The history of crypto day trading is quite large and rich. Before the crypto market came into play, it was possible to trade only on Forex, Stocks, and Futures.

However, trading on traditional markets is not affordable to one and all, because it’s crucial for traders to open large positions, trade with big money, or use broker services, who act as an intermediary between buyer and seller for a substantial sum of commission. Moreover, trading in traditional markets is only available at certain times, as brokers cannot work around the clock.

With the advent of crypto trading, people have gained the freedom to directly and independently trade on exchanges using the same tools as in traditional markets. Now anyone can day-trade and take quick profits anywhere and anytime, making money even on short distances.

Crypto, in turn, revolutionized day trading, making it more accessible and transparent.

So let’s consider all the nuts and bolts of day trading crypto to keep pace with the times and find out if this trading strategy is suitable for you.

Wheels up!

What Is Crypto Day Trading?

Crypto Day Trading - is a type of short-time trading that involves entering and exiting positions within one day; thus, it can also be called intraday trading. In most cases, traders use leverage for cryptocurrency day trading to increase profits and hedge risks.

Crypto day traders look at intraday price movements or price fluctuations to capitalize on them. That includes potentially being able to make money even when prices go down. Traders are laser-focused on the market and seek to take advantage of more immediate profit-making opportunities.

But how to know the perfect time to enter or exit the position and gain? Here is where technical analysis comes into play.

If you want to become a seriously profitable trader and turn any price movement to your favor - we highly recommend starting your crypto journey with learning technical analysis. It’s one of the most required components of a trader's success, along with risk management, fundamental analysis, and psychology.

For those familiar with these terms and their basics, we are diving deeper.

How to Day Trade Crypto?

Since the cryptocurrency market is a relatively new asset class, this leads to significant price fluctuations. Day traders aim to profit from market volatility. As a result, day trading is strongly reliant on volume and liquidity. After all, day traders need good liquidity to execute trades quickly. Having adequate liquidity is particularly necessary when it comes to exiting a position.

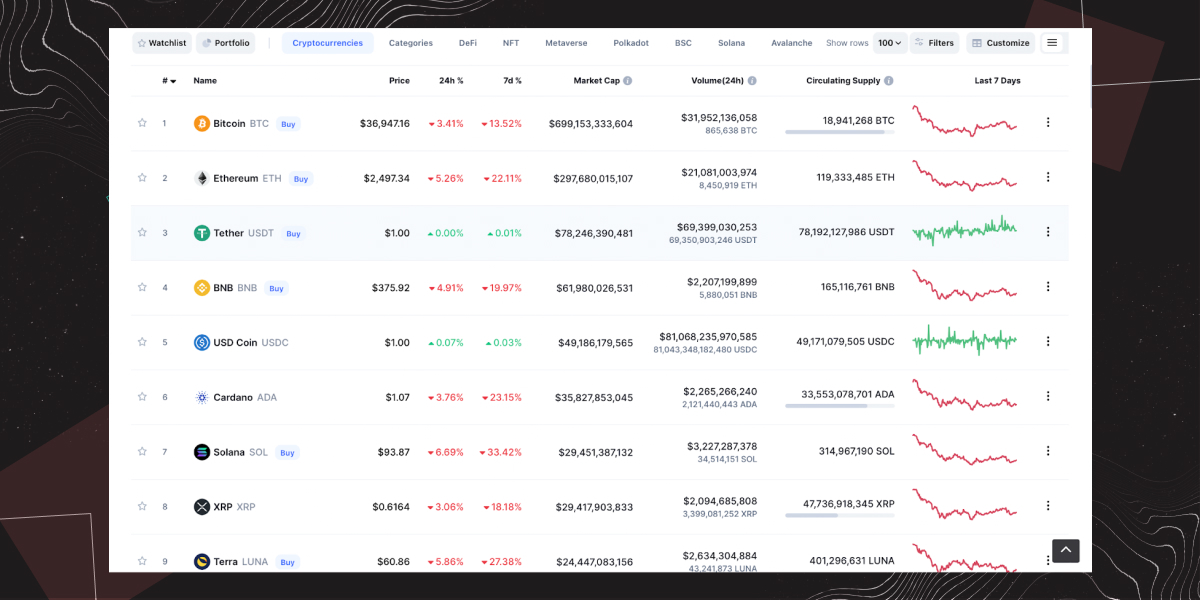

You can simply check the 24-hour trading volume of the chosen asset and then define the best time of the day to buy cryptocurrency.

By the way, CoinMarketCap is an excellent free resource to read and gauge the market volume of any particular asset in every exchange.

By the way, CoinMarketCap is an excellent free resource to read and gauge the market volume of any particular asset in every exchange.

There is a profound misconception about cryptocurrency trading time. Some people think that crypto day trading requires trading every single day. Good news - it doesn’t! Usually, day traders trade cryptocurrencies when all the conditions align in their favor.

Can you day trade crypto? Well yes you can, now fasten your seatbelts as we hit the gas, and show you exactly how you can start trading using the best crypto day trading strategies.

Crypto Day Trading Strategies

As we covered before, the main idea behind crypto day trading is to look for trading opportunities that offer you the potential to make a quick profit.

So let’s dive deeper and get through the most common day trading strategies that will help you bring home that bacon.

Range Trading

The main rule of range trading strategy is to buy at support and sell at resistance

The main rule of range trading strategy is to buy at support and sell at resistance

Ranging is all about the support and resistance levels. There are 2 types of markets: trending markets and ranging markets.

Trending markets are the types of markets where the price is clearly moving in a definitive direction, either uptrend or downtrend.

Ranging markets are the types of markets where the price moves erratically without having a definitive direction and fluctuating in some range.

In general, the market trends only 30% of the time, being in the sideways range of about 70%. Thus, it would be wise to find out how to take advantage of range trading instead of trying to avoid it. But how to make it so?

First of all, when trading ranges, you should pay attention to how overbought (upper line) and oversold (bottom line) the market is. These lines serve as a guide for the trader to trade.

With the Relative Strength Index (RSI) or Stochastic Oscillator technical indicators, you can easily find these zones and understand in advance if trading will be profitable.

When buying and selling go beyond the bottom line of RSI, the asset is in the overbought zone. When an asset is overbought, selling is stronger than buying, and the market sentiment is negative. So here, you can buy the assets and go long.

If the asset is in the oversold zone - beyond the upper limit - then selling is stronger than buying, and the market sentiment is positive. Here you can go short or sell an asset.

Scalping Crypto

Scalping trading is all about short time horizons and fast decision-making. You need to use a fat set of technical analysis and charting tools to use this strategy and make money.

Crypto scalping strategy is one of the most widely used and the most common short-term trading strategies for crypto day trading. It involves profiting from relatively small price fluctuations. Scalpers are not looking for instant big profits. Instead, they seek crypto scalping signals to capitalize on small price movements over and over again. Bots are often used for this strategy to simplify the process and save time.

As a result, scalpers can make a lot of deals in short periods, hunting for tiny price changes and market inefficiencies. The main idea is that by summing up and adding up these small profits, the overall profit will grow to a significant amount over time.

! The scalping trading crypto strategy requires a deep understanding of how the market works, so if you are a newbie in crypto, make sure you know all the basics.

High-Frequency Trading

HFT trading is all about speed. This trading system is used by quantitative traders (also called "quant" traders) and is based on algorithmic trading using high-speed, complex programs and bots for generating and executing orders.

High-frequency traders use various algorithms to analyze minimal price changes and divergences between the same asset prices across multiple exchanges. Typically, HFT platforms and systems can automatically open and close multiple positions per second and seek short-term trades that would otherwise go unnoticed by the naked eye.

The main advantage of using the crypto HFT strategy is increasing profits through speed and automation. It helps with providing liquidity to support trading markets. Some crypto enthusiasts believe that HFT helps to define price trends and price formation processes. Even more, high frequency trading eliminates human error by using complex mathematical processes to analyze the markets and guide the trading process, so there is no risk of wrong decisions being driven by fear or other emotions.

Is Day Trading Crypto Worth It?

Let's start with the issue that interests everyone the most: “how much can you make day trading cryptocurrency?”. The answer is that it’s hard to say. An ultimate profit depends on your personality, deposit and trading skills. What we know for sure is that trading can be highly lucrative, but there are a few things to consider before you start.

Day trading may be stressful and demanding since the necessity of fast decision-making and execution. However, this crypto trading strategy will lead to maximum profits when a trader has a thorough grasp of the market, remains up to date on the slightest market movements and crypto news, can open or close positions оn time, and know how to use trading instruments. For effective and profitable day trading, technical analysis chart patterns and technical indicators must be your best friends and the core of your trading strategy. They help to "read the market," identify trade setups and make the right decisions.

What is more, day trading is quite risky, so you need to remember that the golden rule of risk management is "don’t invest what you are not willing to lose”.

So, before starting day trade crypto, you need to carefully consider these facts and decide if day trading is worthwhile for you.

Swing Trading vs Day Trading

When you begin your journey as a crypto trader you need to choose which style of trading you’re going to hit the road with.

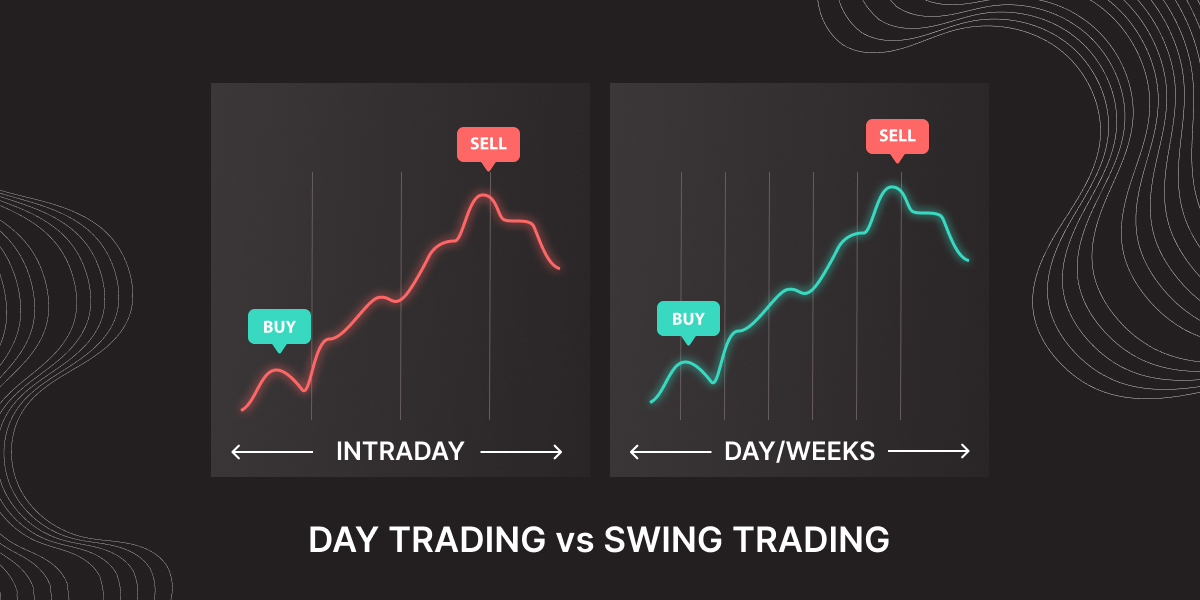

There are two main strategies of trading crypto: day trading and swing trading. But what’s the difference between day trading and swing trading, and which one is good for you? Let’s figure it out.

As it was said, day trading - is a type of short-time trading when you sell and buy assets within one day.

In a nutshell, swing trading - is a type of trading where you can buy or sell assets over a period of days, weeks, or even months rather than within one day.

One of the key differences is that day trading takes much more time than swing trading. Therefore, it is crucial to always be alert for any news and price changes when you day trade. In addition, since day trading focuses on volatile assets most of the time, it is essential to always be ready to decide when to buy or sell the asset. If you must spend most of your time day trading, it turns into a single activity or even a job.

In swing trading, asset prices can fluctuate when the trader is not active, and these fluctuations are generally smaller. Despite this, swing traders are still not safe from quick and sudden market shifts.

Finally, the most essential difference between these two ways to trade – is the final trade profit. Yes, it's true; with a good trading strategy and skillfully running trading skills, day traders are more likely to succeed and make a more significant profit than swing traders. The increase in profit is mainly due to day trading assets often having more substantial price changes than swing trading assets.

But there are some everyday things worth taking into account when starting your way of trading:

- It would help if you were well-educated, interested in trading, and inspired to learn constantly.

- It's crucial to create a profitable trading strategy, and turn the logic on, to make the right decisions.

- You need to use portfolio and risk management when trading. Attach stop-loss and take-profit orders, diversify, use the 1% rule, etc.

As you probably understand, we can’t safely say which of these two trading strategies is better. It entirely depends on your lifestyle. If you have a lot of free time and want to make trading your full-time job, day trading is what you need. But if you want trading to be more like a hobby, and you don't want to trade volatile and highly risky assets - swing trading can be suitable for you.

Try Day Trading Crypto Anonymously With bitoftrade

Knowledge is of no value unless you put it into practice, so it’s time to try to day-trade with bitoftrade.

By nature, bitoftrade is a decentralized crypto exchange that allows users to conduct crypto transactions without registering and maintaining ownership of their funds. Transactions are done directly on the blockchain using the user's Metamask wallet. The platform allows users to trade anonymously, and real-time market prices. Our main goal is to make trading effective, simple, and secure.

With bitoftrade exchange, you can day-trade on every timeframe with various advanced on-chain and financial tools such as leverage and Limit/Swap up for grabs. A leverage trading strategy allows you to expand your market exposure by paying less than the entire amount of your investment. Limit/Swap orders allow you to keep asset prices under control. You need to simply set the limit price when the swap will be executed.

What is more, you can use a wide range of technical indicators for your intraday trading, such as RSI and Stochastic to find oversold and overbought zones and enter or exit positions at better prices.

Connect your Metamask wallet and try to put your knowledge and trading strategy into action.