The crypto crash today has been building for a while and now it is officially here. Bitcoin, the king of crypto, was trading at an all-time high (ATH) in November 2021 of around $69,000. Today, the Bitcoin crash has left the king trading at $30,041.45. This signifies a Bitcoin crash of approximately 56% in the past six months. While the bottom may currently be unknown due to multiple possible factors such as the Fed increasing interest rates, worldwide inflation, the Terra Luna catastrophe, and a broader macroeconomic outlook, it appears that support is finally forming at around $33,300. We will look at some of these factors that have sent crypto tumbling down in the past few months.

Why Is All Crypto Down?

Most people are wondering the same thing right now, why is crypto down and why did Bitcoin crash? The answer is not very simple, as there are many contributing factors, however when Bitcoin scrapes its knees, the altcoin market generally starts to hemorrhage and that is exactly what is happening.

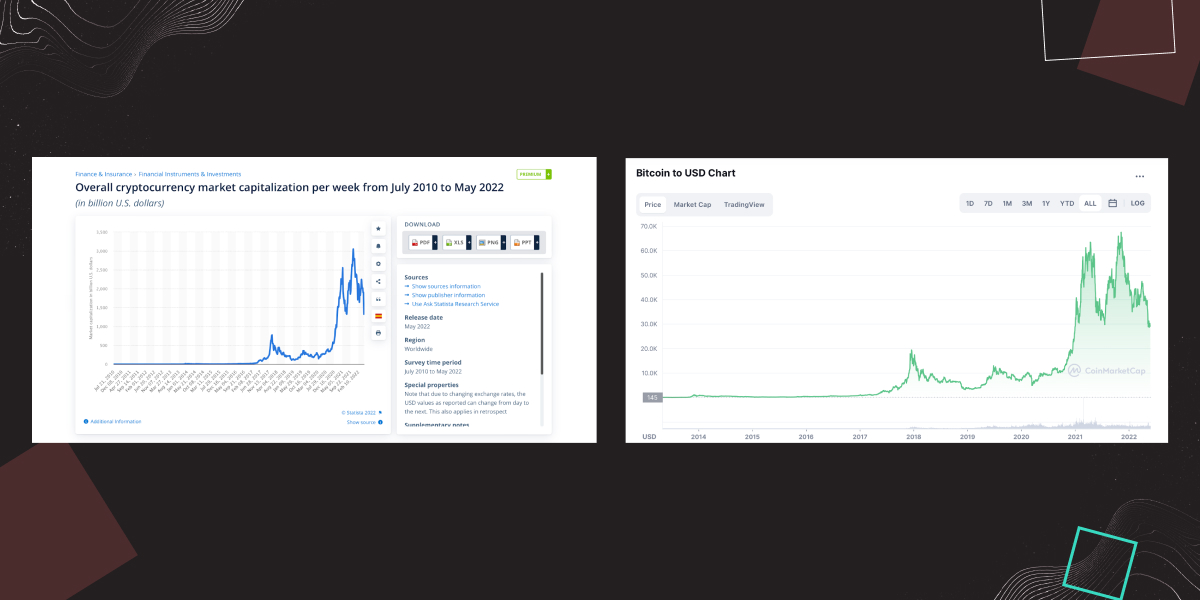

The overall crypto market capitalization reached 3 trillion dollars on November 8, 2021, when Bitcoin and Ethereum both reached record highs. Now in May 2022, the overall global crypto market cap is down to 1.28 trillion dollars according to statista.com as pictured above on the left. The picture on the right, believe it or not, is a different chart, the right is the Bitcoin market cap alone, even though the patterns look almost identical. This equates to a 57% drop in the overall market capitalization of all cryptocurrencies. As mentioned earlier Bitcoin crashed approximately 56% in the same amount of time.

Can you see how the Bitcoin price controls the market?

There is a reason Bitcoin is king. As Bitcoin fell, alts fell in tandem but at much higher rates on both the daily and hourly charts.

Let’s look a bit more into the reasons that are leading to this.

Why Is the Price of Bitcoin Down?

