What is inflation?

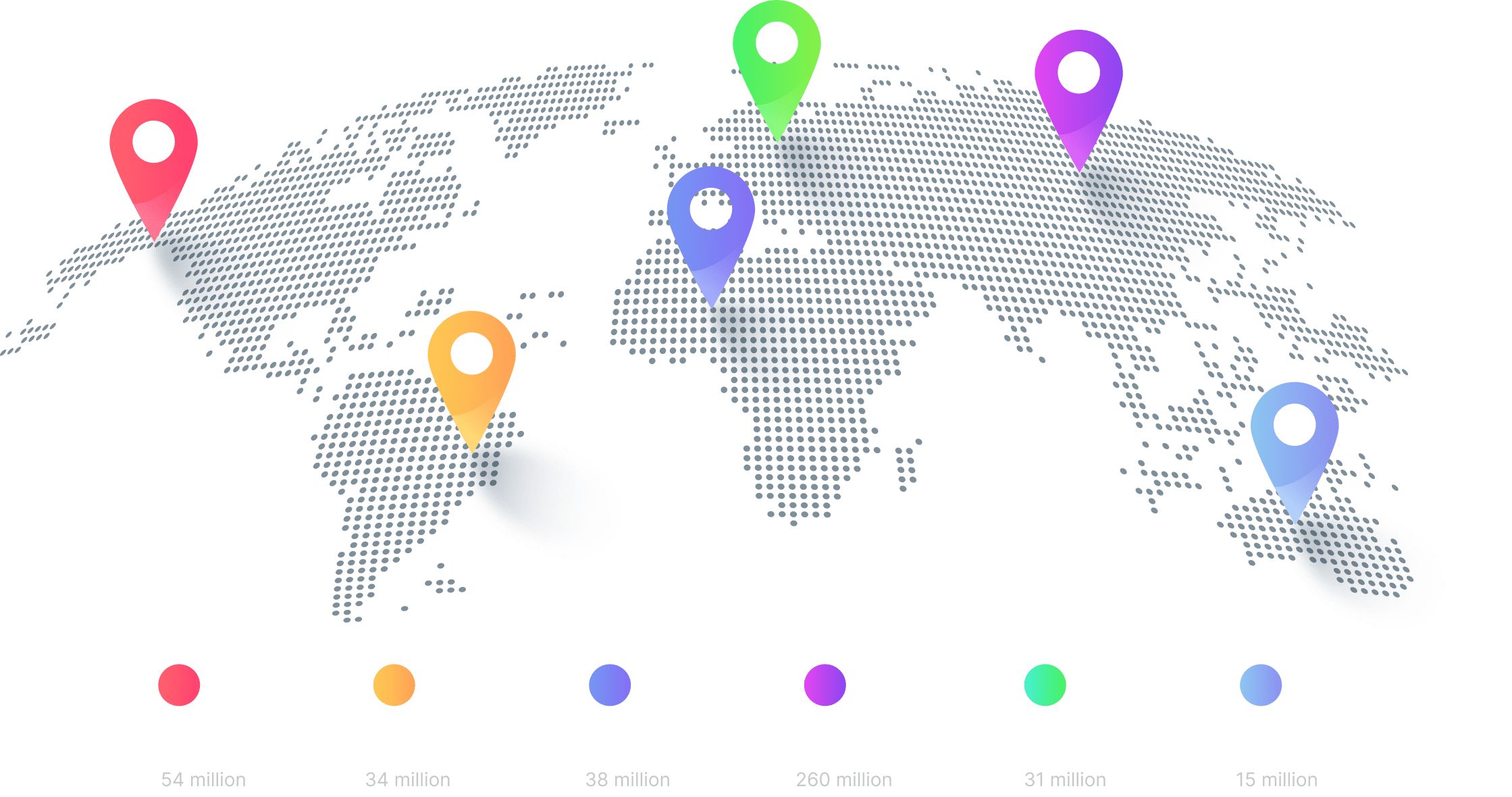

Inflation is a persistent economic issue that affects the purchasing power of fiat currencies. As a result, many investors turn to alternative assets such as cryptocurrencies to protect their wealth. However, the relationship between inflation and crypto is complex and multifaceted. Researchers estimated global crypto ownership rates at 4.2% in 2023, with over 420 million crypto users globally.

