There are different ways to buy or sell cryptocurrencies on trading platforms. The number of options available for traders depends on their preference. Custodial trading platforms offer more options such as market orders, limit orders and stop orders. On the contrary, non-custodial trading platforms are limited. The choices usually found on them are market orders and swap options. In this article, we will focus on limit orders in cryptocurrency trading and how they work.

What is a Limit Order?

Limit orders are used by patient traders who may want to get the most out of trading opportunities. They enable traders to buy or sell cryptocurrencies at prices that offer greater profit potential. Therefore, limit orders can be defined as orders that provide restrictions on the maximum price to be paid, or the minimum price to receive when buying or selling a particular cryptocurrency.

There are different types of limit orders, each of which is automatically executed when specific conditions are met. In the following section of this article, we will be explaining these types of limit orders and providing answers to questions like what is a limit order duration, what is a limit price, and what does limit price mean?

Sell limit order

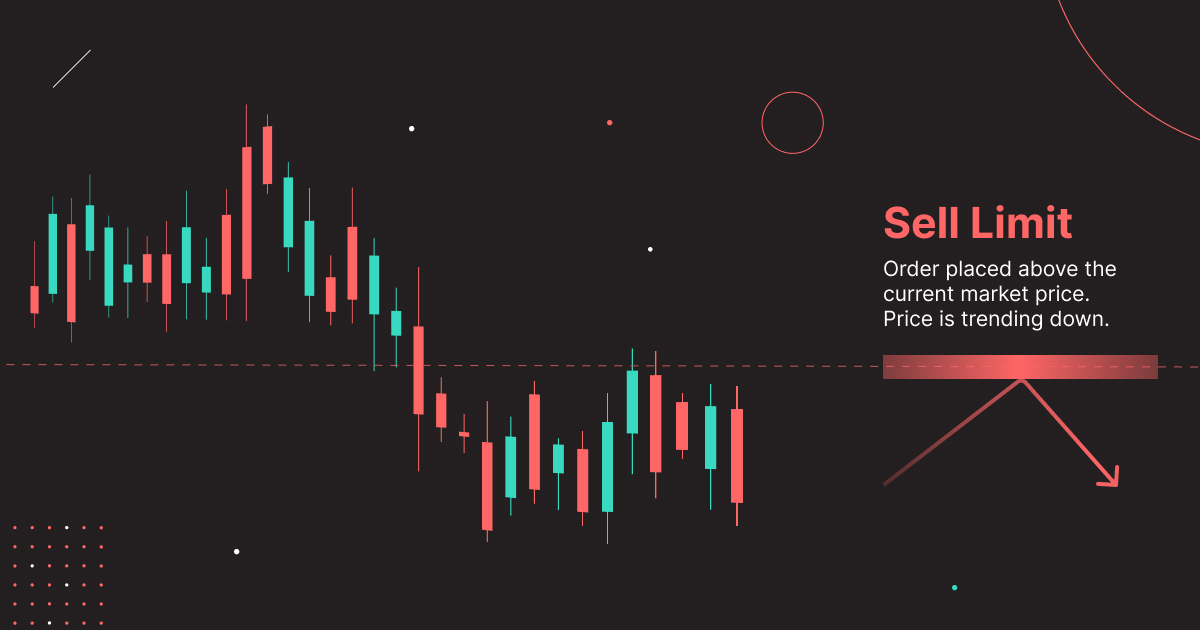

As a crypto trader, you can use the sell limit order if you expect the price to climb higher than the current price. It would mean that the sell order will execute at the set price or higher. A modification of this kind of order is the sell stop limit order. In this case, rather than targeting to sell above the current market price, a trader creates a pending order to sell a particular cryptocurrency/token when the price drops lower than the current market price. A sell stop limit order is used when a trader expects the price to climb higher for a while before falling.

The sell limit order is usually placed above the current market price in anticipation that this price will climb to or above that point before going further down, as illustrated in the figure below:

Buy limit order

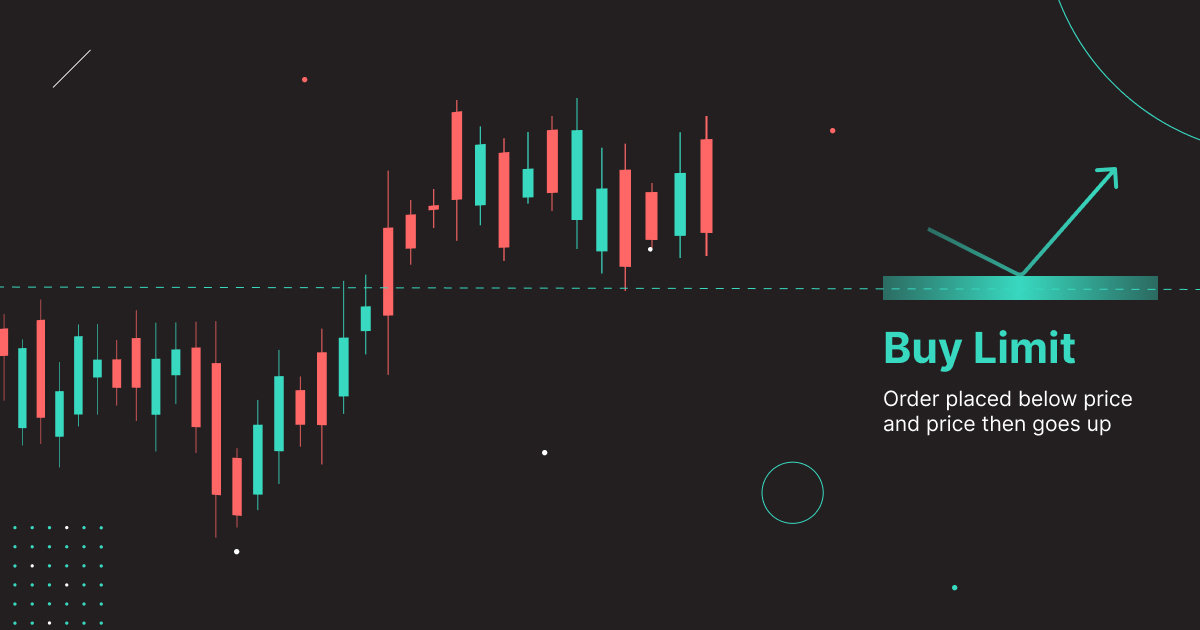

Traders use the buy limit order to place a pending order that would fill at, or below a specified price beneath the current market price. To understand what’s a buy limit order, you can consider a mirror image of the sell limit order described above. Similarly, when a trader expects a particular crypto's price to fall for a while before climbing higher, a buy stop limit order can also be used. On how to place a buy stop limit order, the target entry must be above the current market price and will be filled when the price climbs to this point or higher.

The image below illustrates how to place a buy limit order:

All or None Order (AON)

All-or-none orders in crypto trading come into play when the subject of liquidity becomes a concern. Considering the novel state of the industry and the continuous emergence of new tokens, the all or none order specification becomes a valuable tool in crypto trading.

By definition, an all or none order type is an order with instructions demanding complete execution of the trade otherwise, or the order is canceled. It means that partial fulfillment will not be allowed if the available liquidity in the platform cannot satisfy the entire volume in a particular order. Instead, at the time of expiration, the whole order is canceled.

The all or none order advantage is suitable for trading pairs with small volumes. This is because trades on such markets will fall within the limits of available liquidity more often than trades on markets with large trading volumes, like BTC/USDT.

Fill or kill order (FOK)

The “fill or kill” order type is similar to the all-or-none order. It involves executing the order entirely or not executing at all. However, unlike the all or none order bound by available liquidity, the fill or kill order is centered around specific pricing. When using fill or kill order types like the fill or kill limit order, the entirety of your trade must be filled at the specified price; otherwise, the order is canceled.

The purpose of the fill or kill order in crypto trading is to avoid irregularities due to market volatility. For example, when the market moves too fast, large volume orders could encounter delays that may lead to disparity in price. Fill or kill order ensures that this does not happen.

Immediate or cancel order (IOC)

The IOC order is a variation of the fill or kill order. The uniqueness of the IOC order type lies in the possibility of partial fulfillment. There has to be an attempt to fill the order under the specified conditions for this order type. If only a part of the order is filled, the remaining unfilled portion is canceled. Partial filling of orders can result from fast market movement or insufficient liquidity as mentioned in the all or none order section.

Good till canceled order (GTC)

A GTC order is straightforward. Two outcomes are possible with the GTC order type, either the order gets filled or will remain active until the user cancels it.

Limit order trading on Decentralized Exchanges (DEX)

Limit order trading is quite a rare feature on non-custodial exchanges. Usually, only CEX (Centralized Exchanges) platforms provide the ability to set one or another type of a limit order, BUT bitoftrade is here to change the game! We give our users the ability to use such features as buy/sell limit orders to aid their trading strategies while keeping their identity safe and sound (no KYC is required to trade on bitoftrade). AON, FOK, IOK, and GTC are not yet available on the platform but we assure you that bitoftrade users will have the ability to use those features in the near future! If you feel like one of these features is a must - please submit it here, where bitoftrade asks the community to submit their feature requests and develops them based on votes and potential demand.

How does a Limit Stop Order work?

A stop limit order is used to set up trades that are not only expected to fill in the future, but also provide protection for the trade within a trader’s level of risk appetite. It is most suitable for traders who may be away from their trading desk but want their trades to execute in a protected manner.

Stop limit order gets executed successfully when the price reaches a specified level that was originally set by a user. Unless this price is reached, the order will remain unfilled. Stop limit orders can be used to buy or sell any given asset. The buy stop limit and sell stop limit are symmetrical and are guided by the same rules, just that they are in different directions but follow similar processes on how to execute a stop limit order.

Limit Order vs Market Order

There is one fundamental difference when considering limit order vs market order. While a limit order specifies the maximum or minimum price at which you are willing to buy or sell, a market order works with the best possible entry based on the current price in the market.

The following table is used to compare the differences between a limit order and a market order.

The Difference Between Limit and Stop Orders

Limit orders and Stop orders are both conditional orders usually prepared for future execution. However, the differences in limit orders vs stop orders depend on how and when they are used. A limit order is used to buy or sell at a specific price. The broker is instructed, and the order is filled when the price gets to that point. On the other hand, a stop order is used to activate a market order when a particular set price is met. It instructs the market to come alive at a certain time, not minding the effects of volatility or network delays. The table below illustrates the main differences between a limit order and a stop order.

Trade with Limit Orders Anonymously on bitoftrade!

Cryptocurrency trading can be a very dynamic experience and requires traders to be flexible in their approach. Trading habits and prevailing conditions demand that any crypto trader be provided with the available tools to enhance their trading performance. In turn, when it comes to anonymous trading available mostly on decentralized exchanges, a trader will hardly find a wide range of trading tools, including limit order trading.

Fortunately, such an opportunity can be found on bitoftrade, where traders’ preferences remain the priority. The platform allows easy speculation and enables traders to deploy limit orders for swaps and anonymous trading. This freedom underlines the fundamental ethos of cryptocurrencies, where flexibility and anonymity are deeply appreciated. Limits provide our users with the ability to customize the price at which they would like to buy/sell assets. For example, if a user wants to sell 1 Ethereum (ETH) by the market price of $2700, he/she can offer to sell their ETH for $2800. In case the market goes up, their assets will be sold at their selected price.

A limit order could also help to cover Ethereum gas fees for makers. For example, the user places the order of the aforementioned ETH for $2800 and gas fees for the future transaction are $40. In this case, the taker will execute the order only when it reaches not less than $2840. The same logic applies to buy orders.

The only time the user pays gas fees when trading with a limit is in case they cancel their order. When the order gets executed, the maker will pay 0.2% bitoftrade system fee while the taker will also face gas fees on top of previously mentioned charges. The taker will execute the order only at the time he will be able to cover the gaz fees because of the speed between the real market price and the price user mentioned in the signed message.

The decision of whether to use a limit order or not totally depends on your goals and intentions. bitoftrade is a perfect solution for discovering and practicing trading limit orders - all the tools you need on one comprehensive platform. Go ahead and try out yourself!