As more and more institutional money is moving into cryptocurrency and in particular Bitcoin, the crypto markets are moving more in line with traditional markets. So Bitcoin is down, the stock market is down, and this has happened in the past on occasion, but only time will tell if this will be the new trend. Below is a chart showing the way that BItcoin and The S&P index have been moving in tandem since the Bitcoin ATH.

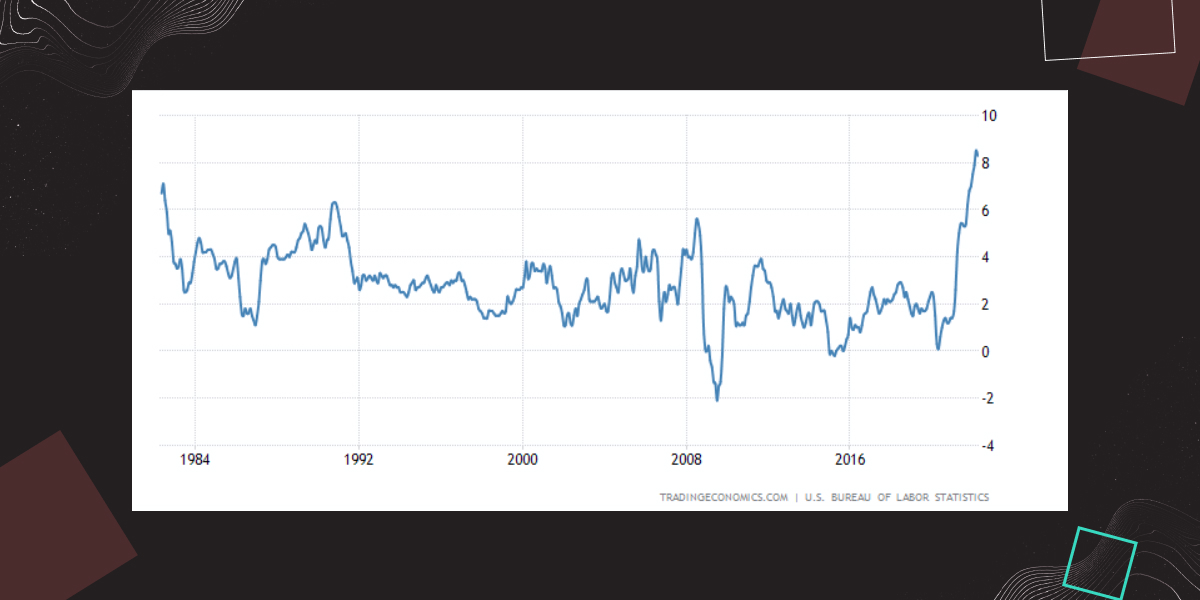

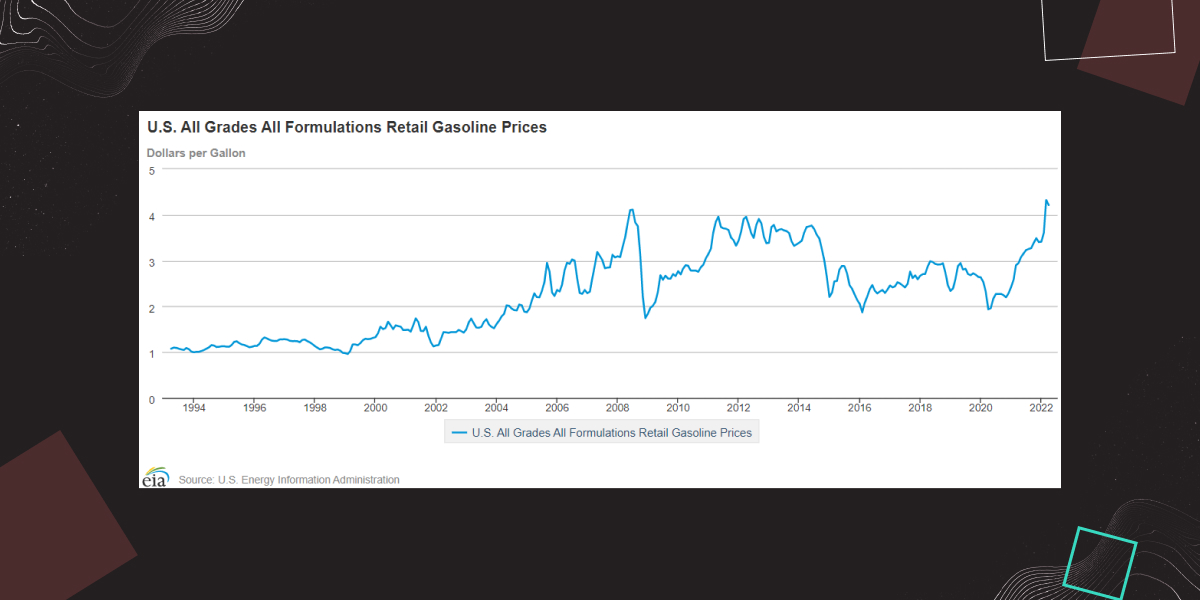

The United States is seeing inflation higher than it has seen in the past 40 years, record-high gas prices, and a great unknown of how high the Fed will push interest rates to help curb these price increases. This is the broader macroeconomic situation that needs to be monitored to understand why Bitcoin prices are crashing. While many people have compared Bitcoin to a “store of value” like gold, gold prices are remaining relatively flat while Bitcoin has continued to decline. Again, there is a chart below showing overall inflation rates by percentage from today’s date in 1982 compared to today. Additionally, there is a chart showing the United States' average gas prices per gallon at the pump from 1994 until today.

In addition to the macroeconomic factors contributing to Bitcoin’s fall, there was the Terra Luna and UST debacle. The UST stablecoin lost its peg on May 9, 2022. While some stable coins maintain their value by being backed by reserves, such as Tether (USDT), Terra’s stablecoin UST was an algorithmic-based stablecoin. In an effort to try and reestablish the one dollar peg Terra sold over 80,000 Bitcoin, worth more than 3 billion dollars which added even more stress to an already fragile Bitcoin market.

Another contributing factor to the Bitcoin crash is new money moving in. Both institutional and the average consumer. Institutional money is trading Bitcoin like they have been for years in traditional markets and aren’t used to the volatility of the crypto market. The same holds true for new consumers in the crypto sphere. They panic and try to just cut their losses since they have never been through a crypto winter in the past. This leads to the speculation of the $30,300 support that we may have found as the investors that have survived previous crypto winters have just been waiting at this point of entry to buy at a discount from the ATH.

For example, Michale Saylor at MicroStrategy reported an average Bitcoin buy price in mid-April of $30,700. He may have set the bar for the institutions to enter, let’s see if it holds, as we keep you up to date on what's happening in crypto.

Why Is Ethereum Dropping?

Ethereum is continuing to fall along with Bitcoin and all other alts. As with Bitcoin, Ethereum reached a new all-time high in November of 2021, at over $4,800. Today, Ethereum is trading at $2,014.71. This signifies a drop of approximately 58%. Are you seeing the pattern of how price action is following “the king”? Take a look at the chart below.

Besides the above-mentioned factors and reasons that have caused Bitcoin and the entire crypto crash, Ethereum is still in the process of switching from Proof-of-Work (PoW) to Proof-of-Stake (PoS), which some investors still question if this is possible. Additionally, there are investors that are worried about Ethereum’s scalability and may be moving toward the so-called “Ethereum Killers”, such as Cardano (ADA), Solana (SOL), and Avalanche (AVAX) to name a few.

Terra LUNA Crypto Crashing 99%

Terra Luna’s crash definitely wreaked havoc across the crypto market and partially led to the Bitcoin crash. Luna was trading at an all-time high in April of 2022, at a price of $119 per token, and as of today, it’s trading at $0.000141. Shortly after their ATH the stablecoin, UST, lost its peg of $1 on May 9, 2022. As mentioned earlier, UST is an algorithmic stablecoin. This means sheer belief, code, and regular market activity was needed to keep its $1 peg. In theory, the $1 peg was also kept up by the algorithm’s link to Terra’s native currency, Luna. Let’s look at the charts showing both the Luna and UST epic collapse.

For over six months, investors were buying UST for one reason. That reason was to make a profit off of the borrow and lend platform, called Anchor Protocol. Anchor offered a 20% yield to any investor that bought UST and then lent it to the protocol. Once this opportunity was announced, many doubters started to scream about the Ponzi scheme. Their reasoning was that it is not mathematically possible to give all investors this sort of return. Terra responded and acknowledged this comparison, that there was a Terra Luna Ponzi scheme; but instead, only compared it to a marketing cost to raise awareness like other startups offering discounts at the beginning of their companies.

As of the time of writing, there is a word that Do Kwon is being investigated now in South Korea to determine if Terra Luna was a Ponzi scheme.

What some crypto experts said was wealthy investors essentially borrowed large amounts of Bitcoin to buy UST, with the intention of making massive profits when the UST value fell. This is known as short-selling.

This is what caused UST to become depegged on the US dollar. This led to a bank run, and investors that had earned interest from Anchor were scrambling to get out before it was too late. This caused Terra Luna (Luna) to crash into a “death spiral” as well. Now both UST and Luna are essentially worthless.

To make matters worse, news leaked today that Do Kwon, Terraform Labs founder, and CEO, shut down operations in both Seoul and Busan, South Korea days before the collapse. This adds more fuel to the fire of the Ponzi scheme speculation. Unfortunately, the future of both UST and Luna is currently unknown.

Stock Market Crash 2022: Wall Street Is Panicking

As mentioned previously, the stock market is in disarray, and all cryptocurrencies are following traditional markets for the time being. Whether this will be the new trend or not is yet to be told. The same macroeconomic factors pushing the crypto market down are also driving Wall Street down. Besides the unknown future with the Fed raising interest rates, record-high gas prices, and inflation rates higher than in the last 40 years, there is also the unknown future of the Russia/Ukraine war. These are all factors that are driving stock prices down daily.

To make matters worse, tech stocks, in particular, are falling rapidly due to chip shortages and supply chain issues. It is possible that the entire traditional market scene could plummet an additional 30-50% in the coming months. Until the world knows what the Fed will do to curb inflation rates and how high-interest rates will spike, the market will remain volatile and on a downtrend.

Is It Crypto Winter Already?

