The Ethereum network, launched in 2015, turned out to be the most in demand among the developers of the crypto industry and the creators of decentralized apps (DApps). State of DApps reports that there are currently over 4,000 applications, with 2,970 of them built on Ethereum by May 2022.

Ethereum has proven its relevance in the crypto industry. But one limitation had to be taken into account: the problem of scalability. Ethereum sample before The Merge had problems with transaction speed (faster finality), and transaction throughput (high transactions per second). Layer-2 solutions came to the rescue.

Over the years, several projects have emerged, called layer-2 solutions, designed to help scale an application by processing transactions of the Ethereum Mainnet. There are names familiar to almost every trader and crypto enthusiast: Polygon, Arbitrum, Optimism, and many others.

To resolve these problems (and several others, which we will discuss below), on September 15, 2022, the long-awaited full-fledged transition of the Ethereum ecosystem to the Proof-of-Stake (PoS) consensus took place. According to the founder of Ethereum, Vitalik Buterin, the Merge update aims to be the first step towards even greater decentralization and transparency, increased throughput, and reduced gas fees.

Let's break it all down and answer frequently asked questions about upgrading Ethereum.

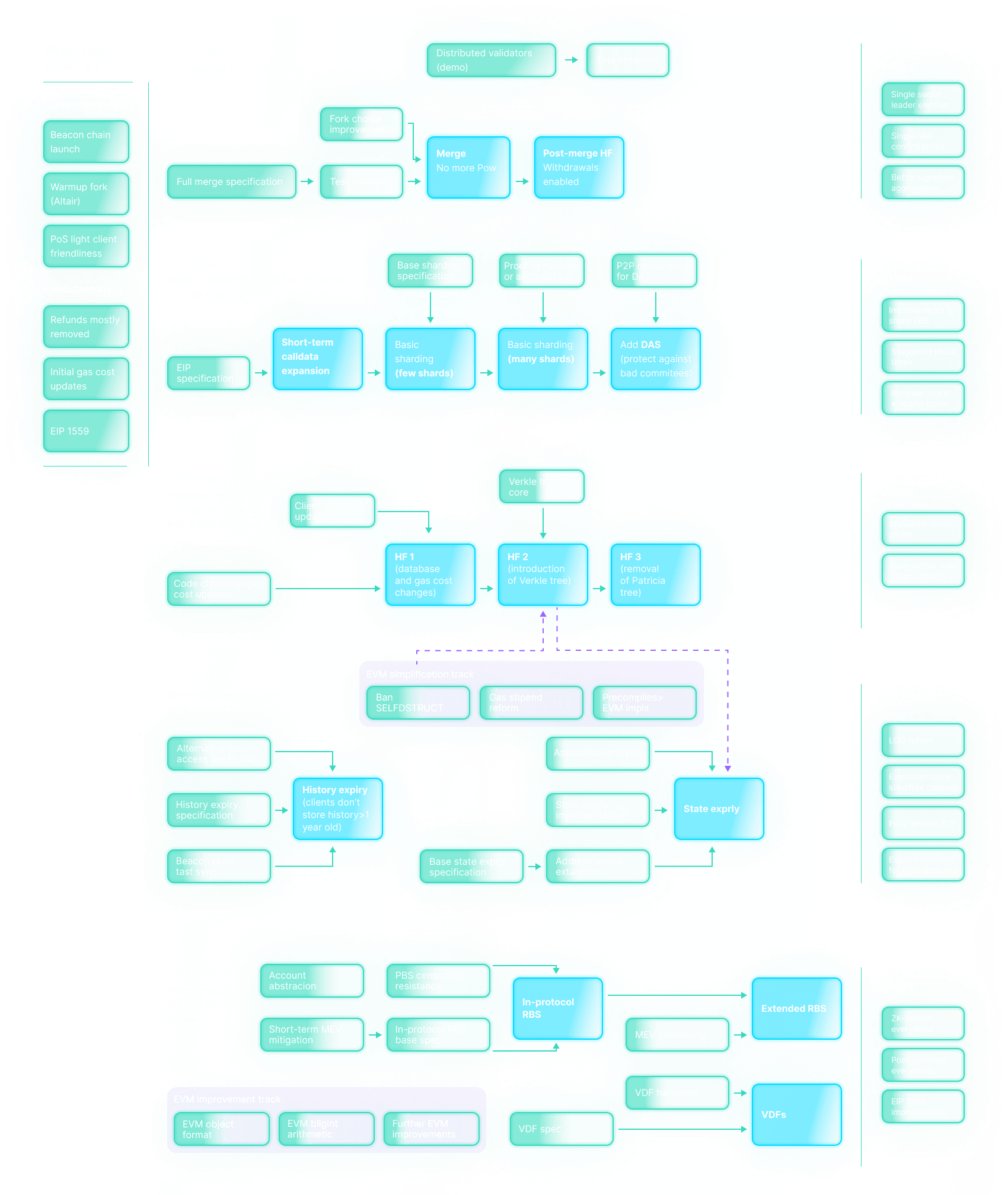

The Ethereum’s roadmap

Every user of the Ethereum network — a trader, investor, validator, and all other crypto fans — should keep in mind: the Merge is just one (albeit fundamental) stage in improving the ecosystem. Right now, Ethereum has solved some of the inherent problems in the Proof-of-Work (PoW) mechanism, in particular, the issue of environmental friendliness. According to the Foundation, by switching to Proof-of-Stake, Ethereum reduced energy consumption by ~99.95%. So, most recently, the Ethereum blockchain consumed about 112 terawatt-hours of electricity per year - this is fraught with the release of more than 50 metric tons of harmful carbon emissions. The Ethereum Proof-of-Work ecosystem devoured as much energy as some countries, like the Netherlands.

However, there are a few drawbacks that the Ethereum developers are going to solve with future updates.

In late 2020, the Beacon chain was launched, you can call it a Proof-of-Stake trial version for Ethereum. Chain was followed by a series of tests and intermediate changes, but a major update has only recently taken place, called the Merge. In the future, the developers of the largest crypto ecosystem aim to stimulate the decentralization, encourage users to participate more actively, improve security and throughput.

On the picture below you can see the roadmap of all the upcoming planned updates of Ethereum, however in this article we will focus only on a few — those that should be implemented in the very near future.

What is Beacon Chain and How Does It Work?

The Ethereum reboot took place in two stages. First of all, the Bellatrix update was launched on September 6. The final activation of The Merge, which will implement PoS, took place on September 15th.

In 2020 the Beacon Chain existed alongside the original Ethereum until the recent Merge upgrade. This consensus layer was designed to manage the coordinate of the Ethereum network and shards – parallel chains.

