If you are reading this article, you’ve already heard a ton of success stories and failures that feature huge sums of money. It might seem like “The Wild West” for a newbie but it’s not that much of a hassle if you really get into it with an open mind and an urge to learn. We hope that you, our dear readers, have exactly this kind of attitude!

To continuously ride the wave along with millions of other crypto enthusiasts and harvest the profits that the crypto industry is bringing, you will have to do your homework. Every year is groundbreaking in terms of technological progress and trendsetting. For example, do you remember hearing anything about NFTs 12 months ago? We bet you haven’t! In contrast, it’s such a big thing now that even Coca-Cola has released a bubble jacket NFT!

It’s very important to keep up with the news! In this article, we will highlight the TOP 5 ways of how to make money off cryptocurrency that will serve you as a great starting point for the rest of your research!

Can I still make money with cryptocurrency in 2022?

As mentioned before, there are plenty of risks involved with crypto. Many scam reports, hacking incidents along with volatile market movements make up for a negative profile and still serve as one of the entry barriers. But where’s a risk, there’s an opportunity.

Last year, Bitcoin reached its historical high by reaching the price of $69,045 and surpassing $1 trillion in market capitalization, proving to everybody that crypto has not faded since the last ATH in 2018 ($19,498.63).

The hype that bitcoin has attracted finally made an official to recognize cryptocurrency — Financial Services Minister Jane Hume has publicly announced “As an industry, and as a government, we need to acknowledge this is not a fad. We should tread cautiously, but not fearfully.”

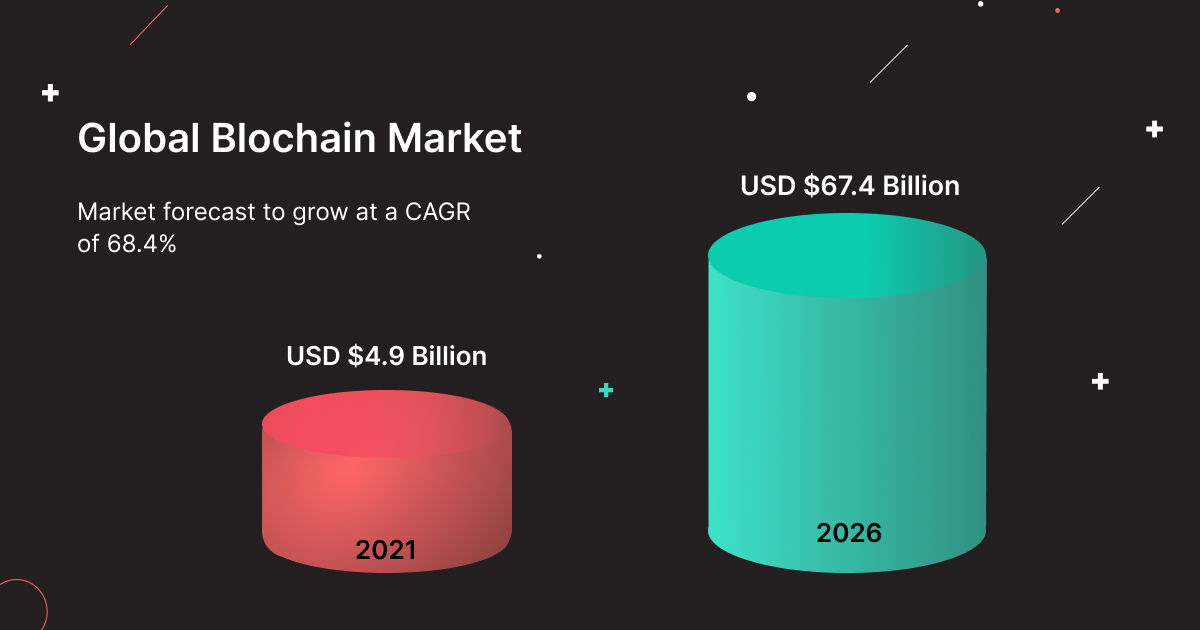

2021 has truly shown us the full potential of the Blockchain industry. The market has grown from $3.06 billion in 2021 to $6.0 billion in 2021 (196%!!!). Analysts at BCC Research believe that the Blockchain market has a long way to go with a compound annual growth rate (CAGR) of 56.9% for the forecast period of 2021 to 2026, meaning that there are still plenty of profit opportunities for those who want to learn how to profit from blockchain.

The 5 time tested ways of making money with cryptocurrency

By 2022, the ways of earring on blockchain have come down to 5 time-proven methods:

- Investing

- Trading

- Staking

- Mining

- Leverage Trading

We will describe every and each of them in a nutshell. The bitoftrade team strongly believes that it will teach you how to trade cryptocurrency and make a profit by diversifying your portfolio instead of putting all of the eggs into one basket.

Investing in cryptocurrency

If you have a natural interest in research, news reading and trend watching, investing is your kind of method to learn how to make money with cryptocurrency. Crypto investments usually mean holding crypto assets (HODL) for periods starting from several months to years in order to gain more and more value.

To invest in crypto you need to keep your hand on the pulse. Despite the countless success stories, the cryptocurrency market is still extremely volatile, therefore, quite risky to invest in. A crypto investor should always be informed about the latest news and learn about aspiring new projects from trusted sources.

Before investing in any crypto project (their coin or token) it is strongly advisable to analyze its whitepaper (a document describing what the project is about and what is the function of its coin). A whitepaper works great if you are leaning towards long-term investments. An experienced investor would understand what kind of innovations (fully described in the whitepaper) the market needs, what may blow up or be forgotten in a couple of months.

The last thing a newbie investor should know to confidently start practising and discovering how to profit from cryptocurrency is risk diversification. It is highly recommended not to invest all in one or a couple of assets. There’s an unspoken rule that half of your portfolio should be taken by fiat stablecoins (cryptocurrencies whose price is pegged to fiat money — regular currencies; e.g. one of the USD stablecoins is USDT or Tether). This way you will always have fiat-backed capital on a crypto wallet or exchange to react quickly while the market is down or minimize your losses from the market volatility by acquiring other assets.

It also makes sense to fill a quarter of your portfolio with Bitcoin and Ethereum — the two assets with the largest market capitalization. These two cryptocurrencies are the main market drivers. Their price usually determines the price of other currencies even if they are completely not related (Bitcoin is the real trendsetter on the crypto market). It is widely believed that Bitcoin and Ethereum still have a long way to go in terms of price growth and market capitalization.

The rest of your portfolio (25%) could be distributed across numerous cryptocurrencies that induce your trust. Don’t be shy to start with safe investment amounts to learn your way through trial and error. You will eventually understand how to make money with blockchain projects by practising.

Trading cryptocurrency for profit

In our humble opinion, to really understand how to make money trading crypto a user would need to spend much more time learning the crypto market and trying out crypto trading strategies, compared to the investing approach. The difference between those two is in the involved risk. Crypto trading could be viewed as “micro investing”. In the case of trading, an investor performs much more market procedures in a short period of time, thus escalating the risk of error. Because of this, a trader would need more experience to minimize the risks.

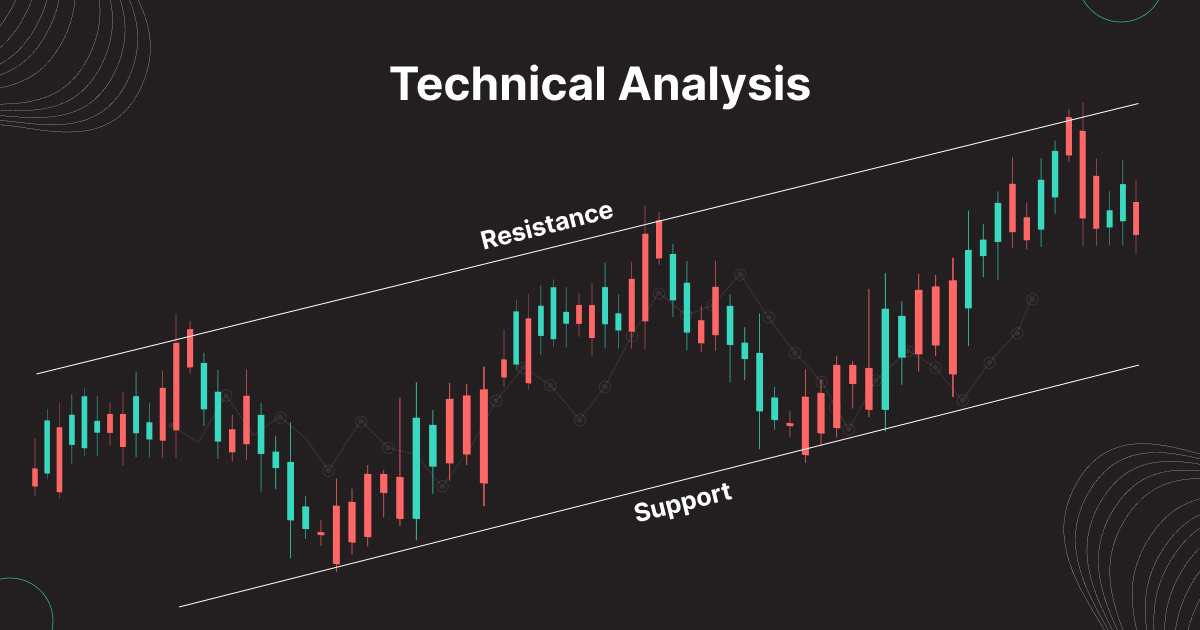

Long story short, it is extremely dangerous to trade blindly. You should study and use both technical and fundamental analysis to finally develop a working cryptocurrency trading strategy of your own. Everything mentioned above about research, market and trend monitoring is called fundamental analysis, which helps a lot to compose reliable approaches that would drive long-medium term revenue. Crypto trading is all about short term profits that rely more on technical analysis and trading tools.

Technical analysis is an entire institution of its own. It relies on statistics and market patterns to project the future price movement based on historical data. Technical analysis uses numerous trading indicators that are famous for being widely unavailable on non-custodial trading platforms. Luckily for traders that want to save their anonymity, bitoftrade will soon be one of the few non-custodial exchanges that feature indicators! This way users all over the world will receive much more data that would help to determine when to sell crypto or when to buy it.

One of the most important trading tools for crypto traders are limit orders which are also quite rare among non-custodial trading platforms. Limit orders help to buy and sell assets in a variety of ways. For example, stoping loss and taking profit orders help to avoid losses that could be projected by the trader. Both mechanisms work as securities that are set in the present time to minimize future risks. Stop- loss crypto limit order helps to sell an asset at a tolerably lower price compared to the present market price to avoid losing even more, while taking profit order helps to sell crypto at a higher price than the market price to gain revenue and avoid losing it to volatility.

“So is crypto trading profitable compared to investing” you may ask. The best answer to that question is “It depends…”. Generally speaking, trading is really profitable while being riskier, so we suggest investing for complete newbies, while more experienced traders are welcome to… diversify their methodologies to minimize the risks! It’s quite obvious but still true. Any user can feel free to make money trading cryptocurrency while also having some crypto investments safely stored on their crypto wallets to provide passive income.

Mining cryptocurrency

The mining process lies at the very core of the Blockchain mechanics. You have already heard of or seen numerous cryptocurrency mining farms but still have no idea how does cryptocurrency mining work. There’s absolutely no shame in it, as its actual mechanism is still quite unavailable for the general public to furthom. Nobody really talks about how it works, people generally focus on the profits that it brings to the table.

We would like to briefly and simply explain to our dear readers, how does mining work and for what miners are rewarded. So, let’s start!

First of all, let’s go back to the fundamentals of blockchain technology and tap into what is cryptocurrency mining. It’s a decentralized system/database that consists of nodes. Every node is a computer that serves as a validator of a crypto transaction. By validating a transaction, a node updates the ledger balances and gets rewarded a commission from the transaction. But it’s not that easy to accomplish. To win a chance of performing a transaction, a machine should guess a keyless mathematical problem that requires lots of GPU power to do it faster by increasing the number of solutions per second. Put simply, the more powerful mining GPU is, the more likely/faster a miner will profit. Simultaneously, no miner would ever be able to create a mining monopoly, due to the sheer complexity of the mathematical problems that are impossible to be solved by a single unit.

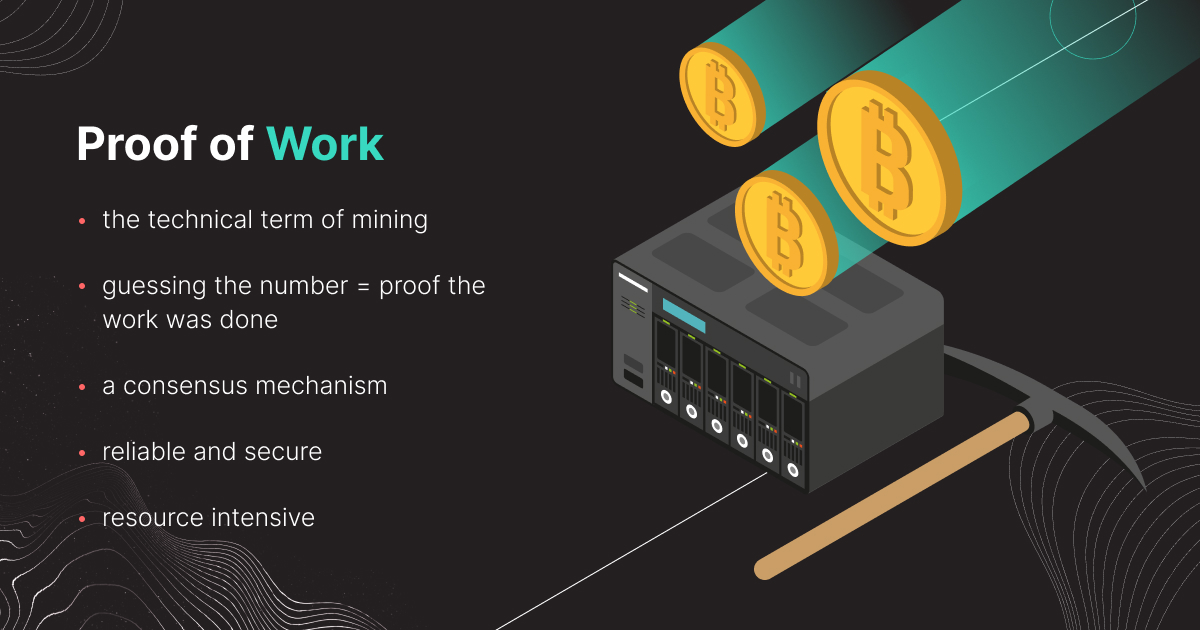

The technical term of mining is Proof of Work, as the most “hardworking” machines get rewarded with transaction commissions. The process is very energy inefficient, so many criticize it for causing environmental problems by utilizing huge amounts of electricity.

We have finally gotten to the most curious question: “Is cryptocurrency mining profitable?” To put it shortly, yes but it requires huge investments to become efficient. A small miner would not be able to live off mined crypto as the passive income it provides is too scarce for supporting day-to-day expenses. Nevertheless, miners can always sell their equipment for a slightly lower price if they decide that it’s not their thing. Mining is not the most profitable method of earring on blockchain but the involved risks and entry barriers are relatively low.

Staking crypto

The variety of ways to earn cryptocurrency grows from one year to another creating more and more opportunities to gain digital revenue. Cryptocurrency staking (AKA Proof of Stake) is one of the methodologies that blew up in 2021. It is an eco-friendly alternative to Proof of Work transaction validation and one of the relatively easy ways to earn cryptocurrency by basically doing nothing.

Proof of Stake is a substitute to the traditional mining that doesn’t include any overwhelming electricity inputs as it also works as a blockchain transaction validator but doesn’t involve any mathematical problems to solve. No supercomputers are needed to get the chance to update the ledger balances for a commission due to a completely different mechanic. Staking cryptocurrency is about giving the power to those who have staked their crypto to receive a chance of serving as a blockchain node. The more a user stakes, the higher the chance to serve as a node even though the decision making here is also really random.

The main pain points of crypto staking are that one would have to give off their computer to serve as a node, there’s a huge entry barrier (e.g. to become a node of the Ethereum blockchain, one would have to stake 32 ETH to become a full validator), and that the demand for validating by the proof of stake is too high (meaning extremely long queues that make it almost impossible to stake crypto).

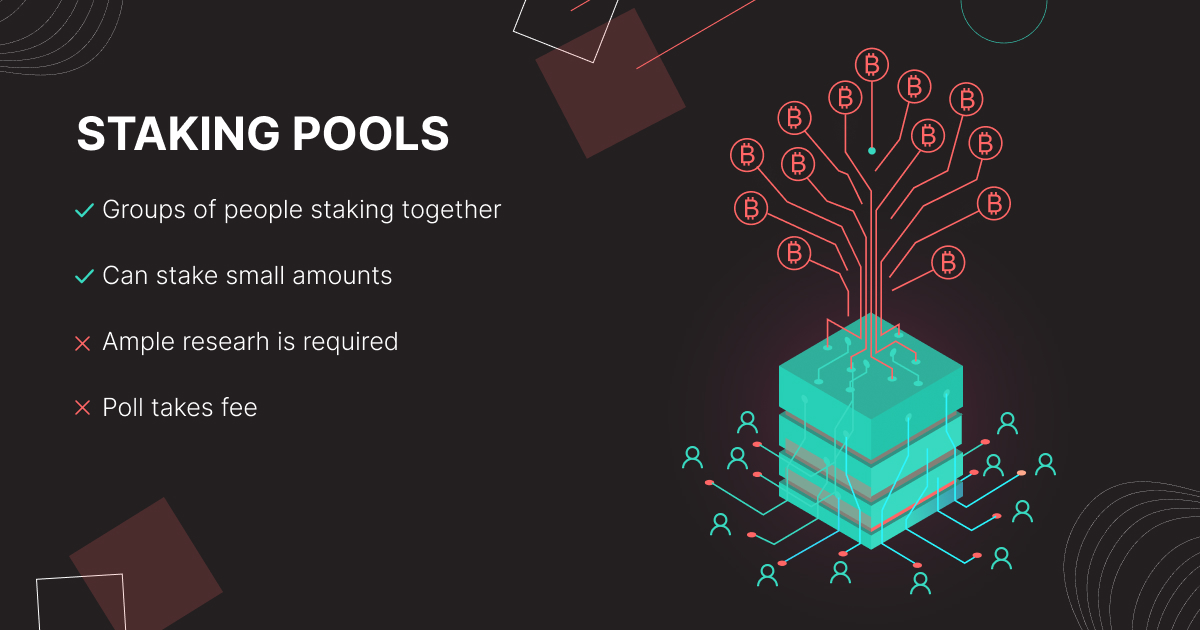

Nevertheless! The market has actually revolutionized staking making it truly one of the most easy and legit ways to earn cryptocurrency. The main stoppers are not compulsory any more thanks to the staking pools. Now there’s a service that allows people to create a shared pool of staked coins that allows common users to breach the high entry barriers and use computers provided by the platform as a node. Of course, the revenue from the staking pools is significantly lower (around 10-20% yearly interest) but it is still a passive income!

But is staking crypto safe? Like crypto investing, staking requires a deep understanding of the crypto market on top of being fluent while operating on the staking platforms. Compared to crypto investing, staking is not as agile due to often having a required minimum time period that disables withdrawals. It means that in case of a price plunge of the staked crypto, an investor might not have an opportunity to withdraw and continue dragging down the value of invested assets.

Leverage trading crypto

Saving the best for last, leverage trading is a method of using borrowed capital for investment purposes. Even though it is one of the most riskier methodologies, trading with leverage gives experienced traders an opportunity to gain the most revenue in the shortest periods of time.

In a nutshell, trading with leverage comes with higher risks since you are not only trading with your funds, but also trading with your broker’s funds. Of course, it provides you not only with a chance to multiply your potential gains, but your losses as well - a double-edged sword.

Cryptocurrency investors utilize leverage to maximize their returns by using either margin or derivatives like options and futures. If you are curious how does leverage trading work, we will explain it to you in the simplest way possible!

Leverage is usually expressed as the ratio between the assets in your account and the price of the position you are trying to open. Hence, a person invests 100$ for the 1000$ position - the leverage will be 1:10.

Once you are operating on a platform allowing you to trade with leverage, it’s time for the traders to keep your initial investment as collateral and provide you with the loan of your own preference.

In case the trade significantly fails, you may receive a margin call - an alert, requiring you to invest additional money into the position, or else you may face liquidation. Being liquidated means that the broker forces the position to be closed and eventually gets his loan back. You may wonder whether it is possible to lose more than the initial deposit? No, at least on our platform your investments are safe and sound! When the losses exceed the initial investments, our system closes your position automatically.

To sum up, crypto leverage trading unveils a lot of opportunities for experienced traders wishing to acquire more assets to execute a proper trading strategy. Unfortunately, similarly to limit orders, it is widely unavailable on the non-custodial trading platforms (exchanges that do not require users to hold their assets on such platforms). That is one of the main reasons why bitoftrade exists!

Get into crypto with bitoftrade

Still not sure about investing in crypto? Makes sense! It is quite difficult to swallow on the first try. But what everybody should know about cryptocurrency is:

- Cybersecurity is no joke when it comes to your money

- The privacy provided by the decentralized blockchain shouldn’t be devalued

Crypto is not just a new and efficient way to transfer money and earn revenue. Crypto is an opportunity to really be in control of your assets. The liability it brings can be easily exploited by hackers. Many people don’t give too much thought about really securing crypto wallets and exchange accounts which results in losing their money.

But the most vicious fact is that you are still insecure even if you have used top tier cybersecurity measures to protect your account on a CEX (Centralized Crypto Exchange) like Binance or Coinbase. While trading on a CEX, a user doesn’t actually own the crypto that is stored on the account meaning that when a CEX gets hacked, your crypto and personal data are on the line. Such platforms regularly suffer from hackers. Not so long ago, early in December of 2021, a centralized crypto exchange Bitmart got hacked and lost around $200 million worth of crypto.

To actually own the traded crypto, people use crypto wallets and non-custodial platforms that provide an opportunity to trade directly from your wallet on the blockchain. But the reason why most people still use CEX platforms is the sheer number of profit opportunities unavailable on non-custodial alternatives that they bring (leverage trading, limit trading and even price charts!).

bitoftrade is here to make a change. Our platform offers its users all the benefits of using advanced trading tools while allowing you to trade directly from a crypto wallet and keeping your anonymity. bitoftrade makes up for a great trading platform as its services cover the full variety of common exchange features while avoiding the risk of being centralized. On bitoftrade users are free to buy and sell crypto while securely keeping it on a digital wallet (a great benefit for the crypto investors that hold assets for medium to long periods of time). Traders will love bitoftrade for the famous TradingView price charts and limit orders that are so rare on non-custodial exchanges. More experienced users will enjoy one of the most lucrative ways of profiting with crypto — leverage trading. bitoftrade is about trading crypto that you actually own. All made possible with no registration or KYC required!

Join the horde of crypto traders without involving the unnecessary risks while utilizing the full potential of trading instruments! Trade on bitoftrade!