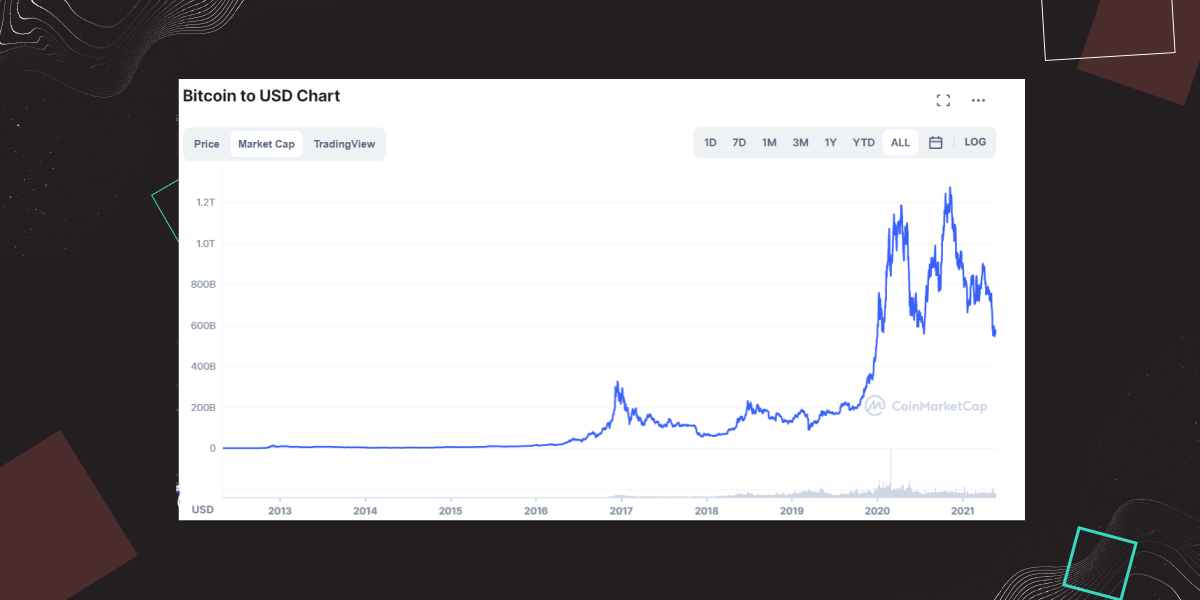

For those unfamiliar with the term "Crypto Winter," it can be summed up as a long period of consolidation or sideways trading after a price crash. Crypto Winters traditionally have come after a bullish market usually triggered after the Bitcoin halving, which occurs roughly every four years. The last "crypto winter" was in 2018, right after the bull-run that sent Bitcoin to just under $20,000. The chart from Coinmarketcap below shows the peaks and valleys associated with Bitcoin from day one. You can easily see the “winter period'' from the 2017 bull-run, through the approximate 18-month consolidation, and onto the next rally in 2020 on this chart.

As of now, it is hard to say if we are in a “crypto winter”. Since there are so many new factors influencing the crypto market that it has never seen, it is hard to tell if we are heading into winter or if the macroeconomic factors already discussed are the driving force. We are genuinely in a wait-and-see point of time.

Will Crypto Recover?

This is what everyone wants to know, and the answer is yes. Crypto has proven resilient over its short life span, and it is here to stay. The more important questions are: How long will it take to recover? Will the world see more regulations since the Terra Luna and UST debacle? Will Bitcoin proves to be a store of value as traditional markets continue to fall? or Will Bitcoin and cryptocurrencies continue to follow traditional markets?

These questions are currently not able to be answered but will all have a significant impact on the future of the cryptocurrency market. The absolute worst-case scenario is that winter may have started, and we will have to wait until the next Bitcoin halving to put us into another full bull market. However, bulls and bears are in a full tug of war right now to see which way the market will go. Before the Bitcoin crash, we were still in a bullish cycle. However, the wide range of macroeconomic factors and the UST situation caused the crash, and we are in a wait-and-see position of whether the bears or bulls will win.

Is Now the Best Time to Buy Cryptocurrency?

This is another question that everyone wants to know the answer to. And the answer is yes. While the bears and bulls are fighting over where the market will go, Bitcoin is a bargain at or under $30,000. Additionally, all the hemorrhaging seen in the alts while Bitcoin scraped its knee means everything is on sale right now at bargain-basement prices. While we have support at the $30,300 level, there is still room for the price to crash a bit more, but no lower than $27,500. Be wary of any algorithmic stable coins and the blockchain they are attached to, but this is definitely a buyer's market.

For those looking at SMA, EMA, and Fibonacci retracement, it is more important to watch volume for the time being. Crypto does follow trends at times, but it is also like dealing with an irrational toddler more often than none. Until we reach FOMO volume bouncing with the price, we are stuck in a very wide range of consolidation for the time being. With low volumes, we will continue to play ping pong inside of the consolidation area. Here is a very basic chart that allows you to see volume spikes and price action moving with it since 2017. Around December 2017, March 2020, and May 2021 are the only weeks that have had more volume than the last two weeks on the weekly chart. Once there is more volume, and in particular more FOMO volume, we are simply stuck in consolidation.

When to Sell Crypto?

The only way to lose money on an investment is to sell at a loss. The crypto market crashed, and a lot of people took a beating. If you invest in any market, you should never invest more than you can afford to lose. While things may seem bleak right now, the market will recover. If you are afraid that the market will continue to collapse, you can choose to cut your losses and close your positions. If you can afford to wait it out and believe in the market coming back, now is not the time to sell. Remember, the market is always correct. Traders are the only ones that make mistakes. It is always a smart move to set a stop loss to protect your investments, whether to protect the profits made or to cut your losses in a market downtrend. The ones that hodl and are buying the dip will be the winners of this cycle.

What Moves to Make When a Cryptocurrency Crash Is On?

As mentioned above, stop loss is an essential part of protecting your assets when crypto crashes. Of course, this is true in all markets, but the fact that crypto markets never take time off makes this feature even more crucial. In addition, the trading and withdrawal fees are more important factors to take in during markets in a downtrend or crash. These things can help you protect your assets and pay substantially lower fees when you need to make moves in a hurry, and also why bitoftrade is an ideal place for not only bearish sentiment markets but all trading times.