This article aims to explore the impact of inflation on crypto market.

Inflation definition

The inflation rate is a rate at which the general level of prices for goods and services rises, and subsequently, the purchasing power of the currency falls. How to calculate inflation rate? It is typically measured by the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services over time. When inflation is high, it can lead to a decrease in the value of a country's currency and an increase in the cost of living for its citizens.

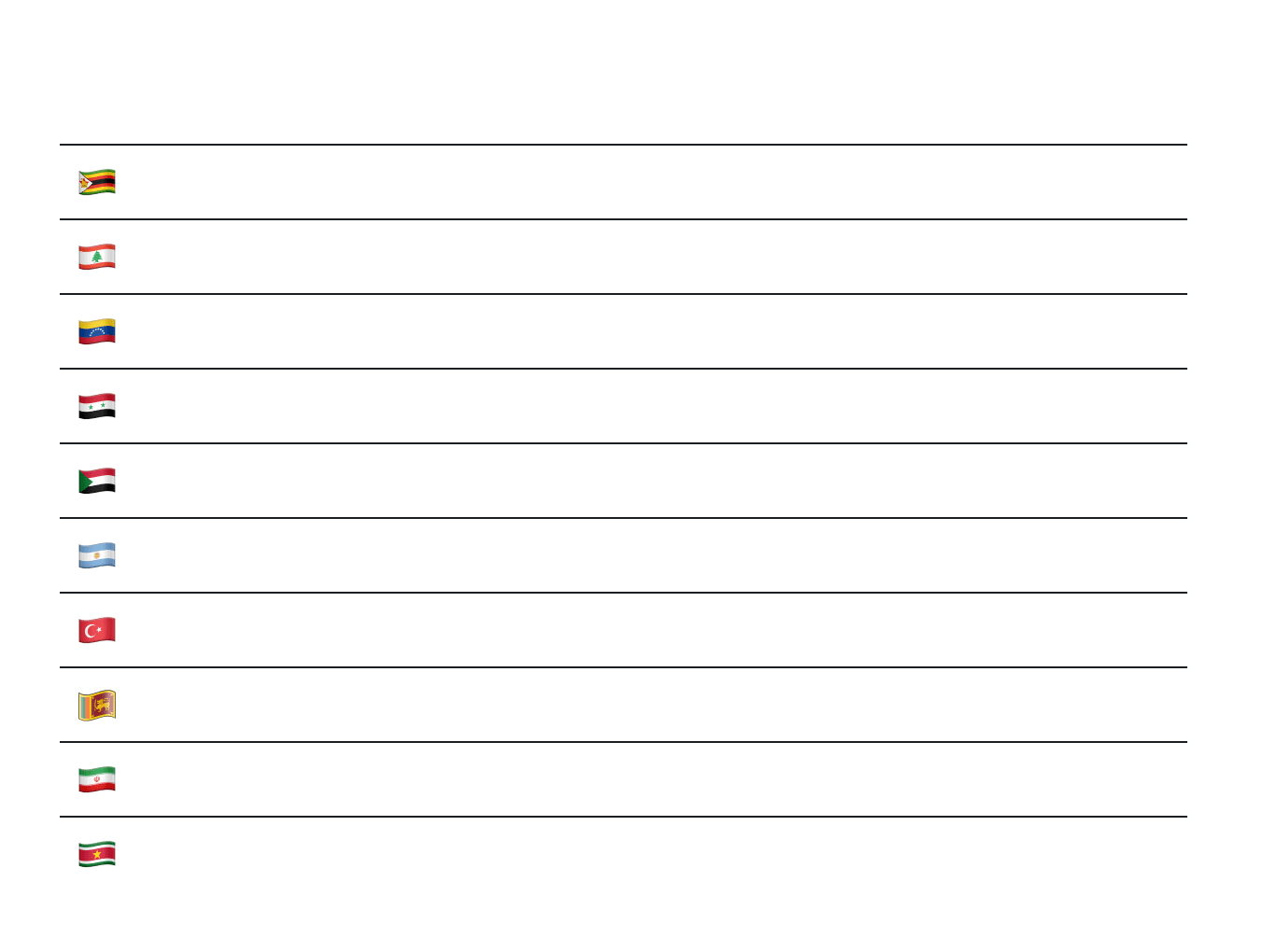

Let's look at examples of countries with the highest inflation:

Inflation can also affect the economy in other ways, such as:

Interest rates: High inflation can lead to an increase in interest rates as central banks try to control inflation by tightening monetary policy. This can affect borrowing and lending rates, making it more expensive for businesses and individuals to borrow money.

Investment: High inflation can discourage investment as it makes it difficult for businesses to plan and make long-term investments.

Savings: Inflation can erode the value of savings over time, as the purchasing power of money decreases. This can be particularly challenging for retirees or those on fixed incomes.

Trade: High inflation can make a country's exports more expensive, reducing demand for them in other countries. It can also make imports cheaper, which can increase demand for them in the domestic market.

Political stability: High inflation can lead to social and political unrest as citizens become frustrated with rising prices and decreased purchasing power. This can ultimately impact the stability of the government and the country as a whole.

The Relationship between Inflation and Crypto

Is crypto currency subject to inflation? The answer to this question is yes and no, depending on the type of cryptocurrency in question. Crypto as a hedge against inflation can be used if it has a fixed supply and is not subject to inflationary pressures like fiat currencies.

Inflation erodes the purchasing power of fiat currencies over time, as the value of money decreases and prices of goods and services increase. This can lead investors to seek alternative stores of value that are not subject to inflationary pressures, such as cryptocurrencies.

Cryptocurrencies, such as Bitcoin, have a fixed supply and, unlike fiat currencies, are not vulnerable to inflationary trends. As a result, their value may become more stable over time, making them an appealing store of value for investors.

BTC is inflationary since new coins are constantly mined and added to the supply. However, disinflationary regulations such as halving, reduce price inflation steadily.

One vital component of establishing an inflation-resistant store of value is scarcity. The mining incentive will fall to 3.125 bitcoin in 2024, then half again every four years until all bitcoin is mined. This mechanism is known as halving, built into the Bitcoin protocol.

The Bitcoin halving mechanism is a process that occurs every four years in which the reward for mining a new block is lowered by 50 percent. This reduces the amount of newly minted Bitcoin that miners receive as a reward for their efforts by half. The halving mechanism's goal is to steadily lower Bitcoin supply over time.

The Bitcoinist predicted that by the moment the last coin is mined, bitcoin could be valued between $17.14 million and $21.1 million.

Ethereum is a different story. The adoption of Proof-of-Stake (PoS) and its growing utility point to ETH experiencing a deflationary trend.

Ether serves as currency for transactions and as a reward for validators. The total amount of ETH has no fixed limit, although the rate of coin production is planned to slow over time.

Prior to the Merge, the yearly issuance rate of ETH was around 5%, which meant the circulating supply of ETH rose by this amount every year. However, the switch to PoS resulted in less ETH being issued as rewards to validators, potentially leading to ETH turning into a deflationary currency.

Because more developers begin to build dApps on Ethereum blockchain, the demand for ETH is expected to increase, boosting its price.

As a result, investors may turn to cryptocurrencies as a hedge against inflation, driving up demand for these assets. This increased demand can lead to an increase in cryptocurrency prices, as well as increased adoption and usage of cryptocurrencies as a means of payment and store of value.

However, Bitcoin price dropped significantly during the COVID-19-induced stock market breakdown that began in February 2020 and lasted until April 2020. However, beginning in October 2020, bitcoin prices began to rise drastically and ultimately reached a record-breaking high.

