Imagine a world where you can trade more cryptocurrency than you actually have — now stop dreaming! It’s really thanks to the wonders of margin and leverage.

Leverage and margin trading have gained extreme popularity among cryptocurrency traders as they unveil more profit opportunities than the regular trading instruments and strategies could ever provide.

Even though these two terms are closely interconnected, they are not interchangeable.

Not being able to differentiate them can cause some confusion - the last thing that you need when getting started with already complex trading tactics.

In this article, we will help you separate these two terms as we walk you through each concept independently.

What to Know About Margin Trading

Margin trading is the process of acquiring a loan from a broker using an individual's capital to potentially amplify trading results.

Let’s say you have 100$ on your trading account and you are willing to buy 500$ worth of cryptocurrency. You approach a broker who lends you 400$ for your position. In this scenario 100$ is the margin.

Margin, aka initial investment, is the amount of money that the broker is taking out of your account and setting aside as the collateral on the trades you take.

Margin trading crypto can be used for opening both short and long positions. Short selling on margin refers to the assumption that the price will fall down and you will profit from a drop in pricing, while long buying on margin means that you think the price will rise and you will benefit from the bullish market.

When trading on margin, you have to open a margin account. Though margin accounts come with higher risks than cash accounts - since you are not trading with your funds only - they are inevitable when borrowing assets.

When comparing margin account vs cash account, a margin account is extremely beneficial for professional traders who use it to maximize profits both on the long side and short side. When used correctly, you can fully maximize your buying power and take advantage of the market volatility.

But when used incorrectly, or if the trader disregards risk management, he/she can lose their entire investment due to a margin call - no rush, we will get there in a moment.

How Does Margin Trading Work?

It all starts when a trader creates a margin account, which enables trading on margin and utilizing leverage.

Margin trading allows to open larger positions by using a smaller amount of funds as collateral, this is also known as using leverage. The collateral will be segregated in the broker’s account during the borrower’s trade - he or she will get it back regardless of whether they win or lose the trade.

If you are lucky enough to close your position with a good outcome - congratulations on your multiplied profit! However, when a margin deal goes unfavorably, you are required to answer what’s called a ‘Margin Call’.

Usually, it's an email or text alert sent to your phone from your broker demanding that you fund additional capital so your position keeps above margin maintenance.

Simply put, margin maintenance is the amount of capital you need in your margin account to keep your trading position afloat. It is, in turn, described as a ratio of initial margin (the price of the position minus loan) to the total value of the position.

That being said, the situation when the total value of the position rises and the initial deposit remains stable - that’s what triggers a margin call. According to FINRA requirements, the maintenance margin is presently fixed at 25% of the entire value of the assets in a margin account.

So, moving back to the margin call, to respond to it, the one should:

- Either fund at least an additional sum of money to the balance, to stay above the margin maintenance.

- Sell part of the asset position for a loss.

- If the trader does not act fast to respond to the margin call, the broker may liquidate the entire position. Liquidation ensures that the broker will get their original loan back.

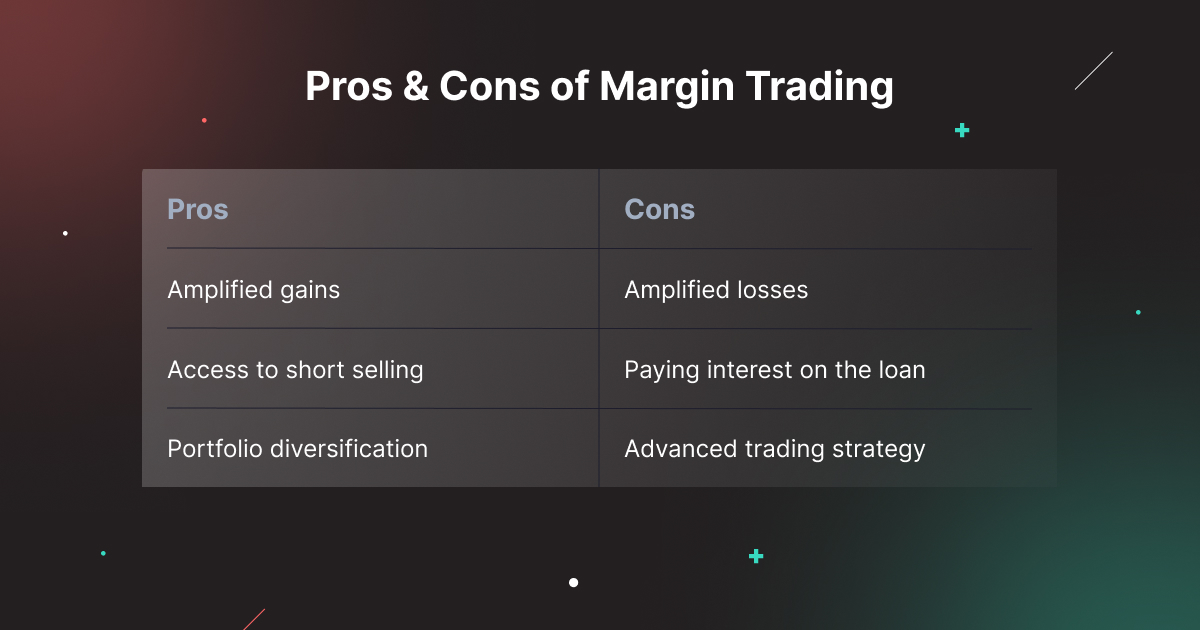

Pros and Cons of Margin Trading

As mentioned before, leveraging crypto assets is riskier than trading stocks or commodities, because of their extremely volatile nature. At this point, you have to weigh up all the positive and negative aspects of trading on margin.

Pros

- The most significant advantage of margin trading is that you get a chance to gain multiplied profits by managing more securities or assets than you could afford with the regular strategy.

- With margin trading, you boost your buying power, so you can afford to control more assets than you actually own.

- Margin gives traders more investing options. It may be tough to establish a diverse portfolio trading with a cash account.

Cons

- Trading with borrowed capital is double risky. There is no guarantee that the trade won’t go against you and you won’t experience a decrease in your balance to a negative one.

- Greater returns also come with the risk of facing greater losses.

- Another underestimated downside of buying on margin is that you will be required to pay interest on your borrowing.

Image: Table-comparison

Image: Table-comparison

The Definition of Leverage Trading

Leverage trading is a trading concept that anticipates investments with the help of a third party’s capital. Unlike regular trading strategies with your own limited resources, leverage trading allows you to access and control larger sums of assets, provided by a broker.

Leverage trading is generally described as a ratio - 1:2, 1:10, and so forth - or in the “X” format (Leverage level) - 2X, 10X, and the list goes on.

With the use of leverage, every trader can rack up some pretty serious gains even with a small initial investment. At the same time, the risk for loss is amplified too.

When talking specifically about leverage trading crypto, traders are controlling large positions (both short and long) in the highly volatile cryptocurrency market. In this case, the funds borrowed can be provided by other traders or cryptocurrency exchanges.

Nowadays, trading with leverage is mostly associated with futures.

Unlike margin deals that take place in the spot market, futures are traded in the futures market simply representing a contract — an agreement to buy or sell underlying cryptocurrency at the predetermined price in the future.

Traders take advantage of market fluctuations and benefit from shorting or longing futures contracts.

Just like margin trading, trading futures contracts allow investors to increase their outcomes by using leverage.

The Difference Between Leverage and Margin Trading

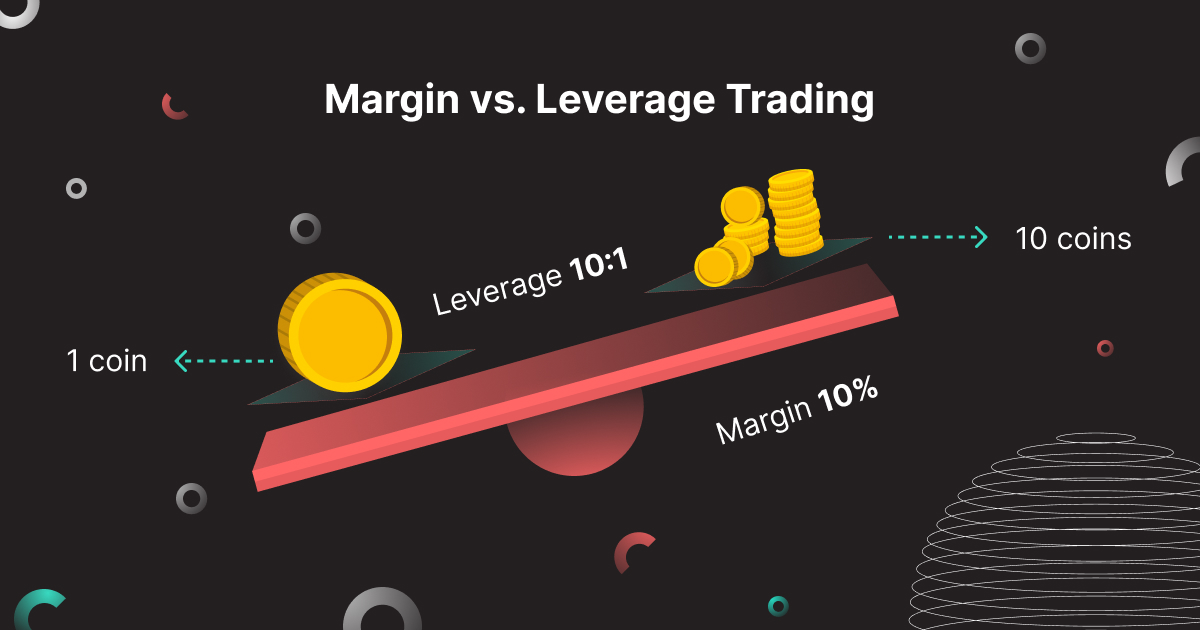

While some may find these two terms interchangeable, which is true in some way, there are 2 crucial distinctions between them.

- First of all, the major difference between cryptocurrency margin trading and trading crypto with leverage lies in how these two are expressed. Leverage is always represented by a ratio or “X” terminology, whereas margin trading is denoted as a percentage.

