Intro

On November 10, 2022, Bitcoin fell to its lowest of $15,717 since 2020, when Bitcoin had already blown up the market, but it was not completely clear that this currency could grow to 60 thousand dollars.

These shockwaves are the result of a story that has once again demonstrated that centralized crypto finance is unstable, and their owners keep many unpleasant secrets. Yes, we certainly mean the collapse of one of the largest crypto exchanges, FTX.

Against the backdrop of the ongoing liquidity crisis, the loss of credibility of FTX, and the beginning of the bankruptcy process, crypto users turned their attention to DeFi. Nansen, a data analytics platform, has calculated that since the beginning of November, decentralized protocols have received a double-digit percentage growth in users and transactions. DEXes trading volume have jumped over $32 billion, with $20.9 billion of the trades on Uniswap, a large decentralized exchange.

These days, centralized exchanges, on the contrary, have lost over 6 billion dollars in the net outflow. Binance lost more than others — almost one and a half billion was the difference between the deposited and withdrawn crypto assets.

Today we want to discuss the issue of trust in centralized crypto solutions and how decentralized crypto finance closes the security and transparency gaps of CEXs.

How Centralized Systems Go Bankrupt and Lose Users’ Money

The FTX case was not unique in this year's string of crypto bankruptcies. Part of the same manipulative scheme was reproduced a few months earlier by the Celsius Network, led by Alex Mashinsky, the CEO of a bankrupt crypto lender.

Celsius Case

What is Celsius? Celsius is a crypto banking firm that offers a lending service. Users deposit crypto assets on the Celsius Network, and the company lends these funds to other borrowers. This fintech network is supposed to return 80% of its revenue as a reward to users. Celsius has provided exceptional customer yields of up to 19%.

So, what did go wrong? Celsius Network filed for Chapter 11 bankruptcy and initiated bankruptcy proceedings on July 13, citing inflationary pressures and volatile market conditions as the reason for its fall. However, this was not the only issue.

The backstory partly starts in mid 2021 when the company lost over 35,000 Ether in Stakehound debacle. The Stakehound incident was also one of the cases when a crypto company hid its losses until the very end. Celsius, like other troubled firms, continued to behave as if nothing had happened.

But, most likely, Celsius had not maintained enough ether holdings even earlier. As the CNBC article points out, in January 2021, the crypto lender suffered significant losses buying ETH in the open market at high prices, unable to meet its obligations to depositors.

According to the official statements of Jason Stone, partner of Alex Mashinsky, Celsius then began to offer double-digit interest rates to lure in new depositors whose funds were used to repay earlier depositors and creditors.

Obviously, this is a crypto Ponzi scheme manifested in an illiterate risk-management strategy. Just as FTX decided to rely on its own FTT currency, Celsius found a "worthy" use for its token.

According to the Vermont Department of Financial Regulation filing, the CEL token aimed to bolster its balance sheet and use new investor funds to repay old investors.

Apparently, being in a crypto liquidity crisis, Celsius increased interest payments for those users who agreed to accept rewards in the form of CEL. The problem was that the value of the CEL token was artificially inflated.

On June 13, 2022, Celsius halted withdrawals, swaps, and account transfers, and the Cel token dropped 70% almost instantly. At the moment, the bankrupt crypto lander owes its users and investors about $4.7 billion, but it is unlikely that these funds will be refunded in the foreseeable future. Almost five billion dollars may remain forever lost.

Another dramatic case of the ongoing downturn in the crypto world was the collapse of the largest crypto hedge fund, founded in 2012 and enjoyed the trust of industry participants.

Three Arrows Capital Case

Three Arrows Capital, a crypto hedge fund focused on providing superior risk-adjusted returns, was one of the most respected hedge firms, founded by high school friends Su Zhu and Kyle Davies.

In 2022, Three Arrows was decimated by the escalating financial turbulence that arose due to the fall of Terra and LUNA. 3Ac held a significant position in LUNA and UST, roughly $560m at its peak. 3AC invested approximately $200 million in LUNA in early 2022, according to Davies.

Another focus for the hedge fund was a play-to-earn game Axie Infinity, which was hacked and lost almost $700m.

Three Arrows also expected the failure of the invested Ether on a Lido Finance platform. As LUNA and other cryptocurrencies plummeted, the price of stETH, the currency offered to stakers as a reward, dropped to a 7% discount when traders rushed to withdraw their funds.

These are the key and objective prerequisites for the liquidity crisis of 3AC, however, everything was not clean in the management and transparency of this company either.

Ryan Watkins, co-founder of crypto hedge fund Pangea Fund Management, notes, “It was the lack of transparency that both enabled 3AC to borrow so much money as well as cause panic across the industry, as no one knows who was exposed and how badly they were.”

Bloomberg says 3AC borrowed from the biggest crypto lenders without disclosing much about its finances. At the moment when the lenders applied for the return of funds, it turned out that the hedge fund could not return them. Three Arrows Capital failed to meet margin calls and ended up in debt for more than 20 companies, including Genesis ($2.36 billion), Voyager ($650 million), Blockchain.com ($270 million) and others.

On July 1, 3AC filed for Chapter 15 bankruptcy protection from U.S. creditors in the U.S. Bankruptcy Court. Noteworthy that when bankruptcy proceedings began, the founders disappeared, and when the liquidators arrived at 3AC’s office, they found an empty room.

The buzz about this hedge fund started the day crypto broker Voyager Digital reported that Three Arrows Capital owed it more than $650 million.

Five days later, on July 6, following the hedge fund's example, Voyager filed for Chapter 11 bankruptcy protection.

Let's dwell on the Voyager case in more detail.

Voyager Digital Case

On June 24, 2022, the Voyager crypto broker assured investors that it continue to fulfill the orders and withdrawals. However, it turned out to be insolvent early next month.

The mentioned loan for $650 million, which failed to return the bankrupt Three Arrows Capital, accounted for more than half of all crypto broker funds.

According to Mikkel Morch, executive director at crypto hedge fund ARK36, this bankruptcy case “basically confirms that the crypto lender did use its customers' funds as a source of dollar liquidity and lent them to entities like 3AC as a leveraged trade of sorts while it would constantly borrow money itself to meet current withdrawal requests.”

Stephen Ehrlich, chief executive of Voyager, argues their platform was built to empower investors by providing access to crypto asset trading with simplicity, speed, liquidity, and transparency.

But it should be admitted that it is difficult to talk about the transparency of a company that does not disclose the names of its creditors, and indicates misleading information on the official website.

Thus, in the course of proceedings, at the end of July, the Federal Reserve Board and FDIC issued a letter to the Voyager Digital.

The crypto lender website stated that user deposits are protected by the Federal Deposit Insurance Corporation, however, the FDIC denied these statements.

Equally important remarks were made by one YouTube crypto scam researcher named Coffeezilla.

He explained how Voyager had deftly assumed the status of having FDIC insurance coverage. The crypto broker became a partner of a legitimate bank — the Metropolitan Commercial Bank, which actually had the protection of the FDIC. However, Voyager chose not to say that this insurance only covered their assets in the event of the bank's failure, not Voyager's.

This is how a company with more than 3.5 million users shamelessly lied to its customers expecting up to 12% interest rates on their investment.

Incidentally, this lending platform also appeared to be closely associated with Alameda Research. We will also tell you about this.

FTX Case

In less than a week, the value of the FTX token fell by 93.25%, and the FTX collapsed in ten days. It would not be an understatement to call this phenomenon a historical and turning point for the entire crypto industry.

So, what happened to the crypto corporation of Sam Bankman-Fried, a billionaire, who a couple of weeks ago at South Korea’s Blockchain Week in Busan (BWB2022), shared his ideas on a crypto policy framework?

It all started with an article in major crypto media Coindesk, where “largely theoretical concerns” were expressed about the close relationship of Alameda Research, a Hong Kong-based private equity firm, created, as well as FTX, by Sam Bankman-Fried.

The short explanation of the situation is that FTX's sister company, Alameda, has been dishonestly using customer deposits and leveraged the FTT token as collateral. Subsequently, it turned out that the company was insolvent and could not match customer withdrawals.

For several years, Alameda, being the main partner of FTX, has been borrowing funds and trading them from FTX users without their knowledge. On November 16, a class-action lawsuit being filed. Project founder Sam Bankman-Fried was accused of a fraudulent cryptocurrency scheme designed to take advantage of unsophisticated investors from across the country.

Hearing on the FTX collapse, according to the U.S. House Financial Services Committee, will start in December 2022.

We want to explore why Alameda and FTX were so tied in an illegal borrowing scheme.

What is Wrong with Alameda

Alameda and FTX are probably exploding time bombs, trailing in the wave of bankruptcies, which we will also discuss in this article.

Back in August of this year, an article by the SNBC expressed doubts about SBF and the transparency of his crypto firms. Alameda, for the record, is a private company, with little information being disclosed about its structure and capital.

Why is it important to remember the events of summer 2022?

In the summer, crypto brokers and landers began to crumble like dominoes. One of the largest firms - Voyager, a crypto brokerage - turned out to be associated with SBF companies.

During Voyager's liquidity crunch, on June 21, it was revealed from the Ontario's Securities Act that Alameda was actively borrowing money from the company and was in fact the largest stakeholder, owning an 11.56% stake in Voyager.

The very next day, Voyager accepted a loan from Alameda — the $500 million rescue — $200 million in dollars and roughly $300 million in Bitcoin.

Events unfolded rapidly, and every day was a piece of big news. So, on June 23, Voyager officially warned that Alameda was selling some of its shares. Shares reduction brought Alameda's total position to 9.49%, and the company “ceased to be a reporting insider of Voyager.”

The Voyager was in limbo at that moment, unable to restructure the losses and make up for customer redemptions, on July 6, declared Chapter 11 bankruptcy, suspending all operations including trading, deposits, and withdrawals.

Apparently, this, in addition to other unfavorable factors that we have seen since the beginning of spring in the crypto industry, created a liquidity hole for Alameda.

When Alameda's creditors began to ask for their money back, the firm could no longer meet its debt obligations. Alameda began to make up for the lack of liquidity by borrowing heavily from the FTX. According to Reuters estimates, $1 billion to $2 billion of a total of approximately 10 billion "borrowed" from uninformed FTX users are now missing.

FTX, in turn, using user funds as collateral for loans (of course, this is contrary to both the law and the company's terms and conditions), forged the availability of funds with its own FTT currency.

As you know, the value of currencies is determined by the belief of investors in them. After the Binance CEO tweet, this belief began to rapidly dissolve rapidly.

Why DeFi is the Solution

In bitoftrade, we cannot act as financial advisors and encourage you to choose one platform or another. But we can say unequivocally: we believe in decentralized solutions, and here's why.

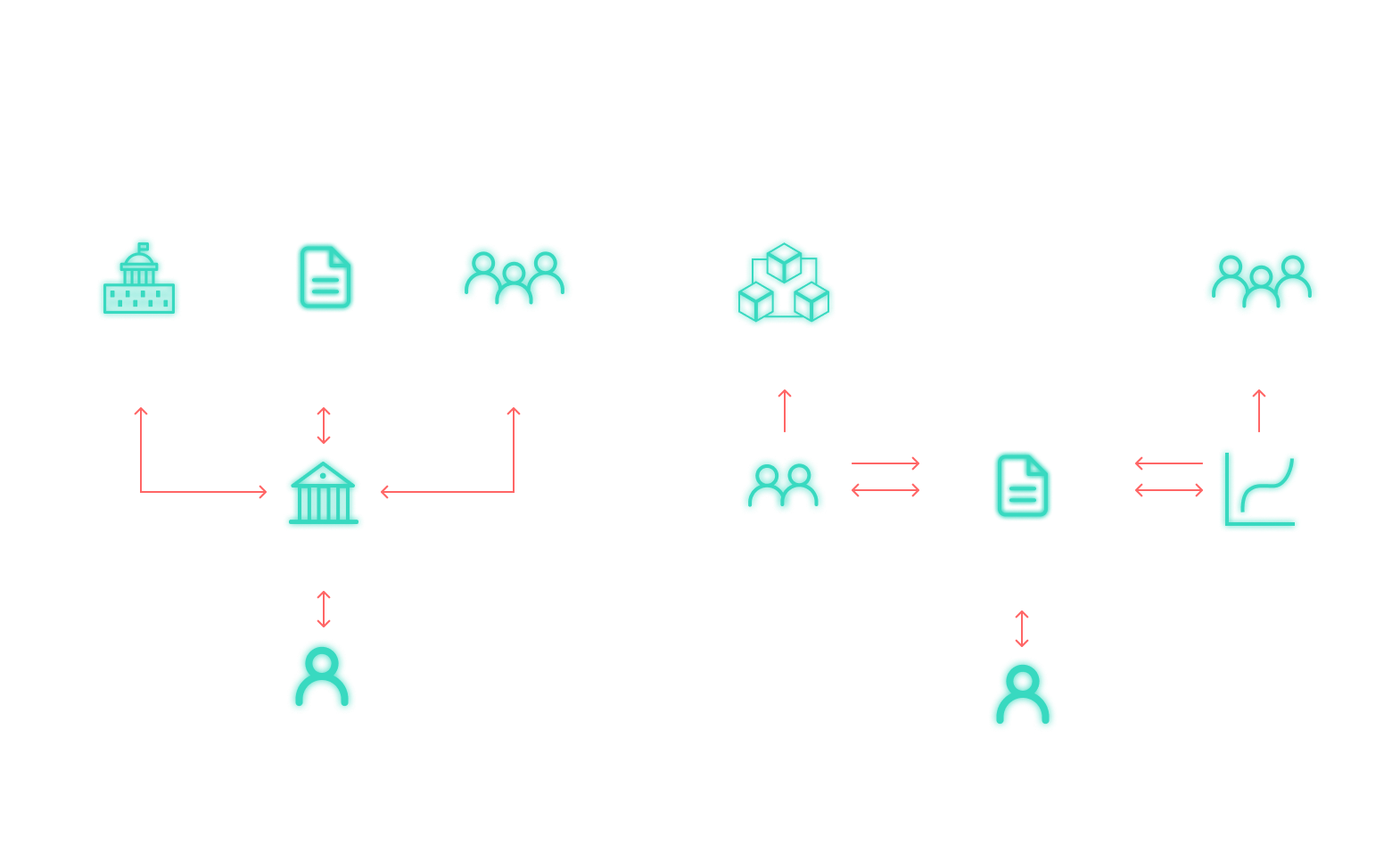

In this article, we have clarified how centralized crypto services failed due to many reasons. The main problem is that centralized systems like Voyager or Celsius are not transparent:

Company executives do not disclose data about their creditors and borrowers, investors of various levels do not fully understand what initiatives their funds are spent on and whether they will be returned in case of bankruptcy.

On centralized platforms, the laws of automatically executing smart contracts do not apply, and large investments can proceed solely on the trust to such large players as 3AC.

Centralized systems often, as the experience of 3AC and Voyager shows, are too interdependent, and the fall of one company rebounds on the rest along the chain. Decentralized finance also has partnerships, but the consequences of, for example, a liquidity crisis are not so dramatic.

On centralized platforms, it is possible to re-pledging of one collateral for multiple loans. Recycling collateral is difficult to track when transaction data is closed.

What is so unique about DeFi and (let’s focus on one area) decentralized lending introduced by Aave, Compound, MakerDAO, and other platforms that currently have over $65 billion locked up?

By building an ecosystem based on smart contracts and self-executing computer programs, DeFi removes the issue of trusting authorities and intermediaries. DeFi banking offers visibility into loans and order books. Over 90% of ecosystems reside on the Ethereum blockchain, so any user can view network activity.

There are online tools like Etherscan or similarly built search engines like Polygonscan, FTMScan, or Avascan to track transactions, blocks, addresses and other information. To view the data about Bitcoin, users often use, for example, Bitcoin Block Explorer.

In addition to self-executing and traceable blockchain-based smart contracts, the concept of liquidity pools is important in the DeFi infrastructure. Liquidity pools are a supply of cryptocurrency that is locked in a smart contract. Good news! There are also applications for tracking the performance of liquidity pools. Among such trackers we can mention APY.Vision and DYP tools.

As you can see, all information about deals on decentralized hedge funds, lending services, or exchanges for trading crypto is open access for anyone. So, let’s go back to our discussion about decentralized lending and borrowing platforms.

How, for example, does Aave or Compound function?

It is worth noting that these platforms employ the same principles as TradFi, with the only difference being that DeFi apps operate without any third-party.

Borrowers of the protocol pay interest and those who lend funds get interest. All deposits are kept in a “liquidity pool”, a source, that allows making loans.

To borrow the money, you'll need to put collateral first. The loan amount directly correlates with your deposit.

As in TradFi, the decentralized lending and borrowing market introduces the practice of over-collateralization. Over-collateralization involves providing more collateral than the loan you are going to take. Thus, the lender is always sure he will get a loan repayment. For example, MakerDAO and Compound specify a collateral requirement of up to 150% of the value of the borrowed currency, for dYdX, this minimum is 115% minimum, with an initial 125%.

As of August 2022, MakerDAO set the minimum collateralization rate of a “vault” of ETH to 170%. Such mechanisms help to protect the platform stablecoin — DAI — from the devaluation of ETH and other currencies. As a result, MakerDAO offers higher returns for lending a stablecoin than for ETH. This encourages users to deposit high collateral.

As we have already mentioned, these measures are no exception for DeFi, and any big broker looking to protect themselves and their finances. However, recalling the bankruptsy cases of this year, we understand that in a non-transparent environment for investing, with central administration intervention and the human factor, market crashes occur. So, for example, The Wall Street Journal found out that Celsius sold undercollateralized loans and rehypothecated the posted collateral.

There is a risk of volatility in any crypto trading. Crypto lending is no exception here, but all automatic mechanisms are set up to ensure that no one suffers an irreparable loss. In DeFi services, collateral liquidations happen automatically if it falls below the loan value. As rightly noted in the Coindesk article, off-chain loans of Three Arrows Capital may not get repaid at all. This is not possible in DeFi protocols.

What criteria should you pay attention to when choosing the decentralized crypto banking service, Maya Zehavi, an angel investor focused on DeFi, says: “I'm looking at how big the TVL [total value locked] is, what the [asset] concentration is, how big the pools are, where the yield is coming from, who the founders are.”

Conclusion

Of course, the mere fact of removing middlemen and making DeFi more transparent does not end with the advantages of decentralization over traditional systems that replicate Ponzi schemes and other financial manipulation strategies. We focused only on what we think is the key advantage, which seems especially important to remember in the current conditions.

On the Bitoftrade Blog, we talked in detail about the differences between DEXs and CEXs. Here are some of those articles:

The Era of Anonymous Cryptocurrency: What Traders Should Know

Decentralized (DEX) vs. Centralized Exchanges (CEX)

DEX vs CEX: Know Where to Trade

Also, do not forget that lending is one of the strategies for generating crypto passive income. We also devoted one of our articles to this topic:

How to Earn Crypto Passive Income

Another quick refresher: DeFi also bears some of the risks. One of them is crypto scams. We advise you to learn more about how not to fall for scammers:

5 Types of Crypto Scams and How to Avoid Them

Make smart decisions when choosing the exchanges and platforms you want to invest in. Be sure to double-check the information posted on the website, and do not delay studying the official documents of companies you are deciding to trust.

bitoftrade is a decentralized crypto platform combining the advanced trading tools of CEXs with a non-custodial approach. Start trading right now.

Check out our social networks to stay up to date: