Stablecoins play an essential role within the crypto ecosystem. One and all who have already dealt with cryptocurrency have come across them. There are many stablecoins, and new ones come out literally daily.

Today we will focus on two of the most famous heavyweights — USDT vs USDC — which compete for the title of the best stablecoin in the crypto market. Of course, both have their history, similarities, and differences. But which stablecoin, USDC or USDT, is a better investment? Which stable is safer to hold?

We'll answer these questions focusing on the main characteristics to make sure you understand both the drawbacks and the benefits of USDC and USDT.

But keep in mind that this article is made for educational purposes only; it’s not financial advice or FUD. Anything you do outside of this article is on you. We at bitoftrade only attempt to share information that will help you make the most balanced decisions.

Stick around, as now we’ll break out each point of the USDC vs. USDT and find out all the commonalities and differences.

What is the Difference Between USDT and USDC?

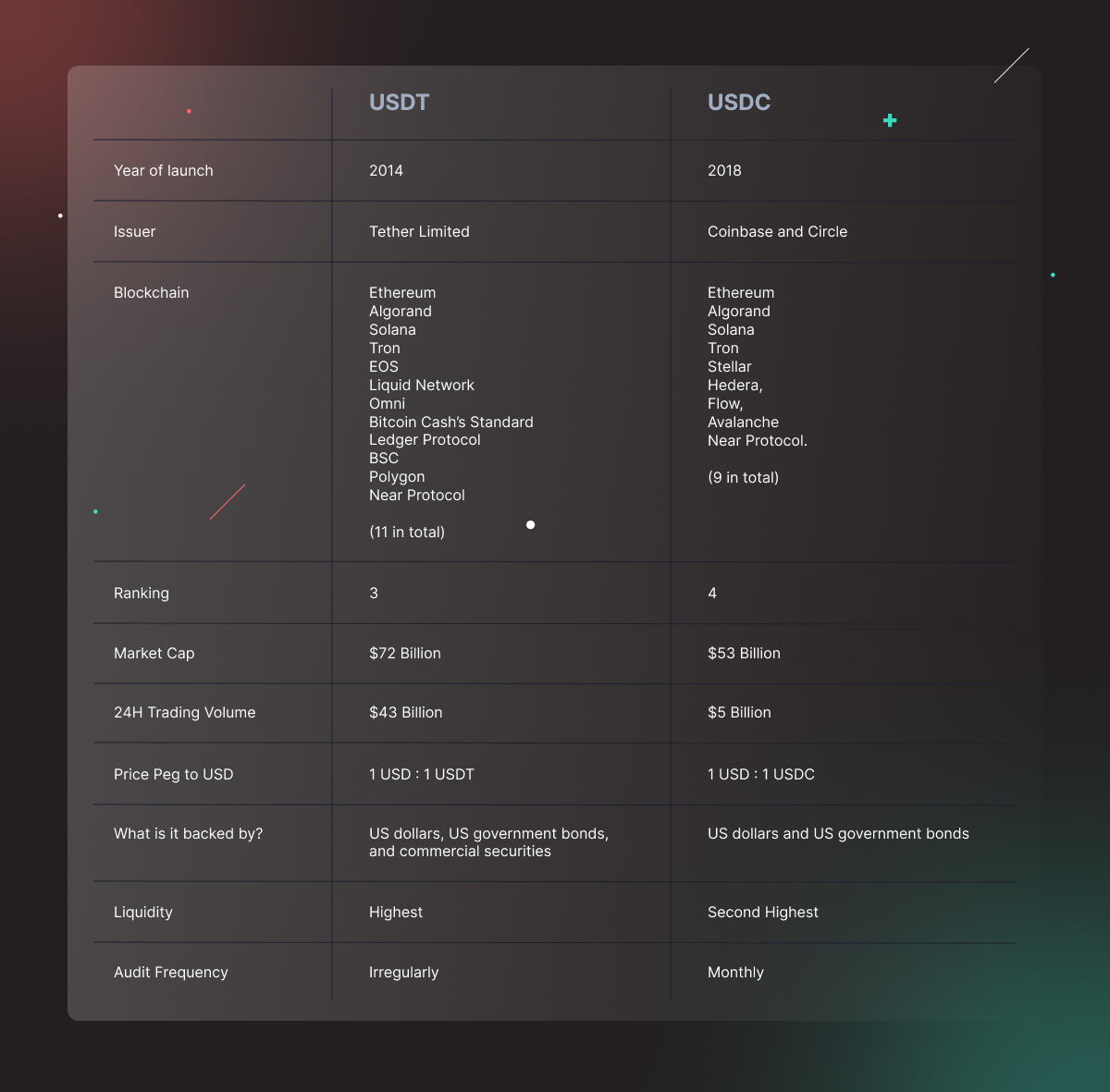

This comparison table should give you a better idea of the difference between USDT and USDC.

Keep reading to learn the basics of stablecoins first.

What Is a Stable Coin in Crypto?

Cryptocurrencies have always been extremely volatile. Even Bitcoin, with its $570B market capitalization, experiences price fluctuations. The value of digital assets can swing by tens of percent in a week or even a day. This colossal problem prevents the use of crypto for day-to-day payments.

However, stablecoins solve this issue and maintain fixed prices. The purpose of stablecoin is to combat price swings and help both investors and holders remain in the ecosystem at a much lower risk.

Stablecoins are pegged to more stable assets or currencies like the US dollar, and traders use them to hedge or mitigate risks. In general, there are three groups of them:

fiat-backed stablecoins

crypto-backed stablecoins

algorithmic

USD Coin (USDC) and Tether (USDT) are leading stablecoins, backed by the fiat US dollar. They are available on nearly every crypto exchange, wallet, and app. Let’s dig into them individually to highlight all their features, benefits, and maybe even some risks. First, we’ll start with the USDT review.

The Meaning of USDT (Tether)

Tether (USDT) is the first, most popular, largest, and most liquid stablecoin in the cryptocurrency market. It’s pegged to the US dollar, US government bonds, and commercial securities. No one stablecoin represents such a variety of trading pairs as USDT does.

Stablecoin USDT was introduced to the market in 2014 when entrepreneur Reeve Collins, BTC investor Brooke Pierce, and developer Craig Sellers founded a project named Realcoin. Their goal was to create an asset that combines the advantages of fiat and crypto and bridges them both. This combination is how the blockchain version of the fiat dollar appeared.

After the launch, USDT, the creators rebranded USDT to Tether, and the coin got listed on the exchange Bitfinex. By the way, as it turned out later, Tezer Limited is a subsidiary of Tezer Holding Ltd., which two leading executives of Bitfinex founded, so they are closely connected.

As we already mentioned, Tether (USDT) is pegged at 1-to-1 US dollar, which means the company issues 1 USDT for 1 fiat dollar, which is treasured up in the corporate vault. As a result, USDT has low volatility and is entirely unaffected by the price of Bitcoin.

The Tether Limited company claims that Tether reserves fully back tokens. In 2021, the auditing firm Moore Cayman confirmed USDT's 100% asset backing. However, it turned out that the share of cash and bank deposits in the reserves was only 10%, and 49% of the reserves consisted of commercial securities. Tether CTO Paolo Ardoino noted that this reserve structure allows the business to rapidly satisfy its USDT redemption obligations and that "in the worst-case situation, Tether just shrinks." Well, let's see, as long as we move on.

USDT Volume

With a market cap of $72 billion, USDT sits in 3rd in terms of market cap in the whole crypto space, behind two top dogs — Bitcoin and Ethereum. However, it is the most traded coin, with unequaled liquidity and a trading volume of $50.2 billion in the last 24 hours.

USDT volume chart.

USDT volume chart.

USDT Blockchains

Tether doesn't have its own blockchain. Instead, it's secured by hashing algorithms and operates as a second layer token on top of other blockchains.

Initially, USDT was run on the Omni Protocol, which is built on the blockchain of Bitcoin, but now it’s expanded to multiple blockchains and offers easy integration and adoption.

Here is the list of all supported blockchains:

- Ethereum

- Algorand

- Solana

- Tron

- EOS

- Liquid Network

- Omni

- Bitcoin Cash

- Binance Smart Chain (BSC)

- Polygon

- Near Protocol.

Is USDT Safe and Stable?

How safe is USDT? This question comes up all the time, and it's not surprising. So let's look at all the facts.

USDT is the most liquid stablecoin, with a market value of $74 billion, making it one of the strongest competitors for the safest stablecoin award. Tether is considered 100% backed and fully transparent. As a result, these tokens are one of the most transacted, used, and adopted ones.

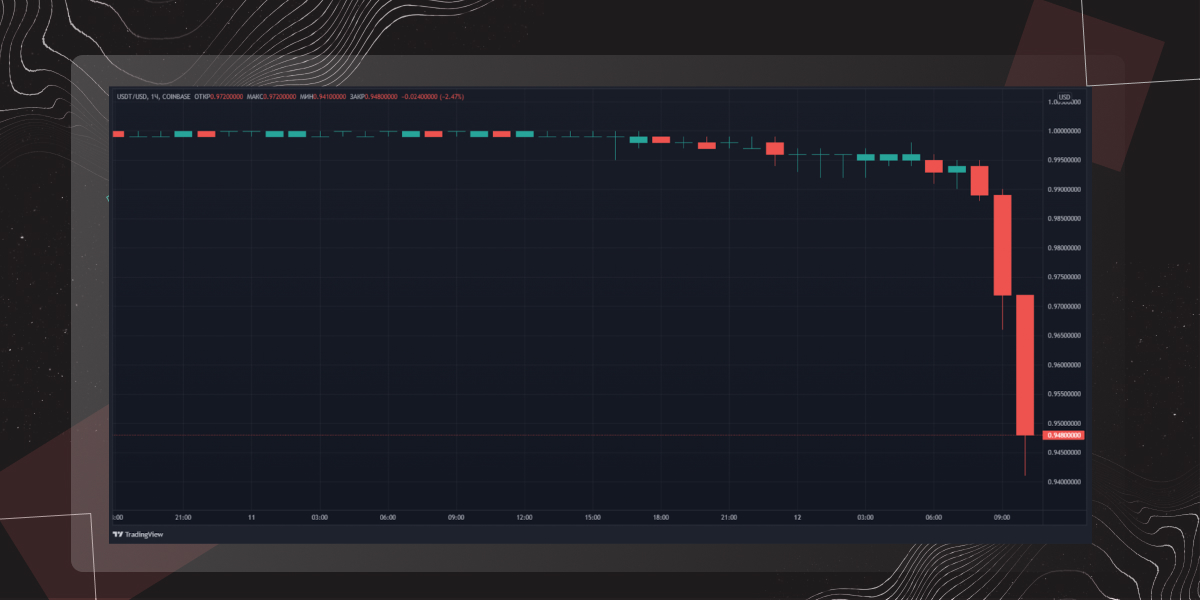

However, on May 12th, a slight depeg from the US dollar shook some investors' faith in the USDT stability and led them to examine the safety of this so-called stable asset.

Against the backdrop of crypto market turbulence, the stablecoin USDT price tested the $0.94 level. The retest likely means that a whale has left the game, but Tezer was quick to respond. Paolo Ardoino said that the company's reserves are enough to buy back all assets at a ratio of 1:1 to the USD. Moreover, he recalled that you can feel free to exchange your assets for a 1:1 ratio via the tether.to portal. Sounds great right? WRONG! The minimum exchange amount is $100,000. So it really only protects those that can afford to lose anyway.

And that’s the crux of the matter! Do you guys have $100K to swap them 1:1 for US dollars? Unlikely! Ardoino claimed “>300M redeemed in the last 24h without a sweat drop”, but considering the $100k statement, this is only 3000 people who were let fear rule them. This is embarrassing and suggests the idea that USDT can repeat the UST bumpy ride.

Another point that may raise suspicion is that the US government has already made claims against Tezer, accusing it of lacking reserves and promoting money laundering. It proves that the regulator is on alert and intently watching. However, Tezer has successfully proven its stability and confirmed 100% asset backing. So let's keep calm and keep reading.

Is USDT A Good Investment?

This asset is perceived as the main stable of the industry by default. USDT is the most adopted in the whole crypto space and has many uses, including staking, farming, AMM, and even a means of payment.

Since it is a stablecoin pegged to the USD, its value should be $1. That's the main point of stablecoin—it aims to be a stable store of value and be as secure as dollars in your piggy bank. This stability is the main reason why the USDT tends to be a rather non-risky investment compared with other digital assets, even if one considers the brief depeg on May 12th and commercial securities backing.

However, you need to do your own research before making a final decision. Last but not least, always keep in mind the golden rule of investments: never invest more money than you can afford to lose.

When we are done with the Tether (USDT) review, let’s move on to the USDC crypto meaning.

USD Coin (USDC) Meaning

The next stablecoin that we'll take a look at is USDC, which is breathing down the USDT’s neck but has not yet surpassed it in terms of market cap. USDC is an ERC-20 utility token supported by most crypto exchanges, so there should be no problem buying or selling it.

A USD Coin is another cryptocurrency whose price is rigidly pegged to the US dollar. The first coins were issued in October 2018 by three companies: Circle (Circle Internet Financial), Coinbase, and Center Consortium. They didn’t bother with developing their own blockchain and used Ethereum.

What is the purpose of USD Coin? The answer is simple: to increase the safety of investors, reduce trading risks, and make it possible to pay in a stable asset.

As for the security of the USD Coin, the issuer assures that this part is in full order. USDC focuses on increased security, transaction transparency, and lower volatility and is fully backed both by US dollars and US government bonds. Check out the proofs. This inspires confidence in the project.

USDC Volume

USDC is the fourth most valuable currency in terms of market cap. It is just behind Tether because of its lower value of $53.5 billion. The USDC's 24-hour trade volume is $5 billion, which is significantly lower than the trading volume of Tether. However, the coin is rightfully competing for the title of the top stablecoin and may even win that race.

USDC trading volume chart.

USDC trading volume chart.

USDC Blockchains

Same as Tether, USDC doesn’t have its own blockchain and was initially launched on Ethereum for smart contract creation. It has now spread to the world's leading blockchain networks.

Here is the list of USDT supported blockchains:

- Ethereum

- Algorand

- Solana

- Tron

- Stellar

- Hedera,

- Flow,

- Avalanche

- Near Protocol.

Is USDC Safe and Stable?

USDC is frequently referred to as a safer stablecoin than USDT since the Centre goes to extraordinary lengths to comply with audits and regulations and has more visible fully-backed reserves. But, initially, it was created by American companies and the American people, so there are stricter regulatory requirements for it and its linked companies.

The USDC stablecoin price remains stable at around $1, and this value has remained almost completely flat year to date. The lowest price of USDС was $0.995. It's a slight and, we believe, an acceptable dip below its USD peg.

The primary risk of USDC is that one of the USDC managing companies may go bankrupt. The rest doesn't raise any suspicions or doubts.

Is USD Coin A Good Investment?

Since USDC is a stablecoin, investing in it will not bring fast and big profits or returns, but you can get staking rewards at 5 – 10% APY, which is not bad.

The advantage of this crypto is more related to its use and is rather non-risky to invest in. USDC aims to offer stable crypto and help transfer currency quickly and cost-effectively by eliminating the need for intermediaries such as banks.

Do your own research to answer the question that pops up in your head, "Should I invest in USDC?" but again, invest no more than you are willing to lose.

USDC vs USDT Fees

No matter if you swap, trade, or store tokens, to perform any transactions on any crypto network, you'll probably need to pay fees.

Because USDT and USDC are available on multiple blockchains fees which are different and dynamic, we recommend that you clarify the current USDT vs USDC fees and activities in the four commonS at the moment of a transaction:

Final Thoughts

So, which crypto USDT vs USDC is better to invest in? It really depends on what you are looking for. Weigh all the pros and cons to make your own decision. In general, there is one thing that we would definitely not advise:

- Don't put all your eggs in one basket.

- Keep in mind the Terra case, which clearly showed us the importance of diversifying portfolios.

- Split your capital among several stablecoins, and trade with a trusted exchange like bitoftrade to protect yourself from losses.

Our platform, bitoftrade, allows you to take advantage of CEX benefits while maintaining your anonymity and trading without intermediaries. bitoftrade covers all the most wanted functions, skipping the KYC process. In addition, users can use a wide range of best trading tools and features, including limit orders and leverage trading, to buy, sell, and swap crypto, keeping it securely in their crypto wallet.

Connect your wallet and experience all the benefits of bitoftrade! If you want to stay in the loop with all things bitoftrade check out all of our community Channels and join in the conversation:

Official bitoftrade Telegram channel

Official bitoftrade Discord channel

Find us on social media!

Find us on LinkedIn

Find us on Twitter

Find us on YouTube