- Second of all, leverage trading does not necessarily mean trading on margin, but from the perspective of trading on margin - it is implied that leverage is used. Trading with borrowed capital involved can also come from a future product or a call option, for instance.

In short, when comparing margin vs leverage, leverage trading is the broader concept and encompasses margin trading as well as options and futures.

How to Trade With Leverage on bitoftrade

Leverage trading by itself is not what’s doing the damage to most cryptocurrency traders - the reason why they fail is the lack of risk management, not following trading alerts, and neglecting the use of stop limits. Here we gathered a few tips paired with advantages of trading with leverage on bitoftrade:

Stop Loss & Take Profit Orders

So before jumping right into crypto leverage trading hoping for quick and large profits, you have to understand and subsequently consider using a concept of crypto stop loss and take profit orders. Setting a stop loss order on the position enables it to be sold automatically once the price level falls down to a specific level. Take profit order works backward - your position will be sold once hit a specific price level. Stop loss and take profit orders are gaining appreciation from traders that want an extra protective measure to their risk management strategy. If you feel like this feature is a must, please submit it here and let our team know what our potential users' demands are.

Losing more money than your initial investment

The reason why trading crypto with leverage on bitoftrade is beneficial as while you have full control over opening and closing positions, we help you keep an eye on the investment’s performance, so you won’t lose all the initial margin if the market moves in the direction you do not want it to. In case the price of your leverage deal experiences a drastic drop and you lose more than 80% of your collateral, the position will be closed automatically and the remaining 20% will be sent back to your wallet (minus costs). bitoftrade’s upcoming alert feature will instantly deliver important information regarding the performance of your investment so you won’t risk losing trading opportunities.

Start Small

If you're just starting and experimenting with leverage trading there's no reason to expose your whole account and there's no reason to go greater than even two times leverage. It’s safer and you don’t risk disaster - total win-win. And then, as you do better and learn more, you can increase your trade sizes as your confidence and your account grow.

Moral of the story: just like with any other trading tool, leverage trading requires a proper risk management strategy and previously made market research. No matter how sure you are, keep in mind that every trade can go against you.

When used correctly, leverage crypto trading turns out to be a profitable trading strategy. You can see it yourself once you try leverage trading on bitoftrade.

Trading with borrowed assets on bitoftrade means trading crypto anonymously and extra safely with up to 20 leverage.

You don't need identification, a job, a credit rating or any other formalities of such an investment - all you need is a phone, internet connection and the money.

With bitoftrade, leverage cryptocurrency trading is becoming accessible like never before! Manage your positions effortlessly with our user-friendly intuitive interface and with no hidden fees.

Unlike centralized cryptocurrency exchanges, that charge fees for practically every transaction, bitoftrade charge only gas fees and the fees of the system.

Image: Table-comparison

Comparison of fees the user will have to pay when executing a leveraged deal on bitoftrade vs. other DEXes:

- Fees (Maker/Taker) - 0.40%/0.40%

- Interest rate

- Opening fee - 0,01 - 0,02%

- Rollover fee - 0,01 - 0.02% per 4 hours+

- Fees (Maker/Taker) - 0.16%/0.26%

- 0.05% USDC for opening a position

- 0.05% USDC for closing the position

- Gas fees

- Charge on Bitfinex Borrow Funding Recipients - Order Execution “Maker Fees” 0.1% will be charged twice:

- first upon depositing collateral to Bitfinex Borrow

- again upon returning borrowed funds and obtaining a return of the collateral.

- Charge on fees collected by Bitfinex Borrow Funding Providers - 15% - 18% (of the fees generated by active Bitfinex Borrow loans)

Let’s review the steps on how to place a leveraged order:

- To get started with leveraged deals, you have to choose the level of leverage and the token pair.

- Once you provide a collateral and open a leveraged position, you pay gas fees only.

- Your order will then be processed through the dYdX protocol, where you will be charged up to 0.05% for opening a position + gas fees in ETH. and you will view it as an open position in your transaction history.

- Here you have 2 scenarios:

- You can close the position any moment you want and receive the profit and collateral back to the wallet - minus gas fees costs (in USDC) and an additional 0.05% for closing fees.

- Your order experiences a liquidation and our system closes it automatically - in this case, you get your remaining collateral back to the wallet + pay gas fees and an additional 1% to the dYdX liquidator.

A quick reminder - there is no withdrawal fee on our platform since all the assets stay in your wallet. Manage your holdings without having to lock them - enjoy all the perks of trading on DEX.

Trading with leverage without identification and KYC is not a myth anymore. Back in the day, trading derivatives and margin has been solely associated with centralized exchanges as the one and only way ever existing. bitoftrade is a revolutionary anonymous cryptocurrency exchange that makes the art of leverage trading accessible like never before. We are here to retain the core value of the crypto market, which is decentralization. Our team aims to break down such a complex subject as leverage trading and explain it to the public clearly, so the strategy itself won’t remain closed for the traders not having tons of experience behind them.

Go ahead - select a trading pair and leverage level and try out leverage trading yourself!