In the past few years, Bitcoin has begun to move in lockstep with other major categories of assets like stocks. Whenever central governments and financial institutions take steps to curb inflation, most assets suffer and lose value, and numerous cryptocurrencies have recently not been an exception. But still, some cryptocurrencies, such as Bitcoin, have characteristics that should make them less susceptible to inflation in the long run, such as scarcity, ease of transfer, and immunity from inflation's direct influence by governments.

Crypto during inflation

The outlook for inflation is uncertain, as it depends on a variety of factors such as government policies, economic growth, and global events. However, many experts believe that inflation is likely to continue to rise in the coming years.

Interest rates and government policies can have a significant impact on inflation and the demand for cryptocurrencies.

When interest rates are low, it can encourage borrowing and spending, which can lead to higher inflation. On the other hand, when interest rates are high, it can discourage borrowing and spending, which can lead to lower inflation. This can also impact the demand for cryptocurrencies, as higher interest rates may make traditional investments more attractive, while lower interest rates may drive investors towards alternative assets like cryptocurrencies.

Government policies can also impact inflation and the demand for cryptocurrencies. For example, if a government increases spending or prints more money, it can lead to higher inflation. This can drive demand for cryptocurrencies as a hedge against inflation. Additionally, if a government imposes regulations on cryptocurrencies or restricts their use, it can impact the demand for cryptocurrencies in that particular jurisdiction.

Overall, macroeconomic factors such as interest rates and government policies can have a significant impact on inflation and the demand for cryptocurrencies, and investors should closely monitor these factors when making investment decisions.

Cryptocurrencies do not experience inflation in the traditional sense, as their supply is typically fixed or limited. For example, Bitcoin has a maximum supply of 21 million coins. This means that there will never be more than 21 million bitcoins in circulation, which makes it immune to the effects of inflation caused by increasing the money supply. The mining process will still continue, but miners will rely solely on transaction fees for their income instead of receiving new bitcoins. It is also possible that the value of bitcoin will continue to increase due to its limited supply, making it an asset for investors and users alike.

However, the value of cryptocurrencies can still be impacted by inflationary pressures in the broader economy, as investors may turn to cryptocurrencies as a hedge against inflation. Some cryptocurrencies may experience inflation through mechanisms such as staking rewards or mining rewards, where new coins are created and distributed to users who participate in maintaining the network.

The difference between deflationary and inflationary crypto?

The monetary structure and supply dynamics associated with inflationary and deflationary cryptocurrencies vary. These distinctions have important implications for every kind of cryptocurrency's utilization and price.

Tokenomics can affect the worth as well as utilization of both deflationary and inflationary cryptocurrencies. Typically, deflationary cryptocurrencies have an established total coin supply limitation, resulting in higher prices as time passes. Inflationary cryptocurrencies sometimes have a variable coin production rate, potentially reducing purchasing power as time goes by.

Deflationary cryptocurrencies may be used to hedge against inflation, hyperinflation, and stagflation, maintaining value over time. Inflationary pressures produced by external causes such as government policy or economic events can be mitigated by a declining token supply.

Remember: cryptocurrencies are still a relatively new and volatile asset class, and their value can be affected by a range of factors, including market sentiment, regulatory changes, and technological developments. As a result, investing in cryptocurrencies carries significant risks and should be approached with caution.

Conclusion:

In conclusion, understanding the relationship between inflation and cryptocurrencies is essential for investors looking to protect their portfolios against inflationary pressures. Cryptocurrencies, such as Bitcoin, have been touted as a potential hedge against inflation due to their limited supply and decentralized nature.

However, it's crucial to carefully consider portfolio allocation and take a long-term approach when investing in cryptocurrencies or any asset class. By staying informed, keeping emotions in check, and diversifying investments, investors can navigate the impact of inflation on the cryptocurrency market and protect their wealth for the long term.

bitoftrade attempts to keep up with all the latest crypto and blockchain news. Check out more articles in the Blog, and don't miss to see our new great products:

Cross-Chain Messaging Protocol

Follow our social media to stay up to date with the latest all-in-one bitoftrade platform news: