You can now apply stop loss to the trading features on the bitoftrade platform.

Stop loss and take profits are methods of protecting your overall crypto portfolio value while you’re trading. They help reduce loss but also enhance your profit margins. You set a price limit on either side of the current market price and you can sit back and relax knowing you’re in safe hands with your trades. In recent days, the market cap hit a low of $1.4 trillion, well below its peak of $2.9 trillion last November. As there are market doubters, it’s a good time to start learning about stop loss and take profit to protect your trades.

Before we dive into using stop loss and take profit, you need to know how to start trading on the bitoftrade platform.

What is stop loss?

Stop loss (or a stop loss order) is an order placed on an exchange to buy or sell a specific token once the market value reaches a certain price. The whole idea around stop loss is to limit your losses when trading and reduce the risk to your portfolio.

A stop loss order will only execute when the price crosses the stop price that you’ve specified. A limit order automatically activates when the stop price reaches your specified amount so the value of your assets doesn’t go into freefall. Stop limit orders can be used to limit any potential losses on your positions by automatically closing them when the price rises above the stop price. Once the stop limit order has been triggered the resulting limit order can immediately be filled.

For example, if you set a stop loss order to 20% below the price at which you bought the token, then your loss will be limited to 20%.

The clue’s in the name: it stops you from making losses!

Before you begin to use stop loss, you need to know what you’re getting yourself into first. That’s why we’ve provided a list of benefits and things to be aware of below.

Benefits and things to be aware of with crypto stop loss

Benefits of stop loss:

No extra charge. It costs nothing to add a stop loss to your trade. You’ll only have to pay your regular fees.

Doesn’t need a watchful eye. You don't have to constantly be checking the crypto market, they run in the background so you can set and forget as you go about your day.

Prevents emotional influences. Trading is exciting and when you’re on a winning streak it can be tough to know when enough’s enough. Markets don’t continually rise as we saw in May with LUNA, so that’s where stop loss can help you manage your potential losses.

Things to be aware of with stop loss:

Early termination. Short-term price fluctuations can activate the stop price. This saves you from potentially higher losses and when you use stop loss as part of your overall trading strategy this protects your portfolio.

Different selling prices. If you reach your stop limit, your stop order then becomes a market order. It’s possible that the price you sell can be different from the stop price, this can happen when the market reaches trigger price, the market order will then be sent to the order book. There are some scenarios of market crash when liquidity is low it will reflect in a sharp price drop. For example, the current price for asset X is 1000. Bad news can affect the market and when it comes to the market, buyers aren’t willing to buy the asset at any price but 100. So, even if your stop loss was set at 800, you'll close your long position only at 100.

Risk of no execution. If the stop order is triggered but the limit order isn’t filled before the market price reaches the limit price, the trade will be canceled. If we take the previous example and apply it here, if the trigger price (800) is crossed then the limit order will be sent to the market, and price for the limit order sent after was set at 750, due to the significant price drop there’ll be no buyers for 750 and the order will be placed but not executed. The user will stay in an open position taking all losses. This means there is potential for your tokens to not sell, which could result in loss due to still having to pay platform fees.

Everything you need to know before you apply stop loss to your trades

Our decentralized platform launched back in March, and since then we've added various networks to enhance your trading experience. You can now trade over 900 tokens on networks including Ethereum, BSC, Polygon, Fantom, and Avalanche. Our trading features have had an upgrade and we’re thrilled to announce you can now make stop loss trades on the bitoftrade platform!

Stop loss and take profit orders can only be applied to the Ethereum network on our platform so far, the tokens you can use it with are:

- ETH/USDC

- BTC/USDC

- YFI/USDC

- CRV/USDC

- 1INCH/USDC

- ZRX/USDC

- MKR/USDC

- COMP/USDC

- SUSHI/USDC

- LINK/USDC

- AAVE/USDC

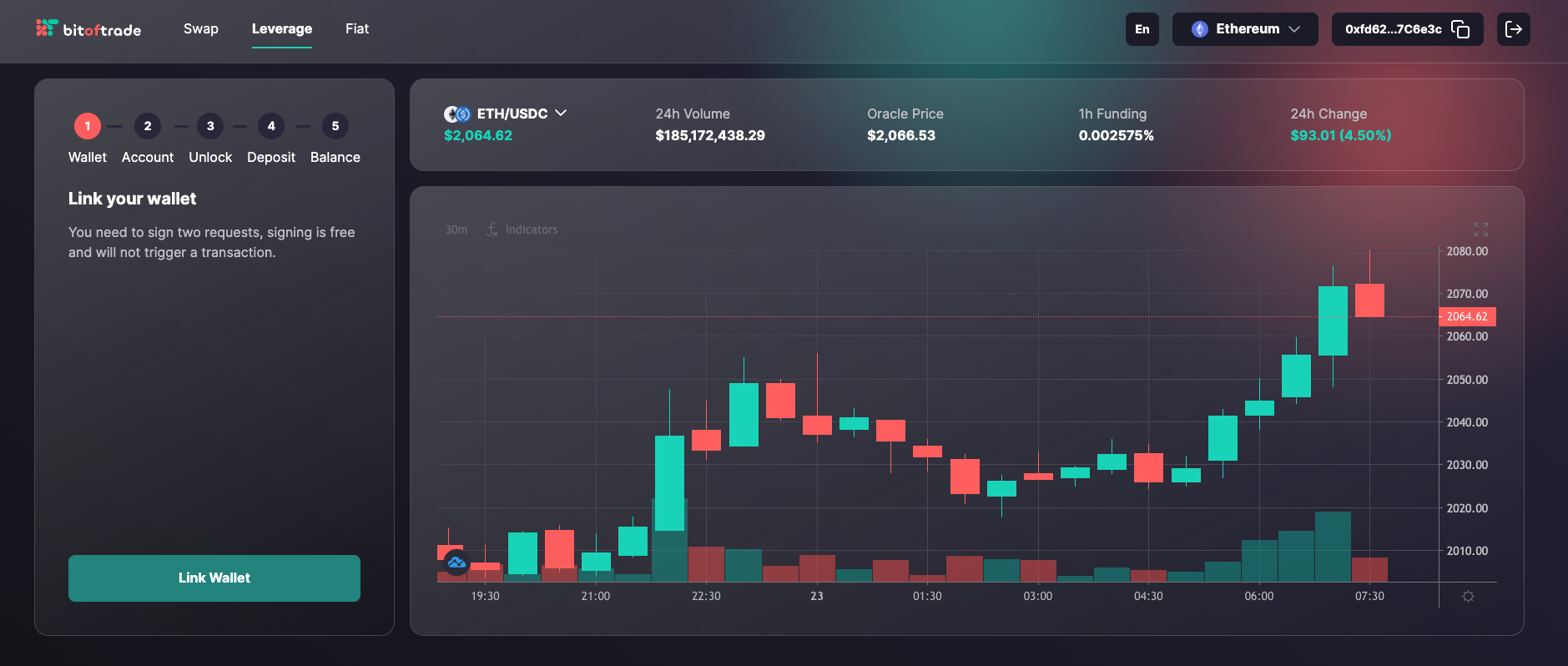

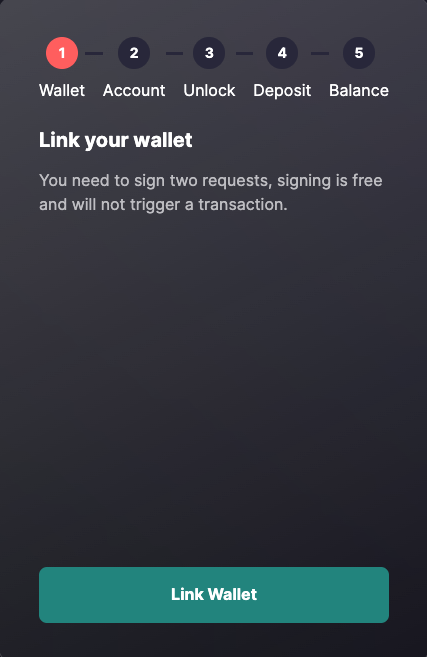

Before you can start using stop loss, you need to connect your MetaMask wallet to our platform. Don’t worry if it’s your first time trading on our platform, it’s quick and simple to get started!

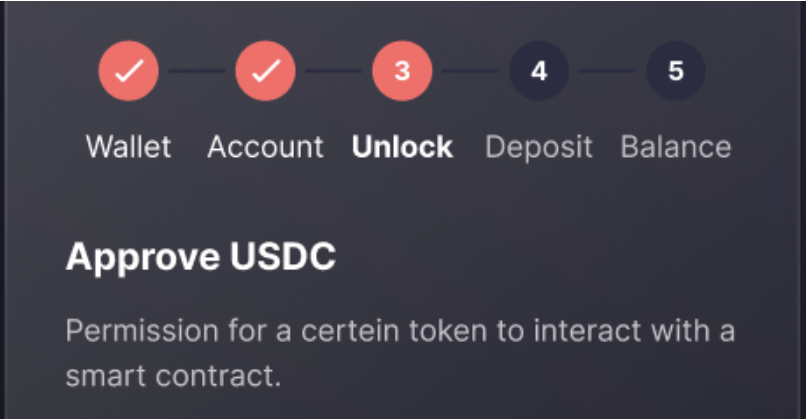

Connect your wallet with these four simple steps

- Click on “Link Wallet” and approve by signing two requests.

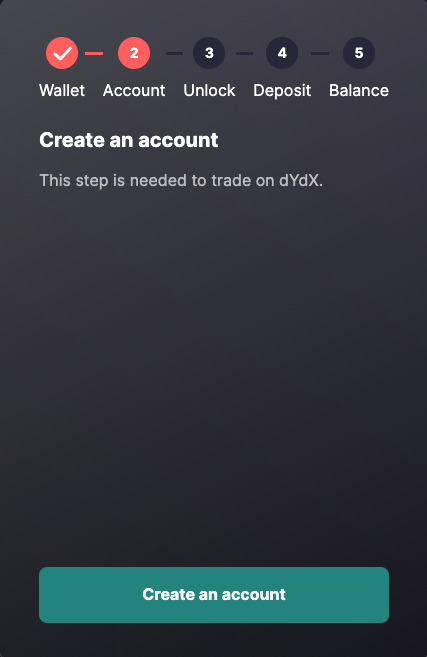

- Click on “Create an Account”. This will create a leverage account linked to your wallet.

- Click on “Approve USDC”. This is a one-time procedure (and includes gas fees) that approves our smart contracts to interact with your USDC balance. This step may take a few minutes.

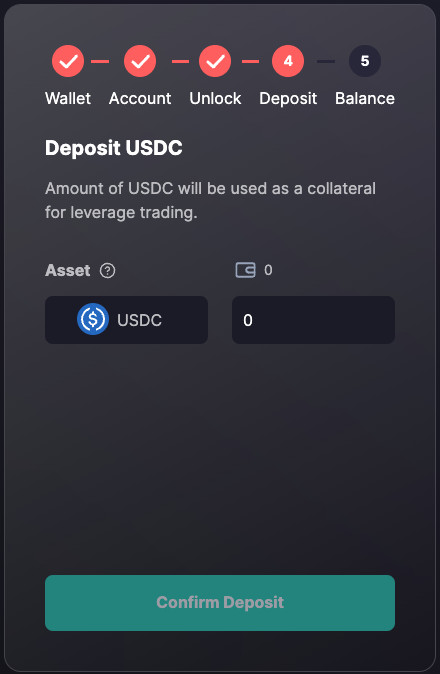

- Deposit USDC to your leverage account. Leverage trading operates in USDC, so please make sure you have USDC in your wallet and ETH to pay for gas fees. This step may take a few minutes.

If it’s not your first time, then you’ll need to just link your wallet to your account pressing “Link Wallet”. You’ll be able to see all of your account details, including equity and transaction history.

Now you’re all set up to start trading like a pro! In this article, you’ll master the art of trading on our platform. But first, what are stop loss and take profit? Read on to find out!

How to stop loss crypto on our platform

Looking to become a pro trader and protect your trades on the bitoftrade platform? Don’t worry, we’ve got you covered!

Read our simple step-by-step process to place a stop loss order:

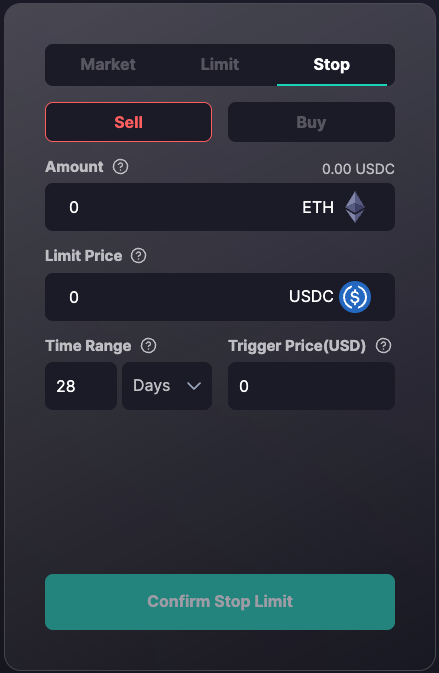

- Select Leverage and then choose Stop Limit under the Stop dropdown menu:

Select Buy or Sell.

Enter an amount—this is the total trade size.

Enter the desired Stop Price. Your order will trigger when the Index Price reaches this amount.

Enter the desired Limit Price. This will be the limit price of the limit order that is placed once your stop order triggers

You can now successfully apply for stop loss orders on your trades! But, before you find out how to add take profit orders to your trades, let’s read more about take profit to make the most out of your trades!

What is take profit?

A take profit order (TP) in crypto is a standing order to sell a token once it reaches a certain level of profit. Selling the token at this price ensures that you’ll make a profit on the trade, limiting your exposure risk. Take profit orders are similar to stop loss and a limit order will trigger when a specified price is reached.

For example, if you predict that a token’s value will rise by 20% you can sell your assets with a take profit order set at 20% higher than the current price to automatically sell once it reaches that level. Equally, you can set a 5% stop loss order below the market price to ensure you don’t lose out.

Where you place your order on the price will depend on the position, for example, if you’re going for a long position you’ll place the order above the current market price. For a short, you’ll also put it above but you should add a stop loss as well to prevent losses.

You can set targets with take profit orders and protect your potential earnings from wild price fluctuations by specifying an exact price to close a position for a specified profit. By setting a target for a profit you remove the risk of waiting for it to get higher which can result in the market going lower and missing out on profit all together.

Again, take profit does exactly what it says: helps you take profit!

Take profit orders are best used for short-term trades when combined with limit orders to help manage risk. You set your take profit and limit orders and go about your day knowing your trade will execute when market conditions meet your chosen parameters so you gain a sizable profit or protect yourself from potentially significant losses.

Before you start applying to take profit on your trades, we’ve compiled a list of benefits and things to be aware of to ensure you know everything you need to know about TP trading.

Benefits and things to be aware of with TP trading

Benefits of take profit: More control over your profit. If a take profit order is executed, you’re guaranteed to take a profit when the market conditions meet your TP order.

Minimal risk. You can take advantage of a quick rise in the market rather than miss the chance to sell.

No second-guessing the markets. The trade executes automatically and removes the emotional rollercoaster and the risk of not selling. You set the profit you want so you know what to expect.

Things to be aware of with take profit orders: Best suited to shorter-term day trading. TP trading is suited more to short-term strategies over longer-term ones. If you’re looking to trade actively and make a tidy profit, then take profit orders are an invaluable asset.

Can’t take advantage of trends. You can’t take advantage of longer-term trends as take-profit orders don’t accommodate them.

Unexecuted trades. The sale isn’t guaranteed to happen, if your profit price isn’t met then the sale may not happen, or you may have to sell at a loss.

Want to take profit on bitoftrade? Suggest this feature!

We’ve got lots of exciting features coming to our platform very soon and take profit could be one of them. We're always looking for ways to expand on our platform to meet trader’s needs which is why we’d love to hear from you!

Head on over to our Request A Feature page and vote on upcoming features to let us know what you’d love to see next on bitoftrade.

Apply stop loss to your leverage and limit trades

Stop loss and take profit are great tools for managing your trading strategy. They help you reduce risk to your portfolio, and likewise ensure you make a tidy profit on your trades when the market is up (and we all know the market can swing wildly within the space of a few hours)! If you’re looking to carefully control your trades and want to have the assurance that you won’t suffer substantial losses when markets tank, then consider making stop loss and take profit orders a part of your trading strategy.

Our new stop loss limit order feature is easy to use and doesn’t include any additional costs or fees on top of our regular leverage trading fees. With this very handy new feature you can apply stop loss to leverage trades on our platform and set up your trades to automatically execute when market conditions meet your requirements. Plus, combining limit orders with leverage trades means you can take advantage of significant market upswings but also be confident knowing you aren’t overly exposed if the market takes a sudden downturn.

Join our community and stay in the loop with all things bitoftrade via our community channels including the latest news, features, and fun competitions!

Official bitoftrade Telegram channel

Official bitoftrade Discord channel