For the functioning of the Beacon Chain, unlike the main Ethereum blockchain, miners are not needed. The network is run by validators. Beacon Chain participants can set up their validator nodes by staking 32 Ether, but for the ecosystem to function more democratically and decentralized, it is possible to participate as a user directing their funds to the staking pool. Such participants, as well as a node validator, can be selected to propose a new block, for which they receive rewards.

What is Ethereum Shanghai Upgrade?

The Shanghai upgrade is planned to be launched approximately six months after the Merge.

At the moment, with the transition of the ecosystem to Proof-of-Stake, stakers are temporarily unable to withdraw their ETH invested in Beacon Chain, though, ETH rewards are available immediately.

After the Shanghai update users will be able to withdraw their money. Right now, 14,796,838 ETH (more than $19 billion) is locked in the Ethereum network, and the number of validators is 437,416.

When withdrawals become possible, time limits will be placed to avoid a mass exodus. Thus, the Ethereum foundation states that “only six validators may exit per epoch (every 6.4 minutes, so 1350 per day, or only ~43,200 ETH per day out of over 10 million ETH staked).”

How Does Ethereum sharding work?

Sharding is one of the scalability improvements planned by the Ethereum developers. Each shard is a repository for a piece of blockchain information and transaction processes aiming to increase transaction speed and, as it said, lower the gas fees.

Since validators no longer need to store all the information on the blockchain, shards give another plus to the ecosystem — as hardware requirements are reduced, the threshold for entering the network is also lowered and made more accessible. It is much cheaper to store the information on one mini-blockchain.

Moreover, sharding will allow users to run Ethereum on a laptop or phone. The more people who run clients on your own, the more secure the network will become.

Shards can only be valid if they are approved by the main chain. Once approved, sharding collations must be added to the main chain. This happens when about 2/3 of the validators (notaries) vote for the validity of collations. As the developers say, shards will allow users to store information better and in a larger volume, but the code will not be executed using them.

This scaling solution solves several problems at once, in particular, the blockchain trilemma.

The terabytes of the Ethereum ledger are constantly growing and require the nodes have such an amount of storage space, in which some of the participants are forced to leave the game, not having enough computer power. As already mentioned, the essence of sharding is to save nodes from having to keep a full copy of the main chain on their hard drive and store only a part of it. Ethereum's recent problem has been precisely the risk of centralizing the system by a group of participants with the powerful computers.

A sharding scaling solution update looms on the horizon for 2023, according to the Ethereum Foundation.

How the Merge Will Affect the Price of Bitcoin?

Some crypto observers are speculating that Ethereum has a chance to overtake Bitcoin's market cap. At the moment, the capitalization of Bitcoin is $ 370,715,936,255, and Ethereum is about half as much — $163,137,169,125.

YCharts reports that Ethereum's capitalization has declined by almost 54% over the year. Significant volume, which is likely to be restored in the next few years. Bitcoin has fallen by about the same amount.

To argue whether Ethereum can overtake Bitcoin, you can try to draw an analogy with traditional finance. BTC is more like digital gold, the most valuable asset, standing apart from exchange currencies. ETH, on the other hand, seems to be analogous to the dollar — this digital currency is inclusive as universal medium of exchange. That is, ETH and BTC belong to different weight categories, and therefore it is difficult to draw conclusions about which project will succeed more.

Also, now Ethereum and its representative Vitalik Buterin have received the moral right to reproach Bitcoin for insufficient environmental friendliness. Many eco-activists are starting to call for Bitcoin developers to switch to Proof-of-Stake, but this does not work. Most of the new crypto applications and ecosystems are built on green consensus, bypassing Proof-of-Work, therefore, the mining market is narrowing, and mining currencies are becoming less profitable.

BTC mining difficulty is on the rise in 2022. On the one hand, an increase in hashrate demonstrates the growth and decentralization of the network but also leads to a decrease in profits for miners since they require more computing power to maintain the network.

On the eve of the Merge, many expected that this would rock the prices of BTC and ETH either up or down, however, we see that there are no significant changes, but it seems that BTC resists market fluctuations better than ETH.

How Will Switching to Proof-of-Stake Affect Miners?

What will happen to the Ethereum miners? It seems like an obvious assumption — they will switch to Bitcoin mining. However, there is a significant snag here. The miners of these two networks use different processors. Ethereum is mined using GPUs (graphical processing units), while Bitcoin miners use more advanced ASICs (application-specific integrated circuits) processors (pick a synonym). We talked a little about this in one of our articles on Ethereum Classic.

The following options turn out to be the way out in this situation: switching to staking in the updated Ethereum ecosystem, replacing processors in order to mine Bitcoin, or switching with the same capacities to networks like Ethereum Classic, Ergo or Ravencoin.

ETH Deflationary After Merge

Prior to the Merge update, the issuance of ETH mining rewards was around 13 000 ETH per day, while staking rewards were around 1 600 ETH. Now that Ethereum is no longer distributing rewards to its miners, emission dropped by 89.4%. In general, the emission dropped to 0.49%.

The decline in inflation rate can be explained by two reasons:

Firstly, due to the change in the PoW mechanism to PoS, it turned out to be unnecessary to produce and distribute new coins among miners every day. The advantage of staking is that participants are more likely to be willing to pledge their funds for a years in order of securing the network. Staking brings stable passive income and becomes a safety cushion for investors.

Soon Ethereum yield will reach 4 to 6%, which is incomparably more than what traditional finance can offer. This factor can significantly affect not only those who are already accustomed to crypto investments, but also institutional crypto adoption. It should be noted that now there are more profitable cryptocurrencies than ETH — for example, Solana. But Solana is 30—40% more volatile currency than ETH.

Secondly, since 2021, Ethereum has introduced the EIP 1559 mechanism, aimed at burning, or permanent elimination from circulation, ETH. ETH that was used as gas fees is taken out of circulation by burning. Since the implementation of the burning mechanism, more than 6 million ETH has been automatically eliminated.

Experts argue that Ethereum deflation could lead to a lot of institutional money invested into ETH in the future.

How the Merge Will Affect Ether's price?

On the eve of September 15, we could observe that ETH is at a high point of growth and fluctuates in the amount of $1770. However, the next day after the Merge, the price began to creep down and has been holding below $1,500 for a week now.

However, this decline did not happen just like that, but against the background of events that go beyond the crypto industry. U.S. government's indicated that Ethereum will be treated as a security rather than a commodity. This is expected to lead to stricter regulations and tax repercussions. External circumstances are always important to take into account when evaluating a currency for investment.

Another circumstance shaping market sentiment is the continued hike in interest rates by the Fed. The Fed's decision to raise rates (for the fifth time in a year) is designed to stabilize the economy and slow down the highest inflation in the US in decades. As a result, the volatile economic environment is affecting investors' confidence in cryptocurrencies.

