manner akin to FTX activities. According to the SEC, Binance's products qualify as "securities” under federal securities legislation, and therefore, Binance had to register as an exchange, broker-dealer, and clearing agency.

Binance is accused of completing unregistered securities offers such as BNB, BUSD, Simple Earn, and BNB Vault, as well as its staking solutions. Chanpeng Zhao, the co-founder and CEO of Binance, is personally accused of the same actions in the accusation.

It is worth saying that this clash between the largest crypto exchange and American regulators is not the first case. Because of regulatory pressure, Binance.US was spun off from Binance.com in 2019 to enable U.S. trading on the platform. This procedure was carried out to adhere to U.S. laws and regulations without affecting any of the services provided by the exchange, while limiting access to the services available on Binance.com.

However, one of the first allegations by the SEC to date is that Binance.com and Binance.US are operating as unregistered exchanges and clearing agencies. The SEC is challenging the company's ability to successfully maintain Binance and Binance.US as separate entities.

On June 8, Binance.US halted deposits and issued an announcement that withdrawal would follow. After a hearing on Tuesday, the court criticized the SEC's use of its regulatory authority to control crypto as “inefficient and burdensome” all through the hearing. So, for now, the parties negotiated a compromise to prevent a complete asset freeze while assuring that US client funds stay in the US and are only available to Binance's US employees. According to the permission order, Binance must move assets to new wallets for US users in two weeks.

What do representatives of the largest crypto exchange in the world say to this?

On the same day as SEC’s press release, the founders of Binance replied with an SEC filing in which they criticized the SEC for not being able to “productively engage” and provide “much-needed clarity and guidance to the digital asset industry.” Binance concluded the response by promising to defend their business, expressing concern that the SEC actions could damage the U.S.'s reputation as “a global hub for financial innovation and leadership.”

A June 22 post from a Binance subsidiary assured users that the system is still fully functional and predicted a return to the standard five-business-day processing time for requests for U.S. currency withdrawals.

SEC Coinbase Case

A day after the lawsuit announcement against Binance, the SEC filed claims against the second largest crypto exchange, Coinbase. According to the SEC, at least 13 of the crypto assets, including tokens like Solana, Cardano, and Polygon, operated by the company on June 6th were securities and provided an unlicensed exchange, broker, and clearinghouse.

The SEC claimed that Coinbase has generated billions of dollars since no less than 2019 by acting as an intermediary on cryptocurrency transactions and dodging transparency rules intended to safeguard investors.

How are Coinbase's lawyers responding to the accusations?

The company that went public in April 2021 has stated its eagerness to cooperate with the SEC but disagrees with its stance that every digital asset traded on its platform is securities. When the SEC accepted Coinbase's initial public offering, the company insisted that the government gave its business model a nod of legitimacy.

The SEC does not have the power to regulate the whole market since many digital currencies are not securities, according to Coinbase's principal counterargument. Since they lack contractual agreements, according to Coinbase, the digital assets on its platform do not pass the Howey test. The SEC has not established clear criteria that would provide cryptocurrency sector players with “fair notice” that a certain digital currency is a security.

In response to this statement, there is a claim about the ways of positioning crypto in the market, which we have heard more than once before - the regulator is concentrating on how digital assets are marketed, including claims made by cryptocurrency developers that investors will profit if their projects are successful. Grewal accused crypto influencers of attempts to exploit individuals who belong to minority groups.

“They’re promoting crypto with the promise of financial inclusion to a segment of the population that has been excluded from traditional finance. That’s offensive to me…,” he remarked.

Crypto Exchange Outflows

Along with Kraken, Genesis, and Gemini, Coinbase and Binance are among the cryptocurrency firms against which the SEC has filed charges. However, Coinbase and Binance also serve as brokerages and clearing agencies.

The two lawsuits differ significantly in a number of aspects. The SEC and Coinbase appear to have different views on whether the majority of digital currencies are securities, which seems to be the basis for the lawsuit against Coinbase.

Concerning Binance, the SEC has outlined a range of accusations against the business and its founder, many of which could have severe repercussions for those identified.

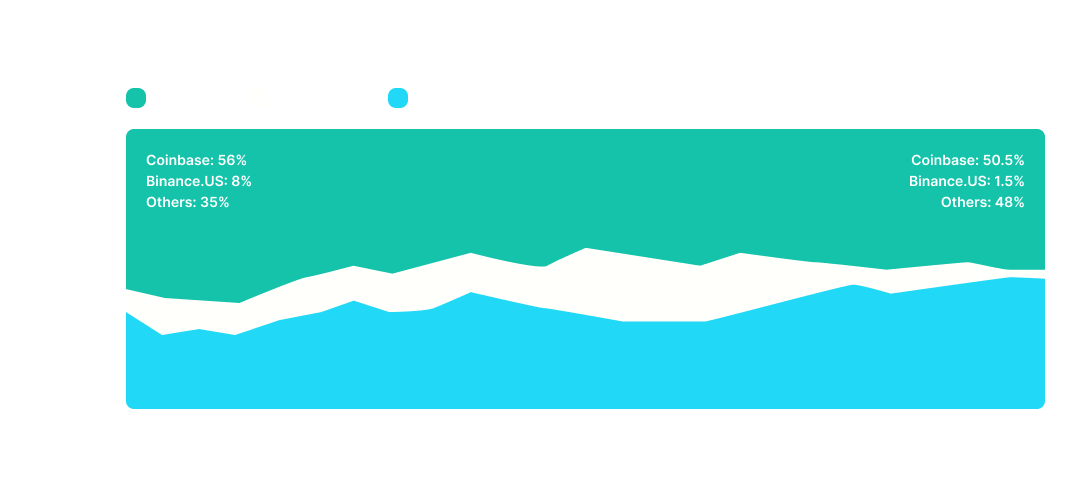

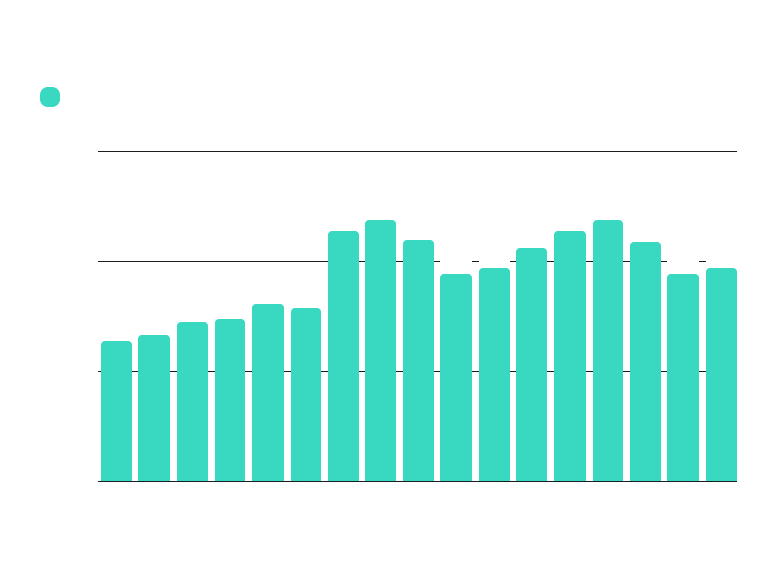

Significant outflows of funds have occurred from the exchanges of Coinbase and Binance in the days after the announcement of these cases.

According to a Coindesk report, Coinbase's net outflows for the day totaled $600 million. As reported by Nansen, a crypto intelligence firm, traders have taken out $1.38 billion in cryptocurrency during this time compared to $771 million in deposits. Bitcoin (BTC) transactions are not included in the statistics.

After the regulatory moves, Binance's withdrawal surge has grown even more. On June 5th, net outflows from Binance exceeded $700 million. The pattern persisted the following day, with net outflows exceeding $1.2 billion, per Nansen statistics.

According to a 20 June report from cryptocurrency analytics source Kaiko, Binance.US witnessed its market share fall to 1.5%. Beginning in 2023, Binance.US has an 8% market share.

On June 10, information from the blockchain analytics firms Nansen and Glassnode showed that three exchanges had lost a net of $3.1 billion via the Ethereum network and $864 million in bitcoin (BTC) from Monday through Thursday. Based on Binance's crypto wallets, the total outflows only represent about 5% of the platform's entire asset worth.

According to blockchain data analysis provided by 21Shares, Coinbase has only deposited 52,992 tokens into Ethereum's proof-of-stake network since the complaint was filed while withdrawing about 149,300 ETH. The $183 million total loss suggests that customers were withdrawing their tokens.

Conclusion

In conclusion, the SEC's ongoing battle against Binance and Coinbase highlights the regulatory challenges facing the cryptocurrency industry. While these exchanges have grown rapidly in popularity, they must also comply with existing laws and regulations to ensure investor protection and prevent financial crimes.

For now, the size of the outflows during this phase is consistent with previous unpleasant incidents in the cryptocurrency business, such as the March crypto banking crisis and the fall of Sam Bankman-Fried's FTX exchange.

As the SEC continues to scrutinize these platforms, it is clear that compliance and transparency will be key factors in their success moving forward. According to a statement from Timothy Massad, the former CFTC chairman, “these cases will be fundamental to the shape of crypto regulation.”

Follow our social media to stay up to date with the latest all-in-one bitoftrade platform news: