A cryptocurrency market is a marketplace where potential moneymakers get to shape an industry. These characters in the market may contribute to growth in blockchain technology, or they may provide a direct benefit to the decentralized financial system. But, on the flip side, more nefarious characters are known as scammers, or one may come across one of these infamous hyped-up cash grabs, AKA RUGS. So, just like any investment, one must think it through before choosing which crypto to opt into.

All being said, Chainlink is a project promising enough to turn off public skepticism. The technology it brings to the table has been integrated into the DeFi ecosystem so deeply that it has become basically impossible to operate without it! Its token - LINK - has been thriving on the market and even became the 6th currency by capitalization at some point. Still recently it faced a severe dump that created controversy and distrust.

The great question is “To buy or not to buy?” or “Is there still a future for the LINK coin?” In this article, we will try to answer these questions by providing our readers with both technical and fundamental analysis and using it to develop a price prediction for Chainlink. But keep in mind that this piece of content is just a suggestion made by the experts at bitoftrade. We do not hold any liability for our predictions being true.

Now when we are all set, let’s start with the basics.

What is Chainlink, and How Does It Work?

Before long-term investing in any kind of crypto, one must study the project first. Discover what is Chainlink all about. We’ll provide a short outline that would help to better understand how does Chainlink work and what is it about. The project was launched in 2017 by Sergey Nazarov and Steve Ellis, as a blockchain-based decentralized oracle network.

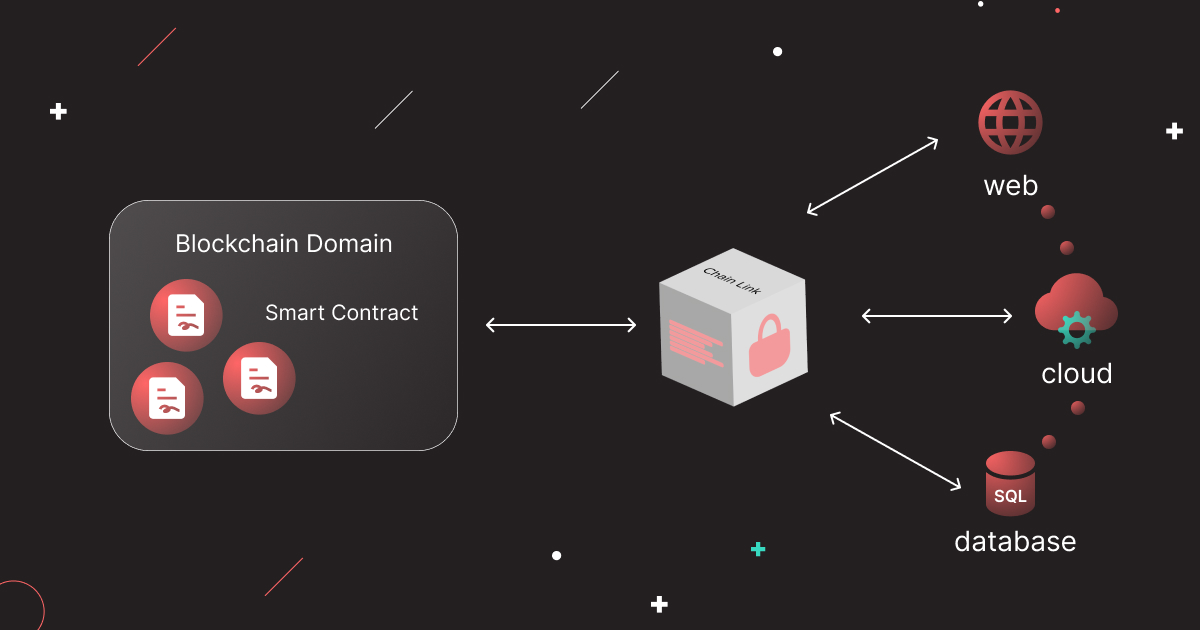

It was and still is one of the leading methods of executing smart contracts off the blockchain using the Oracles, which serve as the bridge between the blockchain and any other external technology.

Now, Chainlink is a company that has a total value secured (TVS) of over US$58B (March 2022) alongside being one of the most crucial technologies in DeFi. The following industry leaders use the Chainlink technologies:

- Amazon

- SWIFT

- Dapps inc

- Matic

- Oracle

- AAVE

- Compound

- and many-many others!

LINK is traded on most of the crypto exchanges but most importantly, on bitoftrade. On our platform, you get the chance to trade from your own MetaMask wallet anonymously while using limit orders or just swaps! So if you have hope for this token, value your privacy, and like to use handy trading tools, don’t waste any more of your time! Buy LINK on bitoftrade.

In a nutshell, Chainlink makes it possible to add a sprinkle of blockchain into any system — starting from video games and finishing with weather forecasting or even other blockchains. All this is made possible with "hybrid smart contracts'', which differentiate Chainlink Oracles from the traditional centralized ones. One may ask how is Chainlink rewarding the Oracle operators in exchange for moving data from or to a blockchain? The answer is simple: LINK tokens. In order to use a smart contract enhanced with a Chainlink node, a company could purchase such an option for LINK tokens. And this is a fundamental factor in building the long-term demand for LINK tokens.

Chainlink token info

If you are feeling suspicious about how we’ve described the project as one of the key parts of DeFi, then don’t. Thus, almost ALL of the DeFi products have a Chainlink integration. It’s the equivalent of a company having an entire human population as clients.

If you are feeling suspicious about how we’ve described the project as one of the key parts of DeFi, then don’t. Thus, almost ALL of the DeFi products have a Chainlink integration. It’s the equivalent of a company having an entire human population as clients.

The Chainlink ecosystem includes AAVE, Synthetix, Celsius, Compound, and many, many others. The company gained such popularity due to the integrations of Chainlink’s technology that allows to:

- Support any data by securely collecting and using it for hybrid smart contracts;

- Support applications that use the RND function (random generation) with verifiable sources;

- Enable automation of tasks and functions for enterprises;

- Enable cross-blockchain operations.

The Chainlink Whales Situation

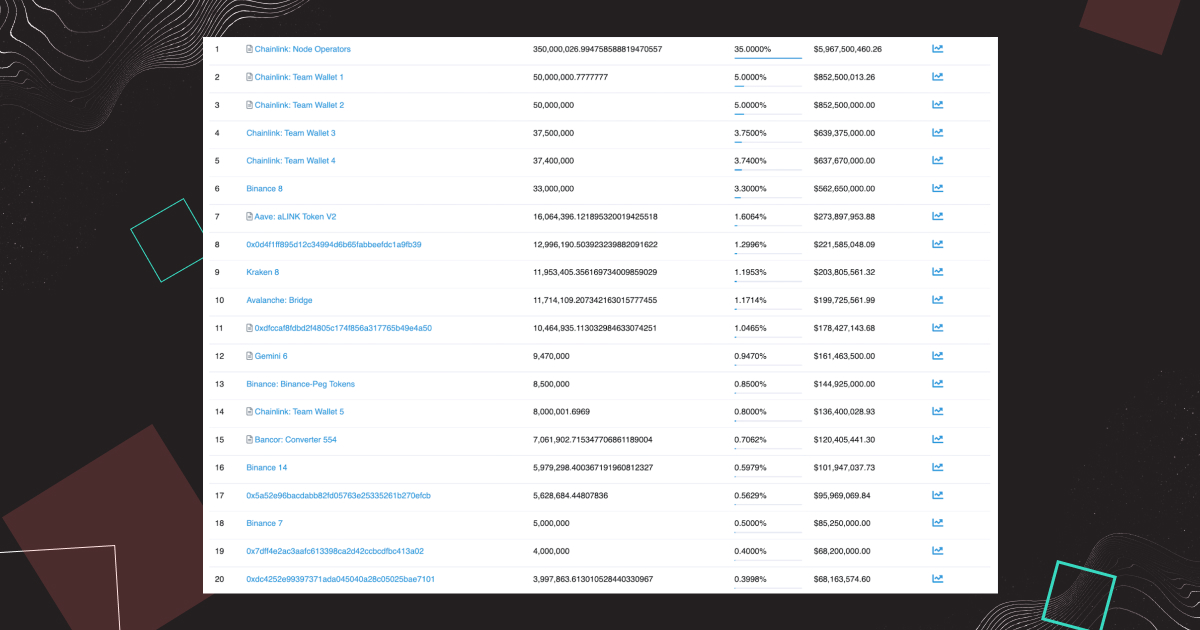

If it’s not your first day in the crypto market, you have to be aware of whales. Yes, those users have enough capital to significantly influence the price of any crypto. So, we’ve checked out LINK on Etherscan to see if there are any whales holding LINK. It turns out that there are some.

Amongst Chainlink team members and crypto exchanges, there are some private wallets that indicate whales. Those whales are real people with tremendous experience in finance, meaning that the big guys trust in the token. LINK whales are holding just the right number of LINK for an investor to be sure of the token, while not being too anxious, as too many whales threaten a retail investor. The whale wallets may unexpectedly dump the price of an asset, causing all of the other LINK connoisseurs to lose profit. Luckily, there are enough teams and exchange wallets to feel safe with the biggest whale investor just holding 1.29%, one holding 1,04% and a few whales holding less than 0.6%, which isn’t critical.

That being said, we are now ready to expand into the technical analysis of LINK to get the full picture of its past price movement to have something to build predictions on. So what is Chainlink's future price going to be? Let’s figure it out!

Technical Analysis of Chainlink

Going back to the charts, one should pay attention to the density of short candles and obvious descending triangle patterns, which could be seen by executing a proper technical analysis of Chainlink. Combined, it may point to price breakouts if the bulls turn back to LINK.

Currently, we can notice an obvious descending wedge, which is a bullish pattern pointing to an upcoming breakout that could result in more than double profit from investments. According to our technical analysis, if a LINK investor buys the token now, he/she may receive from 18% to 77% ROI in about two months.

Chainlink Price History and Analysis

In 2017, a LINK ICO was held by SmartContract.com (Chainlink's mother company), raising $32 million. As a result, LINK was listed on crypto exchanges for roughly $0.13.. Such was the beginning of the Chainlink price history.

In 2017, a LINK ICO was held by SmartContract.com (Chainlink's mother company), raising $32 million. As a result, LINK was listed on crypto exchanges for roughly $0.13.. Such was the beginning of the Chainlink price history.

Long before the hype of DeFi, Chainlink made a strong, promising image and attracted many investors. Only 7 days after listing, it has gone up to $0.50, which means ~ 400% ROI (x4). Unfortunately, the project was not ready for the value to be that high, so the price dropped back to $0.13 and established a strong floor in December, thus proving that it was a legit asset with real technology behind it.

The first two years of theChainlink price history the price of LINK saw a steady decline. After that the price consistently grew cent by cent without sharp speculative spikes.

Chainlink Price in 2019-2021

In 2019, Chainlink's price finally breached $1. Its peak was at $3.7 on the 29th of June, 2019. It happened three days after Bitcoin posted its yearly high of $13,878. LINK has since decoupled from Bitcoin’s price movements, setting a trend of its own, a rare occurrence in the cryptocurrency space.

But it was just the beginning of a long journey and the investors knew it. After the new partnerships with Google Cloud, Polygon Network, and Reserve, the price surged up to $5. Chainlink price in 2020 met a new ATH of $18,79.

New partnerships came to be, as well the continuous price growth. Chainlink price in 2021 started at $11.45 in January 2021, the year of DeFi. Everyone started talking about NFTs and using completely new technologies that were made possible by the Chainlink integrations. It would be fair to say that not only the hype brought LINK to the true ATH - $52,17. This is when just about every crypto project got its serving of off-blockchain smart contracts.

But, as well all remember, the fun of consistent 2021 uptrends ended with a great market correction. It didn’t leave LINK without a great price plunge either lowering it to $20. We can see the price surging above the $30 benchmark in August and November. It hasn’t gone up to such highs ever since.

Currently, LINK is ranked 23 by market capitalization on CoinMarketCap. The price has recovered from the floor of $11 (February, 2nd) and stabilized at $17.

Moreover, Chainlink is about to launch Chainlink 2.0, which means… staking. Staking is famous for putting tokens out from circulation on a free market and locking them, which means lower supply and selling pressure. Also, when deployed in a prominent project of such a size as LINK is ($8 billion market cap), staking is aggressively attracting big investors, which almost guarantees a price surge.

Overall, the asset is quite promising but not without a bunch of problems to be dealt with. The main issue is that the company has reached its limits in terms of client acquisition. In addition, since everyone is using Chainlink, there are not many left to sell the product. As a result, the company has to develop new products and services to move forward. Chainlink has made many promising announcements, but we don't seem to have any precise dates for the moment.

Generally, Chainlink price prediction is rather bullish with a little dash of uncertainty due to no big promises with no substantial dates. The most rational thing to do would be to do the following:

- Monitor the project for the positive news to come;

- Meanwhile, accumulating LINK by small parts via the Dollar-Cost Averaging (DCA) approach in the long run till Chainlink 2.0 is out

- Alternatively, you can speculate on the short-term profit provided by the overall market growth.

Chainlink Partnerships: Who has Chainlink’s Back?

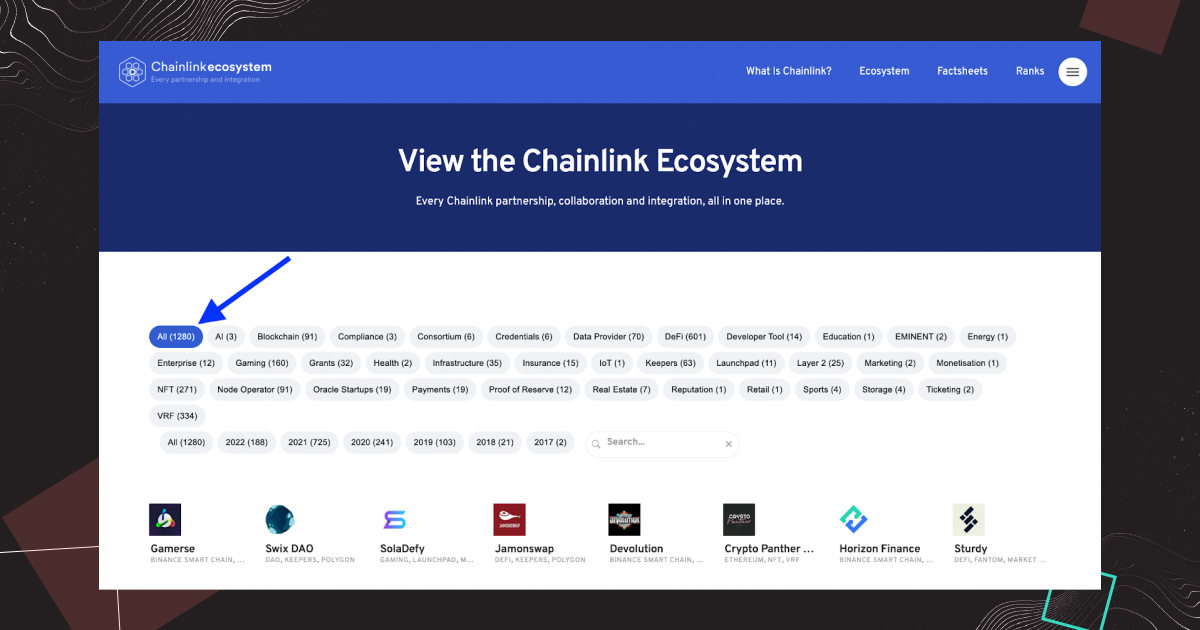

As it had been said earlier, when it comes to partnerships and integrations, Chainlink is the boss. At the time of creating this article, the Chainlink Ecosystem consists of 1280 partners.

In 2017, on the verge of product development, the company was supported by SWIFT, it was the first big name in the long list of Chainlink partnerships. This is what made it possible for SWIFT - The Society for Worldwide Interbank Financial Telecommunication - to connect to various smart contracts on various chains. Among other big off-blockchain Chainlink partnerships there are Google Cloud, Intel, IC3, and Swisscom.

But the main driver of Chainlink’s profile is the gargantuan number of A-class crypto projects that use its services. Here are some of them:

- Dapps Inc.

- Oracle

- Matic

- Polkadot

- Binance

- Curve

- AAVE

- bitofteade

- 1INCH

Chainlink price analysis shows that LINK price is closely related to the number, size, and quality of new projects integrating its technology. As there are not many projects left that actually haven't partnered with Chainlink, the company formally hits the roof. There’s little to nobody to be selling to. What is left is to innovate and create new products. The good news is that Chainlink has been quite busy in that department lately. According to Sergey Nazarov, the company is planning to integrate blockchain technology into the operations of conventional banks. This would mean a huge breakout both for the Chainlink company and the entire crypto industry.

Year by year, blockchain financial solutions are evolving and getting more accessible to the general crowd. Anatoly Yakovenko, the co-founder of Solana, expects "a number of enterprises and banks and various existing players to now want to lose their relationship with customers and users and key institutional clients. I think the world is going to eventually—probably in 2022—realize that there’s this big market called DeFi.”

Global blockchain adoption would be a tremendous opportunity for Chainlink. A new field of clients that would succeed in offering blockchain-related services only through oracles is a window into the great future for Chainlink. Combined with the bullish outcomes of the technical analysis, LINK becomes an excellent option for long-term investments. The only thing left to be sure about the future price movements is news and announcements from the Chainlink team that would totally assure us about what and when would be released.

Chainlink Price Prediction for the Next 5 Years

Chainlink has a background solid enough to be sure of LINK's great growth potential and big future achievements. Meanwhile, we witness significant development and adoption of crypto products worldwide, a considerable contribution to which has been made by Chainlink. But as well as any other crypto asset, long-term LINK price predictions should not be taken for financial advice.

Chainlink (LINK) price prediction 2022

Despite the fact that LINK has obviously lost its momentum at the end of 2021, we can’t say that there’s no way back to the top. Right now, we are seeing a great bullish trend scenario. Both technical and fundamental analyses show that 2022 might be a good year for Chainlink. Some analysts predict that the LINK price may even go above $35 by the end of December 2022.

More positive Chainlink price predictions for 2022 go beyond the $50 benchmark. Of course, it may be considered just speculation until Chainlink starts pulling new integrations and launches Chainlink 2.0.

Chainlink (LINK) price prediction 2023

In the case of a successful 2022, the 2023 Chainlink price prediction has to look positive as well. We can now observe the aggressive digitalization of the world, so it seems reasonable to speculate NFTs and further blockchain integrations to flourish. This would inevitably mean more new projects coming to the crypto industry and, as a result, more Chainlink integrations.

The Chainlink community strongly believes that in 2023, LINK would break the last ATH in case of a failed attempt in 2022. If the relative strength index (RSI) in 2023 stays above 2022, keeping the strong uptrend due to the vast number of new integrations, the price may even reach $120 by the end of the year.

Chainlink (LINK) price prediction 2024

Considering the uncountable variability of possible outcomes, we can’t say that the financial, technological, and competitive landscapes would stay the same. Therefore, it would not be wise to believe in the price going sky high no matter what. Also, Bitcoin’s price and the overall capitalization of the crypto market are influential factors affecting the price of LINK. They are also challenging to predict, but the next economic crisis caused by the huge geopolitical shift of 2022 and expected overall crypto market correction are coming soon. Anyway, considering all the facts and data we have now, our Chainlink price prediction for 2024 is price correction, along with the rest of the market. Although it’s hard to say for sure, the price may vary between $35 and $48. This target is mainly based on technical and fundamental analysis.

Chainlink price prediction 2025

The world expects Web 3.0 to unfold around the year 2025, which means that blockchain is finally becoming mainstream. Only in this case, the Chainlink price would go up to let’s say the $300 and $600 level. In any other case, LINK becomes just an instrument for speculation.

2025 Chainlink price prediction may include stagnation or turn bearish. In any case, it will all depend on the Chainlink team to constantly come up with new product ideas and innovations. We do not expect the price to go above $50 by the end of 2025.

Price prediction for LINK 2026 and after

Considering the volatility of the crypto market and the endless number of possible factors that could influence the market, there's no way for a 2030 Chainlink price prediction written in 2022 to be true. However, the project seems to be performing quite well, while its core idea and technology have proven its legitimacy. With Eric Schmidt - former CEO of Google - on board as a Strategic Advisor and support from the fintech giants of today, it may be reasonable to say that Chainlink would still be around. The price would most likely be stabilized at around $60-$200 or change according to the global market changes.

Chainlink (LINK) Investment FAQ

This final selection will tackle the most frequently asked questions related to Chainlink, price predictions, and LINK trading that our fellow readers could ask.

Is Chainlink a Good Investment?

Generally speaking, yes. Technical analysis gives hope for great profit, while the technology, management, and product development plans make a Chainlink investment look reasonable.

How High Can LINK Go?

While it doesn’t make much sense to speculate about how high can Chainlink's price go, we can keep in mind that crypto hasn’t really hit the mainstream yet. In the future, when blockchain is considered as typical of technology like the Internet itself, there will be a flood of new opportunities and integrations for Chainlink. Therefore, it would create demand for the token.

The historical data showcases the demand for the product being closely related to the demand for the token. So, why is Chainlink going up? Because its technology is in demand. And it will continue surging until there will be demand for the technology.

Will Chainlink Reach $100?

We believe that LINK may reach $100 in 2023 or even go beyond such a price mark thanks to Chainlink 2.0. But as for now, except for this huge product upgrade, there are no indicators that would offer proof that will chainlink reach $100 or not.

Will Chainlink Reach $1,000?

Judging from the available information, that is highly unlikely for LINK to ever be traded for $1000. Such a Chainlink price prediction would only come true if the crypto market blows up tenfold someday. It’s possible, but the probability is extremely low as of now.

Can Chainlink reach $10,000?

Such a case scenario is probably never going to happen. But anything’s possible. Expect the unexpected if you are not losing money while doing it.

Why is Chainlink Rising?

While there are not many new projects to integrate the technology into and the product hasn’t seen any substantial updates this year, LINK price is actively recovering from the recent fall. One of the main reasons for such a steady recovery may be explained by the promising plans for 2022 (staking, integrations with conventional banking). Such public announcements, along with bullish technical analysis results may create additional demand for the token.

How to Buy Chainlink Tokens?

Chainlink is traded on most crypto exchanges, but if you really value the privacy and security of your assets, we recommend avoiding centralized exchanges such as Binance, Kraken, Coinbase, and so on. Such exchanges require their users to identify themselves during the KYC process, which means sharing one’s personal information. On top of that, centralized exchanges usually lack the feature of trading from one’s hot wallet (such as MetaMask), which means that all of the user’s funds would technically belong to the exchange before the withdrawal.

And all this is just the tip of the iceberg… If you don't know any better solution than the centralized exchanges, you must be wondering where to buy Chainlink? We suggest that investors use a non-custodial crypto exchange that would avoid such inconvenience, like bitoftrade, for example. If you are also unfamiliar with how to buy Chainlink tokens on bitoftrade, here is the flow:

- Go to bitoftrade.com

- Just connect your MetaMask wallet

- Make a trade with a couple of clicks.

That’s it, you are all set. Just click here to get to buy LINK. No registration or KYC is required, just a MetaMask wallet. The good news is that on bitoftrade you can use limit orders and leverage for more efficient trading.

Who are Chainlink’s competitors?

Surprisingly so, Chainlink appears to have a long list of competitors. Amongst them are:

- Bridge Oracle

- UMA

- WINKLink

- API3

- i Exec RLC

- Augur

- Band Protocol

- DIA

- And many-many others…

But what is the most significant is that not a single one of the Chainlink competitors stands a chance against the actual Chainlink. Just compare the CoinMarketCap rank of LINK and BRG (Bridge Oracle) to see the full picture: 23 and 128.

How Anonymous is Chainlink?

As bitoftrade users value their anonymity the most, we couldn’t have missed that question. As Chainlink is built on Ethereum, it and any of its transactions are totally anonymous.

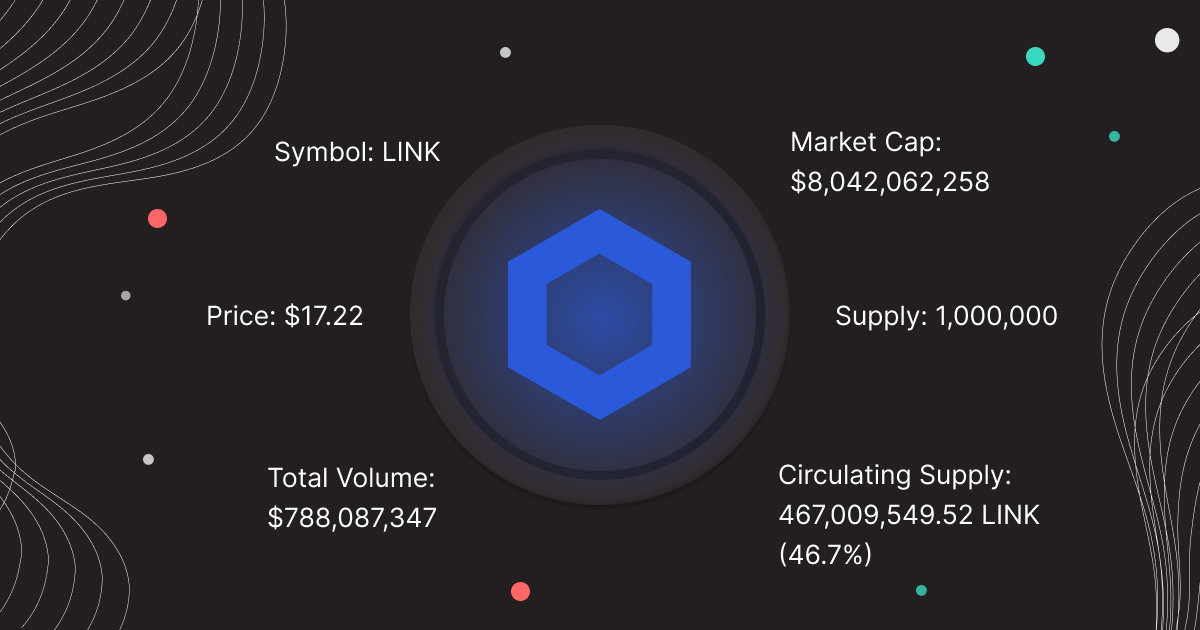

How much is chainlink?

At the moment, LINK is traded for $17.22 with a total volume of $788,087,347. The Chainlink max supply is 1,000,000,000 while the circulating supply is 467,009,549.52 LINK (46,7%). The Chainlink price prediction points to the price going upwards and possibly reaching $50 by the end of 2022.