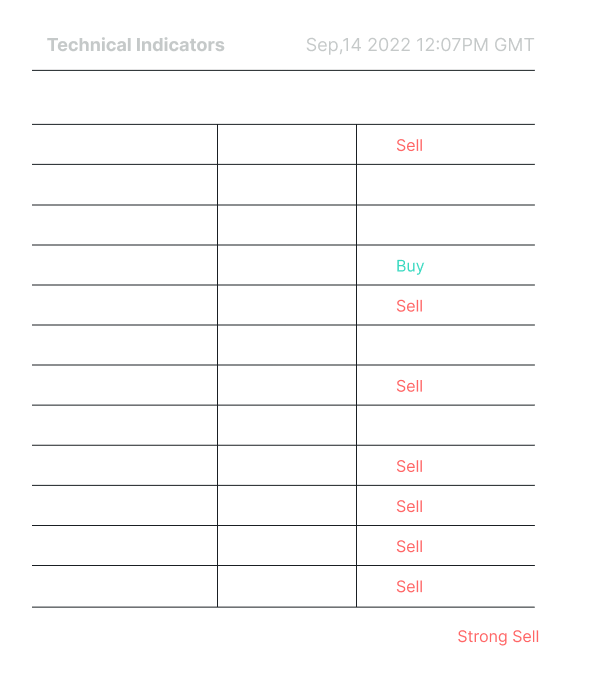

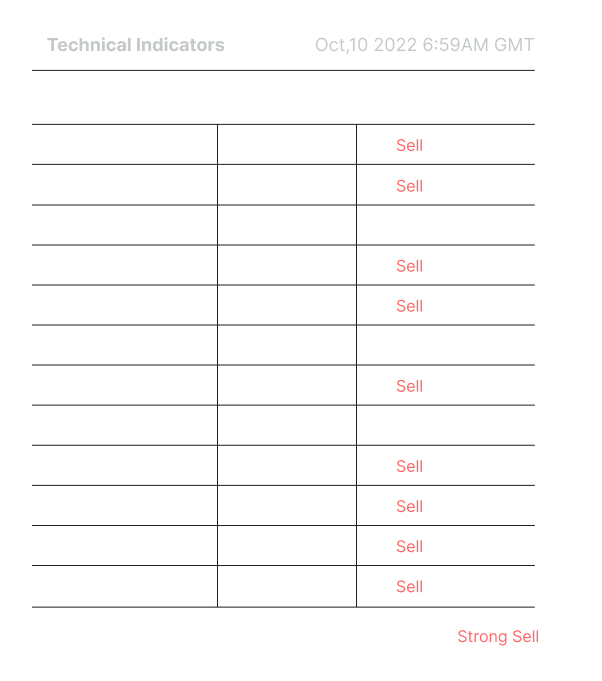

Technical analysis of ETH during the month shows a strong trend to sell the asset, which continues to this day:

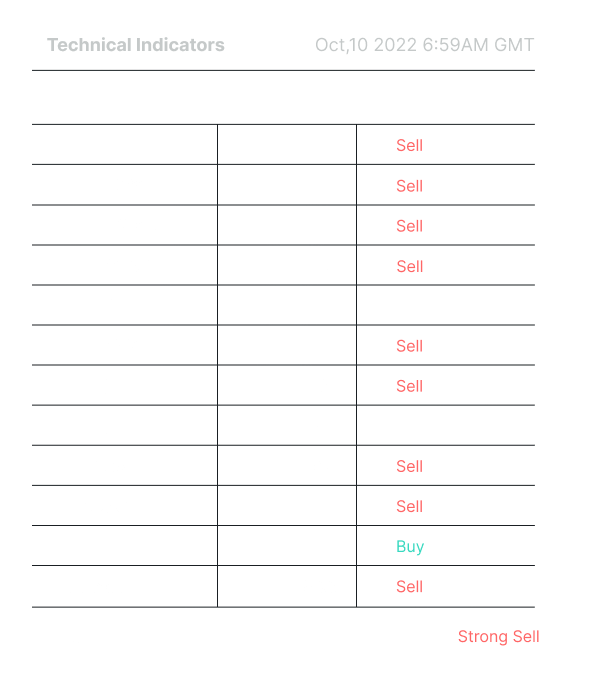

If we analyze the weekly analysis of ETH, we can see that there are almost no changes. The bear market seems to be too strong at the moment:

For comparison, BTC technical analysis shows similar trends:

Conclusion

Ethereum is one of the most mobile and ready to change projects in the crypto industry. Year after year, developers have made decisions that have contributed to the expansion of Web3 capabilities and the spread of crypto around the world.

As Vitalik Buterin said, ‘’By the end, Ethereum will be able to process 100,000 transactions per second’’. This volume indicates that very soon crypto transactions will become as easy as fiat money transactions with MasterCard are now.

Ethereum also does not remain aloof from the eco-agenda, striving to make its product not only convenient and easy to use for users, but also environmentally friendly.

The prospects for an exit from the bear market are still vague, primarily because the global economy is going through hard times. Crypto does not exist by itself and is always directly related to global economic trends.

bitoftrade continues to be that decentralized platform for anonymous trading, where users can exchange crypto.

Subscribe to our social networks and stay up to date with the latest news: